Printable Articles of Incorporation Form for the State of Georgia

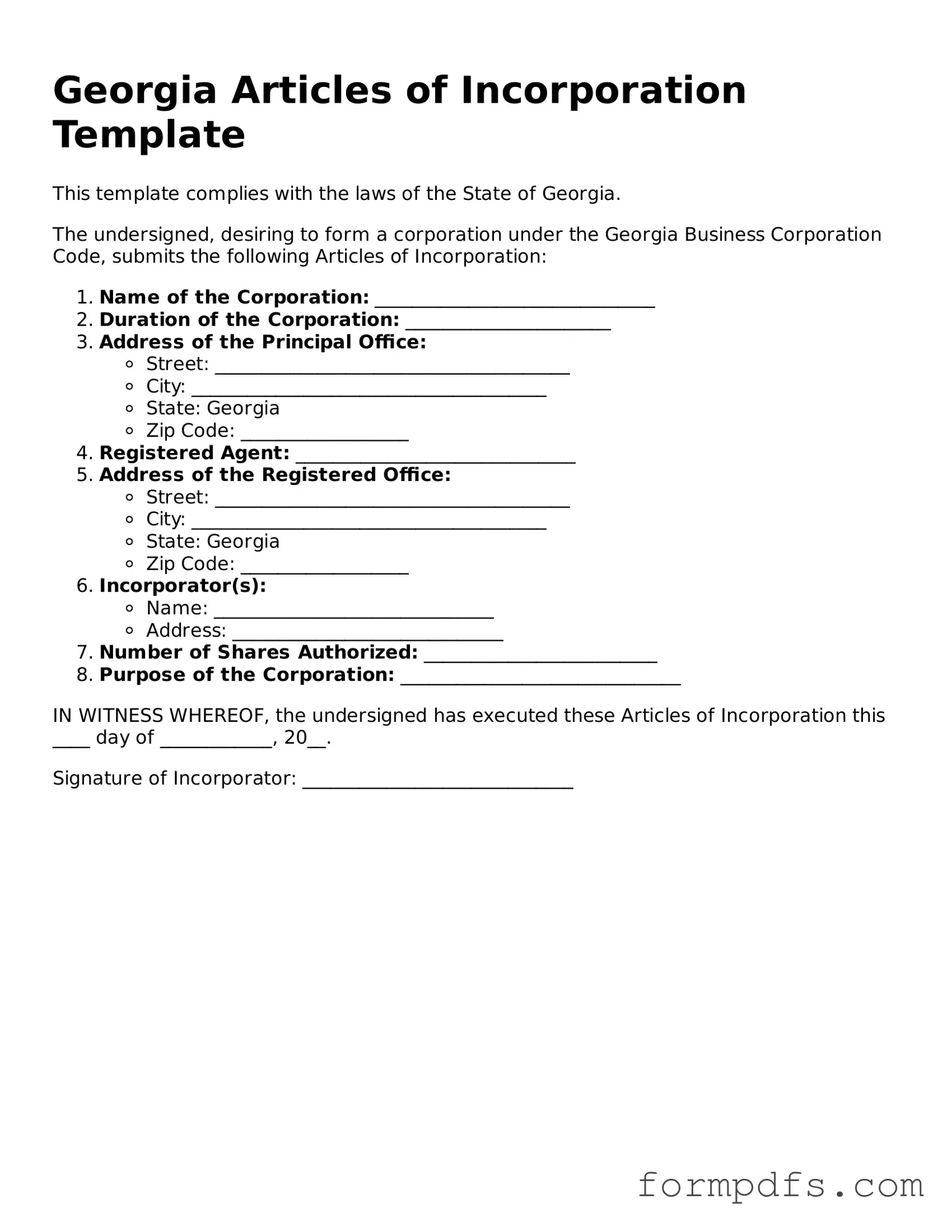

When starting a business in Georgia, one of the essential steps is filing the Articles of Incorporation form. This document serves as a foundational blueprint for your corporation, outlining its structure and purpose. Key elements typically included in this form are the corporation's name, which must be unique and comply with state regulations, and the designated registered agent, who will receive legal documents on behalf of the corporation. Additionally, the form requires details about the corporation's principal office address and the number of shares the corporation is authorized to issue. It’s also important to specify the duration of the corporation, whether it’s perpetual or for a limited time. By carefully completing the Articles of Incorporation, business owners can establish their corporation as a separate legal entity, providing personal liability protection and enabling them to engage in business activities with credibility and formality. Understanding these components is crucial for anyone looking to navigate the incorporation process in Georgia successfully.

Check out Other Common Articles of Incorporation Templates for Different States

Ohio Llc Fees - They can aid in clarifying the structure and purpose of the business entity.

The California Homeschool Letter of Intent form is a crucial document that informs local school districts of a parent's or guardian's decision to educate their child at home. This formal notice ensures that the homeschooling arrangement complies with state educational regulations. For those seeking additional resources and information, you can find them in the All California Forms. In essence, it acts as the first step toward creating a personalized and compliant learning environment for one's child.

How to Get a Copy of Your Articles of Incorporation - Registered agents must be available during business hours.

Documents used along the form

Incorporating a business in Georgia involves several important documents beyond the Articles of Incorporation. Each of these forms serves a specific purpose in the establishment and operation of a corporation. Below is a list of commonly used documents that complement the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and regulations governing the corporation. Bylaws specify how the corporation will be managed, detailing the responsibilities of directors and officers, meeting procedures, and voting rights.

- Organizational Meeting Minutes: These minutes record the proceedings of the first meeting of the board of directors. They typically include the adoption of bylaws, appointment of officers, and any initial business decisions made.

- Trailer Bill of Sale Form: For those involved in trailer sales, the necessary trailer bill of sale documentation ensures proper transfer of ownership and compliance with state regulations.

- Initial Report: Some states require an initial report that provides basic information about the corporation shortly after incorporation. This report may include details such as the corporation's address, officers, and registered agent.

- Registered Agent Consent Form: This document confirms that the registered agent has agreed to serve in this capacity. A registered agent is responsible for receiving legal documents on behalf of the corporation.

- Certificate of Incorporation: This is the official document issued by the state upon approval of the Articles of Incorporation. It serves as proof that the corporation is legally recognized.

- Employer Identification Number (EIN) Application: This form, submitted to the IRS, is necessary for obtaining an EIN. The EIN is essential for tax purposes and is required for hiring employees.

- Business License Application: Depending on the type of business and location, a business license may be required. This application ensures that the corporation is legally permitted to operate within its jurisdiction.

- Annual Registration: Corporations in Georgia must file an annual registration with the Secretary of State. This document updates the state on the corporation's current status, including changes to officers or registered agents.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders. It may address issues such as share transfer restrictions, voting rights, and dispute resolution processes.

Understanding these documents is crucial for anyone looking to establish a corporation in Georgia. Each plays a vital role in ensuring compliance with state laws and facilitating effective governance within the organization.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Articles of Incorporation form is used to legally establish a corporation in the state of Georgia. |

| Governing Law | This form is governed by the Georgia Business Corporation Code (O.C.G.A. § 14-2-1001 et seq.). |

| Filing Requirement | To create a corporation, the form must be filed with the Georgia Secretary of State. |

| Information Needed | Key information required includes the corporation's name, registered agent, and business purpose. |

More About Georgia Articles of Incorporation

What is the Georgia Articles of Incorporation form?

The Georgia Articles of Incorporation form is a legal document that establishes a corporation in the state of Georgia. It outlines essential information about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form is a crucial step in the process of forming a corporation.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Georgia must file the Articles of Incorporation. This includes businesses of all types, whether they are for-profit or non-profit. If you want to enjoy the benefits of limited liability and a formal business structure, this form is necessary.

What information is required on the form?

The form requires several key pieces of information. You will need to provide the name of the corporation, its purpose, the address of the principal office, the name and address of the registered agent, and details about the shares being issued. It's important to ensure that the information is accurate and complete to avoid delays in processing.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, you can submit the form online through the Georgia Secretary of State's website or mail a paper copy to the appropriate office. There is a filing fee associated with this process, and payment can typically be made via credit card or check. Make sure to keep a copy of the filed form for your records.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Georgia varies depending on the type of corporation being formed. As of now, the standard fee is around $100 for a for-profit corporation. Non-profit corporations may have a different fee structure. Always check the Georgia Secretary of State's website for the most current fee schedule.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, online submissions are processed faster than paper filings. You can expect a turnaround of a few business days for online submissions, while paper submissions may take longer. If you need expedited service, there may be an option for an additional fee.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are filed and approved, your corporation is officially formed. You will receive a certificate of incorporation, which serves as proof of your business's existence. Following this, you should focus on obtaining any necessary licenses and permits, setting up a corporate bank account, and drafting bylaws.

Can I amend the Articles of Incorporation later?

Yes, you can amend the Articles of Incorporation if changes are needed in the future. Common reasons for amendments include changes to the corporation's name, purpose, or structure. To do this, you will need to file an amendment form with the Georgia Secretary of State and pay any associated fees.

Do I need a lawyer to file the Articles of Incorporation?

While it is not required to hire a lawyer to file the Articles of Incorporation, it can be beneficial. A legal professional can help ensure that all information is correctly filled out and that your corporation complies with state laws. If you are unfamiliar with the process or have specific questions, seeking legal advice may be a wise decision.

What is the difference between Articles of Incorporation and bylaws?

The Articles of Incorporation are a public document filed with the state to create the corporation, while bylaws are internal rules that govern the operation of the corporation. Bylaws outline how the corporation will be managed, including details on meetings, voting procedures, and the roles of officers and directors. Both documents are essential for a well-functioning corporation.

Georgia Articles of Incorporation: Usage Steps

After completing the Georgia Articles of Incorporation form, the next step is to submit it to the Georgia Secretary of State along with the required filing fee. Ensure that all information is accurate and complete to avoid delays in processing.

- Obtain the Georgia Articles of Incorporation form from the Georgia Secretary of State's website or office.

- Fill in the name of the corporation. Ensure the name complies with Georgia naming requirements.

- Provide the principal office address of the corporation. This address must be a physical location in Georgia.

- List the registered agent's name and address. The registered agent must have a physical address in Georgia.

- Indicate the purpose of the corporation. A general statement of purpose is acceptable.

- Specify the number of shares the corporation is authorized to issue, if applicable.

- Include the names and addresses of the initial directors. At least one director is required.

- Sign and date the form. The incorporator must sign the document.

- Review the completed form for accuracy and completeness.

- Submit the form along with the filing fee to the Georgia Secretary of State, either online or by mail.