Blank Erc Broker Market Analysis PDF Form

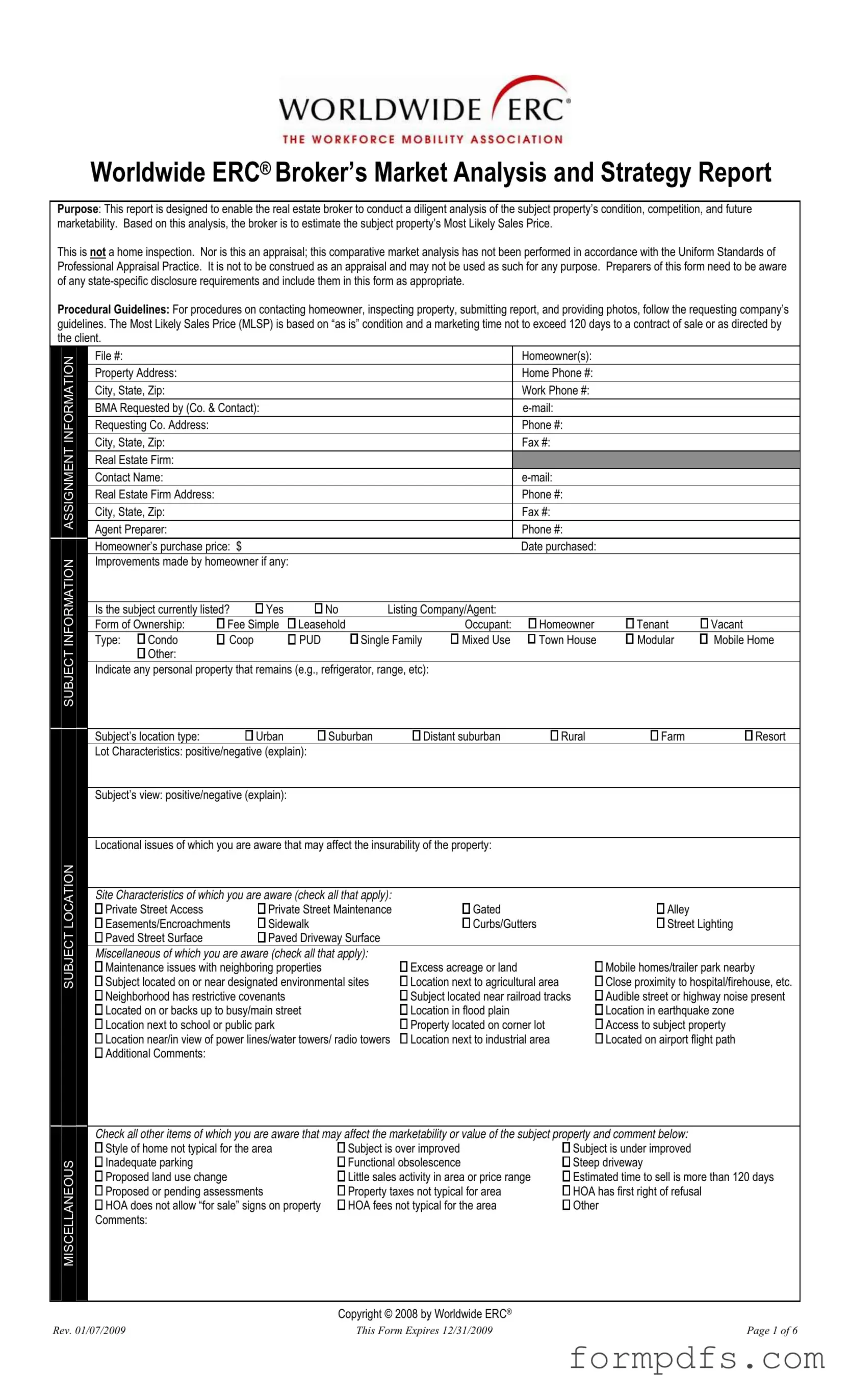

The Worldwide ERC® Broker’s Market Analysis and Strategy Report serves as a vital tool for real estate brokers, enabling them to perform a thorough assessment of a property's condition, its competitive landscape, and its potential for future marketability. This form is not intended to replace a home inspection or appraisal; rather, it focuses on providing a comparative market analysis that estimates the Most Likely Sales Price (MLSP) of the property in its current state. Brokers must take into account specific state disclosure requirements and ensure that these are incorporated into the report. The procedural guidelines outlined within the form emphasize the importance of following the requesting company's protocols for contacting homeowners, inspecting properties, and submitting reports, including necessary photographs. The analysis is based on the property’s “as is” condition, with a marketing timeline of no more than 120 days, unless otherwise directed by the client. Key sections of the form include detailed information about the property, its location, and any improvements made, as well as an assessment of the neighborhood and broader market conditions. Additionally, the report requires brokers to identify potential financing options and any issues that may arise during the selling process, ensuring a comprehensive understanding of the property’s position in the market.

More PDF Templates

Med Express Mt Pleasant Pa - Positive results include specific substances detected in the sample.

To facilitate a smooth transaction, it is vital to understand the importance of a thorough Trailer Bill of Sale document, which serves as a proof of purchase and ensures legal compliance. Learn how to create your own by checking out this guide on our site: detailed information on Trailer Bill of Sale requirements.

Aao Transfer Form - Document significant treatment modifications to inform the new orthodontist properly.

Physical Exam Form for Healthcare Workers - Indicate if a seizure disorder is present, including relevant details for medical care continuity.

Documents used along the form

The ERC Broker Market Analysis form is a vital document for real estate brokers. To support the analysis and ensure a comprehensive understanding of the property and market conditions, several other forms and documents are often used in conjunction with it. Below is a list of these documents, each serving a specific purpose in the property evaluation process.

- Comparative Market Analysis (CMA): This report compares the subject property to similar properties that have recently sold in the area. It helps in estimating a fair market value based on actual sales data.

- Property Disclosure Statement: This document provides details about the condition of the property, including any known issues or repairs. It is essential for transparency between the seller and potential buyers.

- Home Inspection Report: Conducted by a licensed inspector, this report assesses the physical condition of the property. It highlights any necessary repairs or maintenance issues that could affect the sale.

- Appraisal Report: This document is prepared by a licensed appraiser and provides an independent assessment of the property's value. It is often required by lenders for financing purposes.

- USCIS I-864 Form: A crucial document required by the United States Citizenship and Immigration Services, the OnlineLawDocs.com outlines the agreement a sponsor enters into, ensuring supportive financial backing for family members applying for a green card.

- Title Report: This report details the ownership history of the property and any liens or encumbrances. It ensures that the title is clear and can be transferred without issues.

- Financing Pre-Approval Letter: This letter from a lender indicates that a buyer is pre-approved for a specific loan amount. It strengthens a buyer's position when making an offer on a property.

- Listing Agreement: This contract outlines the terms between the seller and the real estate agent regarding the sale of the property. It includes details about the commission and marketing strategies.

- Marketing Plan: This document outlines the strategies that will be used to promote the property. It includes details on online listings, open houses, and advertising efforts.

- Neighborhood Market Report: This report provides insights into the local real estate market, including trends, average home prices, and economic conditions. It helps to contextualize the property's value within the neighborhood.

Each of these documents plays a critical role in the real estate process. They work together to provide a clearer picture of the property, its market value, and the conditions affecting its sale. Having these documents in hand can lead to a smoother transaction and a better understanding of the real estate landscape.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | This report helps real estate brokers analyze a property's condition, competition, and future marketability to estimate its Most Likely Sales Price. |

| Not an Appraisal | The form is not an appraisal and should not be used as such. It does not comply with the Uniform Standards of Professional Appraisal Practice. |

| State-Specific Requirements | Prepares must be aware of and include any state-specific disclosure requirements in the report. |

| Marketing Time | The Most Likely Sales Price is based on the property being sold "as is" within a marketing time of 120 days or as directed by the client. |

| Inspection Guidelines | Follow the requesting company's guidelines for contacting homeowners, inspecting properties, and submitting reports. |

| Expiration Date | This form is valid until December 31, 2009, and must be used before that date. |

More About Erc Broker Market Analysis

What is the purpose of the ERC Broker Market Analysis form?

The ERC Broker Market Analysis form is designed to help real estate brokers analyze a property's condition, its competition, and its potential for future sales. By using this form, brokers can estimate the Most Likely Sales Price (MLSP) of the property. It’s important to note that this form is not a home inspection or an appraisal, and it should not be used as such.

Who should fill out the ERC Broker Market Analysis form?

This form should be completed by licensed real estate brokers who are conducting a market analysis for a specific property. The broker needs to gather relevant information from the homeowner, inspect the property, and consider market conditions to fill out the form accurately.

What information is required on the form?

The form requires various details, including the property address, homeowner contact information, the real estate firm’s details, and specifics about the property itself. This includes its condition, any improvements made, and any relevant market factors that could influence its value.

How does the form help in determining the Most Likely Sales Price?

The form provides a structured way for brokers to evaluate the property’s condition and compare it to similar properties in the area. By analyzing these factors, brokers can make an informed estimate of the Most Likely Sales Price based on the property’s current state and market conditions.

What should brokers keep in mind regarding state-specific requirements?

Brokers must be aware of any specific disclosure requirements in their state. It’s crucial to include these disclosures in the form where applicable to ensure compliance with local laws and regulations.

Can the ERC Broker Market Analysis form be used for financing purposes?

No, the ERC Broker Market Analysis form is not intended for financing purposes. It is a comparative market analysis tool and does not meet the standards of a formal appraisal. Lenders will require a different type of assessment for financing decisions.

What happens after the form is completed?

Once the form is filled out, it should be submitted according to the requesting company’s guidelines. This may include providing photographs of the property and any additional documentation that supports the analysis. The completed form helps the broker provide a comprehensive report to the client.

Erc Broker Market Analysis: Usage Steps

Completing the ERC Broker Market Analysis form is an essential step in estimating the most likely sales price of a property. This process involves gathering detailed information about the property, its condition, and the surrounding market. Once the form is filled out, it will serve as a crucial tool for brokers to analyze and strategize effectively.

- Begin by entering the File Number and the Homeowner(s) name.

- Provide the Property Address, including City, State, Zip.

- Fill in the Home Phone and Work Phone numbers.

- Indicate who requested the BMA by filling in the Requesting Company and Contact details, including e-mail and Fax number.

- Next, enter the Real Estate Firm and the Agent Preparer details.

- Document the Homeowner’s Purchase Price and the Date Purchased.

- List any Improvements Made by the homeowner, if applicable.

- Indicate whether the subject property is currently listed by checking Yes or No.

- Specify the Form of Ownership and the Occupant type.

- Identify the Type of property (e.g., Condo, Single Family, etc.).

- Note any personal property that remains with the property.

- Describe the Subject’s Location Type and any Lot Characteristics that may be positive or negative.

- Detail the Subject’s View and any Locational Issues that may affect insurability.

- Check all relevant Site Characteristics and Miscellaneous Issues that may impact the property.

- Complete the Property Condition section by checking the appropriate boxes and providing comments.

- Estimate costs for Recommended Repairs and Improvements for both interior and exterior items.

- List all required inspections and disclosures.

- Identify the most probable means of financing and describe any necessary concessions.

- Comment on any anticipated issues that may affect financing.

- Define the Subject Neighborhood and provide statistics that reflect the market area.

- Gather data on Competing Listings and Comparable Sales to assess market conditions.

- Finally, ensure all sections are completed and review the form for accuracy before submission.