Blank Generic Direct Deposit PDF Form

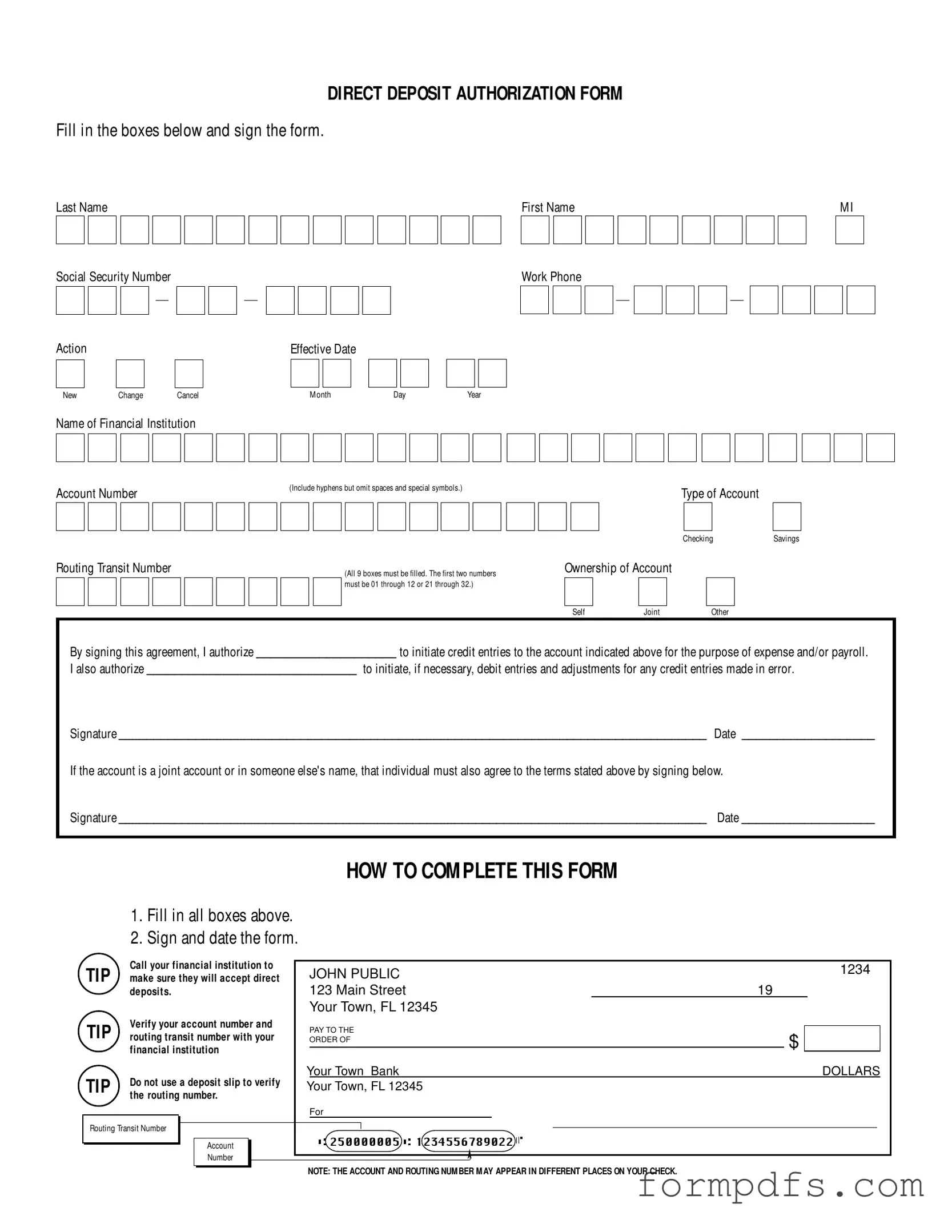

When it comes to managing finances efficiently, the Generic Direct Deposit form plays a crucial role for both employees and employers. This straightforward document allows individuals to authorize their employers to deposit funds directly into their bank accounts, eliminating the need for paper checks. The form requires essential information such as the employee's name, Social Security number, and contact details, ensuring that the correct person receives the funds. Additionally, it asks for the name of the financial institution, the account number, and the routing transit number, all of which are vital for accurate processing. Users must indicate whether the account is a checking or savings account and specify the nature of the action—whether it's a new setup, a change, or a cancellation. By signing the form, individuals not only grant permission for deposits but also authorize any necessary corrections for errors that may occur. Joint account holders must also provide their signatures, ensuring that all parties agree to the terms. Completing this form is a simple yet important step in streamlining payment processes, and it’s advisable to double-check account details with the financial institution to avoid any complications.

More PDF Templates

Florida Family Law Financial Affidavit Short Form - Inaccurate information could lead to penalties or affect your case negatively.

Minor Travel Consent Letter - It ensures that the cruise experience is enjoyable and worry-free for both parents and minors.

Obtaining a bill of sale document is crucial for buyers and sellers alike, ensuring a smooth transaction process. For further information, you can refer to this comprehensive guide on the California Bill of Sale that outlines its significance and provides a template for use.

Proof Paperwork Positive Planned Parenthood Pregnancy Test Results - Patients receive a Notice of Health Information Privacy Practices acknowledgment.

Documents used along the form

When setting up direct deposit, there are several other forms and documents that may be needed. Each of these plays a role in ensuring that your direct deposit is processed smoothly. Here’s a brief overview of some commonly used documents alongside the Generic Direct Deposit form.

- W-4 Form: This form is used to determine the amount of federal income tax withholding from your paycheck. Employees fill it out to indicate their tax situation to their employer.

- Bank Account Verification Letter: This letter, provided by your bank, confirms your account details. It helps ensure that the correct account is used for direct deposits.

- Employee Information Form: This document collects essential details about the employee, such as address, phone number, and emergency contacts, which may be necessary for payroll processing.

- Void Check: A voided check from your account can be submitted to verify your account number and routing number. It’s a simple way to ensure accuracy.

- State Tax Form: Depending on your state, you may need to fill out a specific form for state income tax withholding, similar to the W-4 for federal taxes.

- Employment Agreement: This document outlines the terms of employment, including salary and payment methods, which may reference direct deposit arrangements.

- Change of Direct Deposit Form: If you need to change your existing direct deposit information, this form allows you to update your account details easily.

- Florida Lottery DOL-129 Form: This form is essential for businesses aiming to become authorized lottery retailers in Florida, detailing the application process and requirements. For more information, you can visit All Florida Forms.

- Payroll Schedule: This document provides information about when paychecks will be issued, which is useful for understanding the timing of your direct deposits.

Having these documents ready can help streamline the direct deposit setup process. It’s always a good idea to check with your employer or financial institution to ensure you have everything you need.

Form Breakdown

| Fact Name | Details |

|---|---|

| Form Purpose | This form allows individuals to authorize direct deposits into their bank accounts. |

| Required Information | Fill in your last name, first name, middle initial, Social Security Number, and account details. |

| Account Types | You can select either a savings or checking account for your direct deposit. |

| Routing Number | The routing transit number must consist of 9 digits. The first two digits should be between 01-12 or 21-32. |

| Signature Requirement | You must sign the form to authorize the direct deposit. If it’s a joint account, the other account holder must also sign. |

| Effective Date | You can indicate the effective date for the new or changed direct deposit. |

| Verification Tips | Contact your financial institution to confirm they accept direct deposits and verify account details. |

| State-Specific Forms | Some states may have specific laws governing direct deposits. Check local regulations. |

| Common Errors | Ensure all boxes are filled out correctly to avoid delays in processing your direct deposit. |

More About Generic Direct Deposit

What is a Generic Direct Deposit form?

The Generic Direct Deposit form is a document that allows individuals to authorize their employer or another entity to deposit funds directly into their bank account. This can include payroll, expense reimbursements, or other payments. By using this form, you can ensure that your funds are transferred securely and efficiently without the need for paper checks.

How do I fill out the Generic Direct Deposit form?

To complete the form, start by filling in your last name, first name, and middle initial. Next, enter your Social Security number and indicate whether you are initiating a new direct deposit, changing an existing one, or canceling a previous authorization. You will also need to provide your work phone number, the name of your financial institution, and your account number. Make sure to select whether your account is a savings or checking account and fill in the routing transit number accurately. Finally, sign and date the form to validate your authorization.

What is a routing transit number, and why is it important?

A routing transit number is a nine-digit code that identifies your financial institution in the United States. It is crucial for ensuring that your funds are directed to the correct bank when a direct deposit is made. All nine boxes of the routing number must be filled out correctly, and the first two digits should fall within the specified ranges (01 through 12 or 21 through 32). Errors in this number can lead to delays or misdirected deposits.

Can I use a deposit slip to find my routing number?

No, it is not advisable to use a deposit slip to verify your routing number. Instead, contact your financial institution directly for the most accurate information. They can provide you with the correct routing transit number and ensure that you have the right details for your direct deposit setup.

What should I do if I have a joint account?

If you have a joint account, both account holders must agree to the terms of the direct deposit authorization. This means that both individuals will need to sign the form. It is essential to ensure that everyone involved is aware of the agreement to avoid any issues with the deposit process.

How long does it take for direct deposit to start after I submit the form?

The time it takes for direct deposit to begin can vary. Typically, it may take one to two pay cycles for the direct deposit to be set up and processed. It's a good idea to check with your employer or the entity making the deposit to get a more specific timeline based on their processing times.

What if I need to change my direct deposit information?

If you need to change your direct deposit information, you will need to fill out the Generic Direct Deposit form again, selecting the option to change your existing information. Make sure to provide the updated details, including your new account number and routing transit number, and sign and date the form. Submit it to the appropriate entity to ensure the changes are made promptly.

What happens if I make a mistake on the form?

If you make a mistake on the Generic Direct Deposit form, it is important to correct it before submitting. You can either cross out the incorrect information and write the correct details next to it, or you can start fresh with a new form. Ensure that all information is accurate to prevent any issues with your direct deposit.

Who should I contact if I have questions about my direct deposit?

If you have questions about your direct deposit, the best course of action is to contact your employer's payroll department or the financial institution where your account is held. They can provide specific guidance and assistance based on your situation. Additionally, if you encounter any issues with deposits, reaching out to these entities can help resolve problems quickly.

Generic Direct Deposit: Usage Steps

After completing the Generic Direct Deposit form, it will need to be submitted to your employer or payroll department. They will process your request and ensure that your funds are deposited directly into your designated bank account. Follow these steps carefully to ensure that all necessary information is filled out correctly.

- Fill in your Last Name, First Name, and Middle Initial in the designated boxes.

- Provide your Social Security Number in the format of XXX-XX-XXXX.

- Select the appropriate Action by checking the box for New, Change, or Cancel.

- Enter the Effective Date in the format of Month, Day, Year.

- Fill in your Work Phone number in the format of XXX-XXX-XXXX.

- Write the Name of Financial Institution where your account is held.

- Provide your Account Number, including hyphens but omitting spaces and special symbols.

- Select the Type of Account by checking either Savings or Checking.

- Fill in the Routing Transit Number (all 9 boxes must be filled, and the first two numbers must be 01 through 12 or 21 through 32).

- Indicate the Ownership of Account by checking the appropriate box (Self, Joint, Other).

- Sign the form in the designated area to authorize the direct deposit.

- Enter the Date of your signature.

- If applicable, have the co-owner of the account sign the form as well, along with the date.

Before submitting the form, it is advisable to verify your account and routing numbers with your financial institution. This will help prevent any delays in processing your direct deposit request.