Blank Fl Dr 312 PDF Form

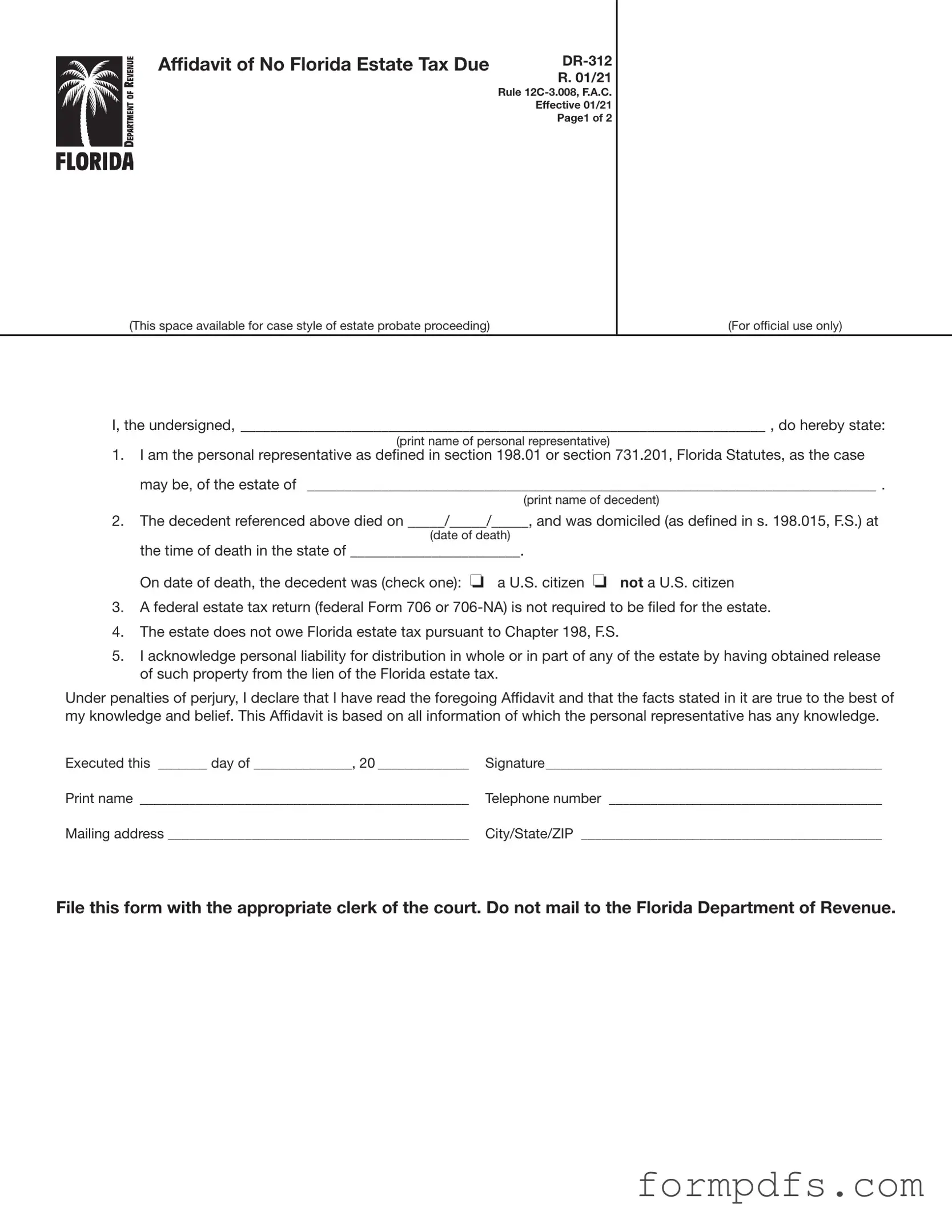

The FL DR 312 form, officially known as the Affidavit of No Florida Estate Tax Due, plays a crucial role in the estate administration process in Florida. Designed for personal representatives, this form confirms that no Florida estate tax is owed for the decedent's estate, allowing for a smoother transition of assets. It requires the personal representative to provide essential details, including the decedent's name, date of death, and residency status at the time of passing. Importantly, the form asserts that a federal estate tax return is not necessary, further simplifying the estate settlement process. By filing the FL DR 312, personal representatives can effectively remove the Department of Revenue's estate tax lien, which is vital for ensuring clear title to the estate's assets. The form must be submitted to the clerk of the circuit court in the appropriate counties where the decedent owned property, rather than sent to the Florida Department of Revenue. Understanding the proper use and filing requirements of the FL DR 312 is essential for those managing estates that do not meet federal filing thresholds, ensuring compliance with Florida law and facilitating the distribution of assets to beneficiaries.

More PDF Templates

What Is a W3? - This form also includes total tax withheld from employees' paychecks during the year.

Before entering into a commercial lease, it's crucial for both landlords and tenants to understand the complexities involved. The California Commercial Lease Agreement form not only facilitates a clear communication of expectations but also helps in avoiding disputes by delineating responsibilities. For those interested in exploring various options and templates, resources like All California Forms can provide valuable assistance in navigating this process.

How to Get a Pay Stub From Adp - Accessing your pay stub regularly helps ensure accuracy in your pay.

Documents used along the form

When dealing with estate matters in Florida, the Affidavit of No Florida Estate Tax Due, known as Form DR-312, is just one of several important documents that may be required. This form serves to affirm that the estate in question does not owe any Florida estate tax and that a federal estate tax return is not necessary. However, there are other forms and documents that often accompany or relate to Form DR-312. Understanding these can provide clarity in the estate administration process.

- Federal Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is required for estates that exceed a certain value threshold and must be filed with the IRS. It details the decedent’s assets and calculates any federal estate tax owed.

- Federal Form 706-NA: This form is specifically for the estates of nonresident aliens. Similar to Form 706, it is used to report the estate's value and determine tax obligations for non-U.S. citizens.

- Arizona ATV Bill of Sale Form: To facilitate the legal transfer of ownership, utilize the critical ATV Bill of Sale documentation for your all-terrain vehicle transactions.

- Florida Form DR-1: This is the Florida Estate Tax Return. It is filed when an estate is subject to Florida estate tax, detailing the assets and liabilities of the estate to determine the tax due.

- Letters of Administration: This document is issued by the court to appoint a personal representative for the estate. It grants the representative the authority to manage the estate’s affairs, including settling debts and distributing assets.

- Death Certificate: This official document certifies the date and cause of death. It is often required for various estate-related filings and is essential for proving the decedent's passing.

These documents, when used in conjunction with Form DR-312, help ensure that the estate administration process proceeds smoothly and legally. Each form plays a unique role in clarifying the estate's tax obligations and the authority of the personal representative, thereby facilitating a more efficient resolution of the estate's affairs.

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The DR-312 form serves as an Affidavit of No Florida Estate Tax Due, confirming that the estate does not owe any Florida estate tax. |

| Governing Law | This form is governed by Chapter 198 of the Florida Statutes and Rule 12C-3.008 of the Florida Administrative Code. |

| Filing Requirement | Personal representatives must file this form with the clerk of the circuit court in the county where the decedent owned property. |

| Federal Tax Return | The form is used when a federal estate tax return (Form 706 or 706-NA) is not required to be filed for the estate. |

| Liability Acknowledgment | By signing the form, the personal representative acknowledges personal liability for any distributions made from the estate. |

| Evidence of Nonliability | The DR-312 form acts as evidence of nonliability for Florida estate tax and helps remove the Department's estate tax lien. |

| Space for Case Style | The form includes a designated area for the case style of the estate probate proceeding, ensuring it is properly identified. |

| Not for All Estates | This form cannot be used for estates that are required to file a federal Form 706 or 706-NA. |

| Contact Information | For questions or assistance, individuals can contact Taxpayer Services at 850-488-6800 or visit the Florida Department of Revenue's website. |

More About Fl Dr 312

What is the FL DR 312 form?

The FL DR 312 form, also known as the Affidavit of No Florida Estate Tax Due, is a document used in Florida to declare that an estate is not subject to Florida estate tax. It is typically completed by the personal representative of the estate when there is no requirement to file a federal estate tax return, such as Form 706 or 706-NA. This form serves as evidence of nonliability for Florida estate tax and helps to remove any estate tax lien imposed by the Florida Department of Revenue.

Who should complete the FL DR 312 form?

The personal representative of the estate should complete the FL DR 312 form. This individual is defined under Florida law as someone who is in actual or constructive possession of the estate's assets. Even if a person is not formally appointed as a personal representative, they may still complete the form if they possess property included in the decedent's gross estate.

When should the FL DR 312 form be used?

The FL DR 312 form should be used when an estate does not owe Florida estate tax and when a federal estate tax return is not required. It is important to note that this form cannot be used for estates that are obligated to file federal Form 706 or 706-NA. If there is any doubt about the requirement to file these federal forms, it is advisable to consult the relevant IRS guidelines.

Where should the FL DR 312 form be filed?

This form must be filed directly with the clerk of the circuit court in the county or counties where the decedent owned property. It should not be sent to the Florida Department of Revenue. Filing the form with the court ensures that it is recorded in the public records, which is essential for establishing the estate's nonliability for Florida estate tax.

What information is required to complete the FL DR 312 form?

To complete the FL DR 312 form, the personal representative must provide specific information, including their name, the name of the decedent, the date of death, and the decedent's state of domicile at the time of death. Additionally, the representative must indicate whether the decedent was a U.S. citizen and affirm that no federal estate tax return is required.

What are the consequences of filing the FL DR 312 form?

Filing the FL DR 312 form removes any lien for Florida estate tax that may have been placed on the estate's property. This form acts as a declaration of nonliability, allowing the personal representative to distribute the estate's assets without the burden of estate tax concerns. However, the personal representative also acknowledges personal liability for any distributions made from the estate.

Is there a deadline for filing the FL DR 312 form?

While there is no specific deadline mentioned for filing the FL DR 312 form, it is generally advisable to file it as soon as it is determined that no Florida estate tax is owed. Timely filing helps avoid complications and ensures that the estate can be settled smoothly without any tax-related issues.

How can I get assistance with the FL DR 312 form?

If you need assistance with the FL DR 312 form, you can contact the Florida Department of Revenue's Taxpayer Services at 850-488-6800. They are available Monday through Friday, excluding holidays. Additionally, information, forms, and tutorials are available on the Department's website, which can provide further guidance on completing the form and understanding the filing process.

Fl Dr 312: Usage Steps

Completing the Fl Dr 312 form is an important step for personal representatives of estates that are not subject to Florida estate tax. This process ensures that the necessary information is accurately documented and submitted to the appropriate authorities. Follow the steps below to fill out the form correctly.

- Begin by entering the case style of the estate probate proceeding in the designated space at the top of the form.

- In the first blank line, print your name as the personal representative of the estate.

- Next, fill in the name of the decedent in the second blank line.

- Provide the date of death in the format of month/day/year in the specified area.

- Indicate the state where the decedent was domiciled at the time of death by writing it in the appropriate blank.

- Check the box to confirm whether the decedent was a U.S. citizen or not.

- Affirm that a federal estate tax return (Form 706 or 706-NA) is not required for the estate by leaving that section as it is; no additional information is needed.

- Confirm that the estate does not owe Florida estate tax according to Chapter 198, F.S.

- Sign and date the form in the designated area, ensuring that you include your printed name and telephone number.

- Complete your mailing address, including city, state, and ZIP code in the provided fields.

After completing the form, file it with the appropriate clerk of the circuit court in the county where the decedent owned property. Remember, do not mail this form to the Florida Department of Revenue. Ensure that all information is accurate to avoid any complications in the processing of the affidavit.