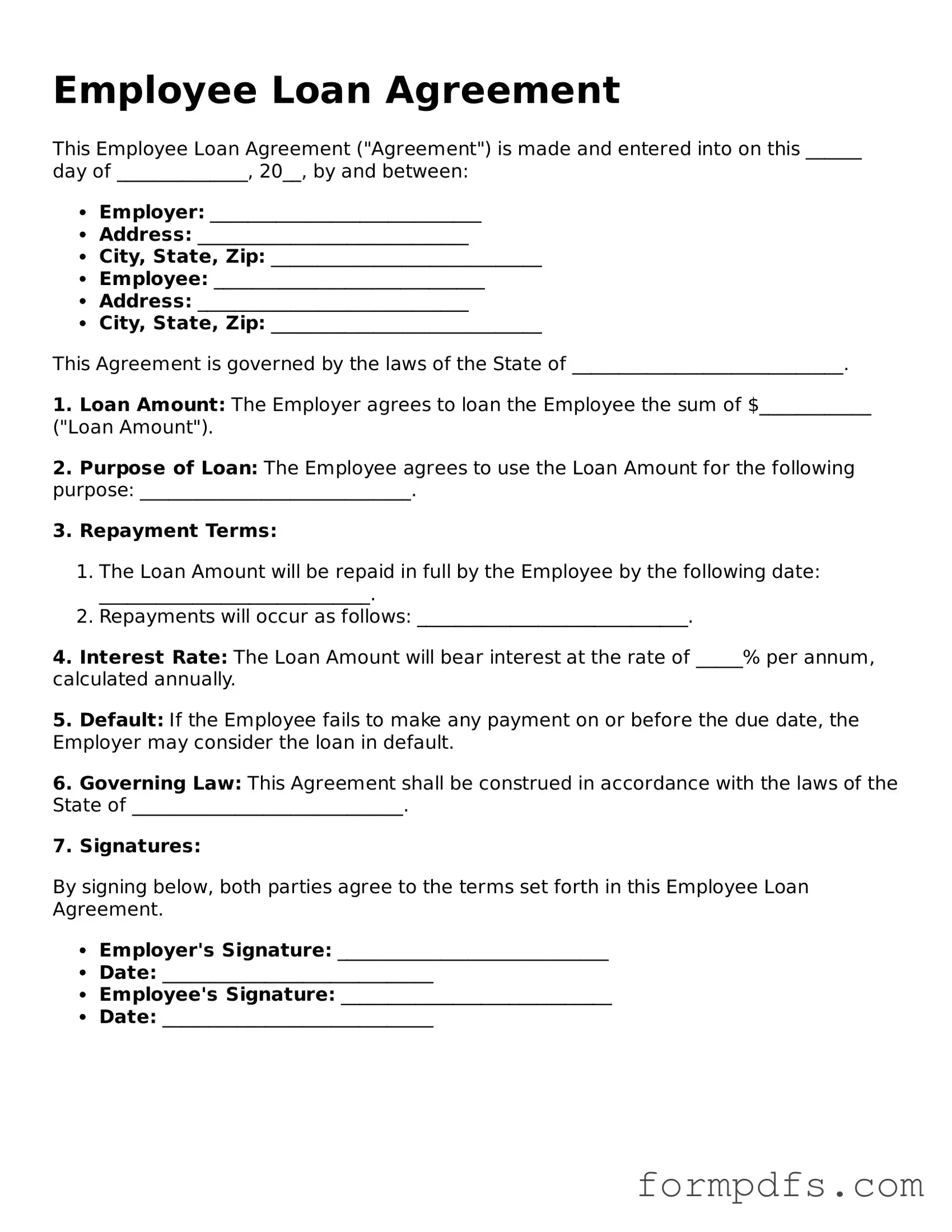

Valid Employee Loan Agreement Template

When it comes to managing employee loans, having a clear and comprehensive Employee Loan Agreement form is essential for both employers and employees. This document outlines the terms and conditions under which a loan is granted, ensuring that all parties understand their rights and responsibilities. Key elements typically included in the agreement are the loan amount, repayment schedule, interest rates, and any applicable fees. Additionally, the form may specify the consequences of defaulting on the loan, providing a safety net for employers while also protecting employees from unexpected penalties. By laying out these details, the Employee Loan Agreement fosters transparency and trust, helping to maintain a positive working relationship. Whether for personal emergencies or professional development, a well-structured agreement serves as a vital tool in facilitating financial support within the workplace.

Documents used along the form

The Employee Loan Agreement form is a crucial document used to outline the terms and conditions of a loan provided by an employer to an employee. Alongside this agreement, several other forms and documents may be utilized to ensure clarity and legal compliance. Below is a list of commonly associated documents.

- Promissory Note: This document serves as a written promise from the employee to repay the loan amount. It typically includes details such as the loan amount, interest rate, repayment schedule, and consequences for default.

- Repayment Schedule: A detailed plan that outlines when payments are due and the amount of each payment. This document helps both parties keep track of the repayment timeline.

- Loan Disclosure Statement: This statement provides important information about the loan, including interest rates, fees, and the total cost of the loan. It ensures that the employee is fully informed before accepting the loan.

- Loan Agreement Form: This form serves as a comprehensive contract between the employer and employee, detailing all relevant terms such as loan amount, interest rates, and payment schedules. To ensure a thorough understanding and proper documentation, it is advisable to utilize the form available at LegalDocumentsTemplates.com.

- Authorization for Payroll Deductions: This form allows the employer to deduct loan payments directly from the employee's paycheck. It must be signed by the employee to authorize these deductions.

- Termination of Loan Agreement: In the event that the employee leaves the company or the loan is fully repaid, this document formally terminates the loan agreement and releases the employee from further obligations.

These documents work together to create a comprehensive framework for employee loans, promoting transparency and accountability. Understanding each document's role can help both employers and employees navigate the loan process effectively.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a document that outlines the terms under which an employer lends money to an employee. |

| Purpose | This agreement clarifies the repayment terms, interest rates, and any conditions related to the loan. |

| Loan Amount | The agreement specifies the exact amount of money being loaned to the employee. |

| Interest Rate | It may include an interest rate, which can be set at a fixed or variable rate depending on the agreement. |

| Repayment Schedule | The document outlines a repayment schedule, detailing when and how payments should be made. |

| Governing Law | The agreement is subject to the laws of the state in which it is executed, such as California's Civil Code or New York's General Obligations Law. |

| Default Conditions | It defines what constitutes a default and the consequences of failing to repay the loan. |

| Confidentiality Clause | Many agreements include a confidentiality clause to protect sensitive financial information. |

| Employee Rights | Employees have the right to review the terms of the loan and seek clarification before signing. |

| Termination Clause | The agreement may include a clause that addresses what happens to the loan if the employee leaves the company. |

More About Employee Loan Agreement

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer provides a loan to an employee. This agreement specifies the loan amount, repayment schedule, interest rates, and any penalties for late payments. It protects both the employer and the employee by ensuring that all parties understand their rights and obligations.

What should be included in the Employee Loan Agreement?

The agreement should clearly state the loan amount, the purpose of the loan, and the repayment terms, including the duration and frequency of payments. Additionally, it should outline the interest rate, if applicable, and any fees associated with the loan. It's also important to include provisions for default, which detail the consequences if the employee fails to repay the loan as agreed.

How does an Employee Loan Agreement benefit both parties?

This agreement creates a transparent framework for the loan process. For the employer, it minimizes the risk of misunderstandings and ensures that funds are repaid in a timely manner. For the employee, it provides access to financial resources that may be needed for emergencies or other personal expenses. A clear agreement fosters trust and maintains a positive working relationship.

Can an Employee Loan Agreement be modified after it is signed?

Employee Loan Agreement: Usage Steps

Completing the Employee Loan Agreement form is a straightforward process that ensures both the employee and employer are clear on the terms of the loan. Follow the steps below to fill out the form accurately.

- Begin by entering the employee's full name in the designated space at the top of the form.

- Provide the employee's job title and department to clarify their role within the organization.

- Fill in the loan amount requested by the employee. Ensure that this amount is clearly stated in both numbers and words.

- Specify the purpose of the loan. This could include reasons such as medical expenses, education, or home repairs.

- Indicate the repayment terms, including the duration of the loan and the repayment schedule (e.g., monthly, bi-weekly).

- Include the interest rate, if applicable. Make sure this is clearly defined to avoid any confusion later on.

- Both the employee and a representative from the company should sign and date the form to confirm agreement to the terms.

After completing the form, ensure that both parties keep a copy for their records. This will help maintain clarity and accountability throughout the loan process.