Blank Florida Commercial Contract PDF Form

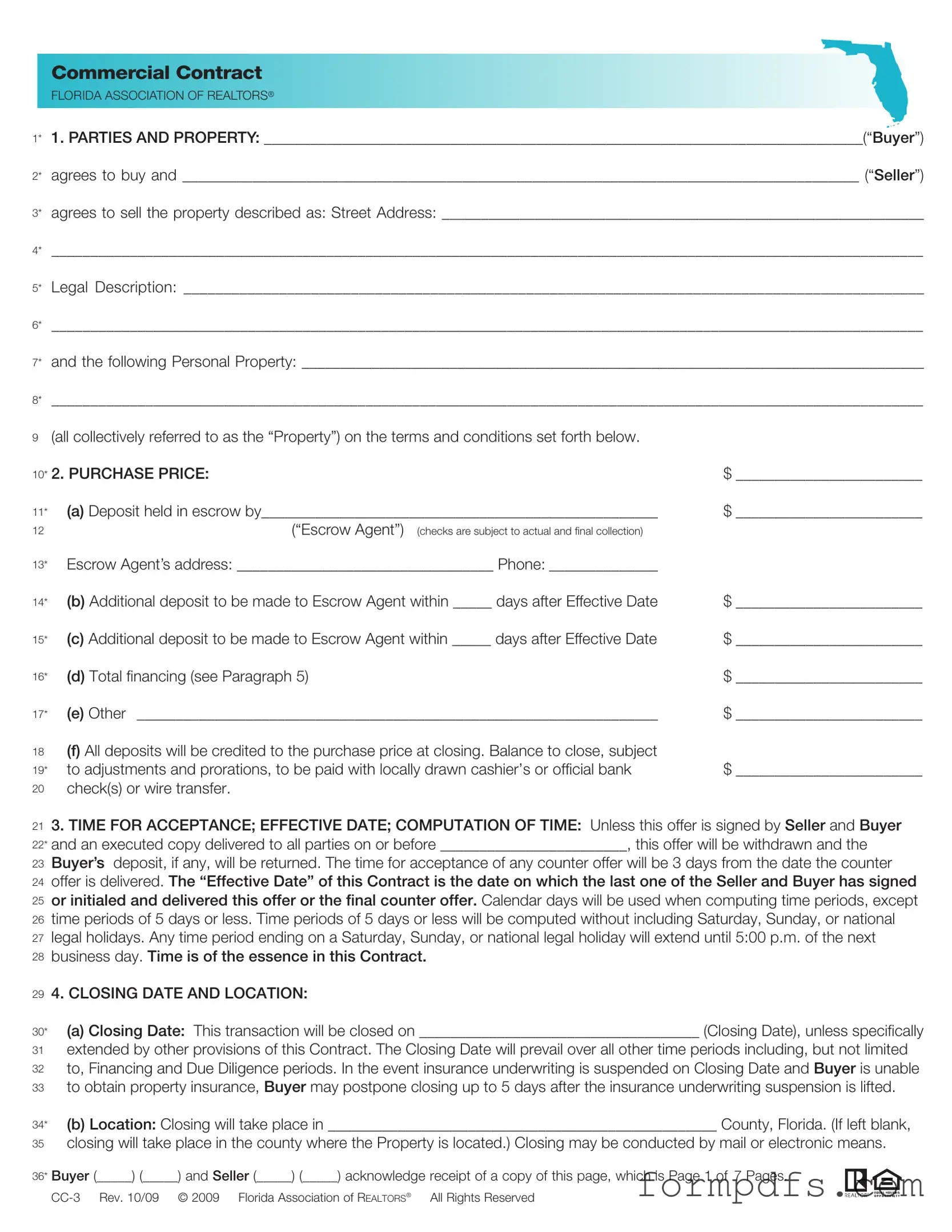

The Florida Commercial Contract form serves as a vital tool for real estate transactions, outlining the responsibilities and expectations of both buyers and sellers. This form identifies the parties involved and the property being sold, including its legal description and any personal property included in the sale. It specifies the purchase price, detailing the deposit amounts and financing arrangements. Important timelines are established, including the effective date of the contract and the closing date, ensuring all parties are aware of their obligations. The form also addresses financing contingencies, allowing buyers to secure third-party financing while outlining the consequences if financing is not obtained. Title transfer is another crucial aspect, with provisions for ensuring that the seller can convey a marketable title free of liens. The condition of the property at the time of sale is also addressed, with options for buyers to accept the property “as is” or conduct due diligence inspections. Additionally, the contract outlines the closing procedures, including the responsibilities of both parties regarding costs, documents, and escrow arrangements. By clearly defining these elements, the Florida Commercial Contract form helps facilitate smooth transactions while protecting the interests of all parties involved.

More PDF Templates

Dekalb County Water New Service - Experience streamlined access to your water services.

When entering into a room rental arrangement, it's essential for both landlords and tenants to have a clear understanding of the expectations and obligations laid out in the agreement. This not only helps in preventing disputes but also ensures a smoother rental experience for both parties involved. For those in California seeking a comprehensive resource for rental agreements, refer to All California Forms for a variety of templates and legal documents that can be tailored to specific needs.

Medical Prescription Paper - Used by healthcare professionals to authorize medications.

Documents used along the form

The Florida Commercial Contract form is a crucial document in real estate transactions, particularly for commercial properties. However, it is often accompanied by other important forms and documents that facilitate the process. Below is a list of common documents that are frequently used alongside the Florida Commercial Contract.

- Title Insurance Commitment: This document outlines the terms of the title insurance that protects the buyer from potential defects in the property title. It ensures that the seller can convey clear ownership and details any exceptions to coverage.

- Escrow Agreement: This agreement establishes the terms under which an escrow agent will hold funds and documents until the conditions of the contract are met. It provides security for both the buyer and seller during the transaction.

- Property Disclosure Statement: This statement requires the seller to disclose any known issues with the property. It informs the buyer about the condition of the property, helping them make an informed decision.

- Financing Contingency Addendum: This addendum specifies the conditions under which the buyer must secure financing. It outlines the timeline and requirements for loan approval, protecting the buyer if financing falls through.

- Affidavit of Support: Required by the USCIS, the Affidavit of Support demonstrates a sponsor's financial ability to support an immigrant, and it is essential for ensuring the immigrant does not become a public charge. For more information, visit OnlineLawDocs.com.

- Due Diligence Agreement: This document allows the buyer to conduct inspections and investigations on the property within a specified time frame. It is essential for assessing the property's suitability for the buyer's intended use.

These documents play a vital role in ensuring that both parties are protected and informed throughout the transaction process. Understanding their purpose can help facilitate smoother negotiations and closings in commercial real estate deals.

Form Breakdown

| Fact Name | Description |

|---|---|

| Parties Involved | The contract identifies the Buyer and Seller, defining their roles in the transaction. |

| Property Description | Includes the street address and legal description of the property being sold. |

| Purchase Price | The total purchase price is specified, along with details about deposits and financing. |

| Time for Acceptance | The offer must be accepted by a specified date, or it will be withdrawn automatically. |

| Closing Date | The contract sets a closing date, which can only be changed through specific provisions. |

| Financing Contingency | Buyers must apply for financing within a specified timeframe, with options for cancellation if not approved. |

| Title Assurance | The Seller must provide marketable title, free of liens, with specific requirements for evidence of title. |

| Property Condition | The property is sold "as is," with the Buyer accepting it in its current condition unless otherwise agreed. |

| Governing Law | This contract is governed by Florida law, ensuring compliance with state regulations. |

More About Florida Commercial Contract

What is the purpose of the Florida Commercial Contract form?

The Florida Commercial Contract form is designed to outline the terms and conditions under which a buyer agrees to purchase commercial property from a seller. It serves as a legally binding agreement that details the responsibilities of both parties, including the purchase price, financing arrangements, and the conditions for closing the transaction.

Who are the parties involved in the contract?

The contract involves two primary parties: the buyer and the seller. The buyer is the individual or entity purchasing the property, while the seller is the individual or entity selling the property. Both parties must sign the contract for it to be valid.

What information is required about the property?

The contract requires specific information about the property, including the street address, legal description, and any personal property included in the sale. This ensures clarity regarding what is being bought and sold.

How is the purchase price structured in the contract?

The purchase price section of the contract outlines the total amount the buyer agrees to pay for the property. It includes details about the initial deposit, any additional deposits, and the total financing amount. All deposits are credited toward the purchase price at closing.

What is the effective date of the contract?

The effective date is the date when the last party signs the contract. This date is crucial as it triggers various timelines for actions such as financing applications, inspections, and closing dates.

What are the buyer's obligations regarding financing?

The buyer is required to apply for third-party financing within a specified timeframe after the effective date. This includes providing necessary documentation to the lender and keeping the seller informed about the status of the loan application. If the buyer fails to obtain loan approval, they have options to either waive the financing contingency or cancel the contract.

What is the closing process outlined in the contract?

The closing process includes the transfer of ownership from the seller to the buyer. It specifies the closing date, location, and the documents each party must provide. The seller must deliver the deed and any relevant contracts, while the buyer must provide financing documents and pay associated fees.

What happens if there are title defects?

If the buyer discovers title defects upon reviewing the evidence of title, they must notify the seller within a specified timeframe. The seller has a chance to cure these defects. If the defects are not resolved, the buyer may choose to terminate the contract or accept the property with existing defects.

What are the consequences of defaulting on the contract?

If either party defaults on the contract, the non-defaulting party has specific remedies. For example, if the seller defaults, the buyer may receive a refund of their deposit or seek specific performance. Conversely, if the buyer defaults, the seller may retain the deposit as liquidated damages.

Florida Commercial Contract: Usage Steps

Filling out the Florida Commercial Contract form requires careful attention to detail. This form outlines the agreement between the buyer and seller regarding the sale of commercial property. Follow these steps to ensure you complete the form correctly.

- Identify the Parties: Fill in the names of the Buyer and Seller in the appropriate sections at the top of the form.

- Property Description: Provide the street address and legal description of the property being sold.

- Personal Property: List any personal property included in the sale.

- Purchase Price: Enter the total purchase price and details of any deposits, including amounts and due dates.

- Effective Date: Specify the date by which the offer must be accepted by the Seller.

- Closing Date and Location: Indicate the closing date and location for the transaction.

- Financing Details: Complete the section regarding third-party financing, including terms and amounts.

- Title Information: Provide details about how the title will be conveyed and any title insurance commitments.

- Property Condition: State whether the property is being sold "as is" or if there will be a due diligence period for inspections.

- Closing Procedure: Fill in the sections related to possession, costs, and documents required at closing.

- Notices: Ensure that all notices will be sent to the specified addresses on the signature page.

- Signatures: Finally, have both parties sign and date the form to make the agreement binding.

Once you have completed the form, review it carefully for accuracy. Ensure that all required fields are filled out and that both parties have signed the document. This will help avoid any issues during the transaction process.