Valid Durable Power of Attorney Template

The Durable Power of Attorney (DPOA) form is a vital legal document that empowers an individual, known as the agent or attorney-in-fact, to make decisions on behalf of another person, referred to as the principal. This arrangement remains effective even if the principal becomes incapacitated, ensuring that their wishes are honored during challenging times. The DPOA can cover a broad range of financial and healthcare decisions, allowing the agent to manage assets, pay bills, and make medical choices when the principal is unable to do so. It is essential for individuals to choose a trusted person as their agent, as this relationship will play a critical role in their well-being. The DPOA can be tailored to fit specific needs, whether it is limited to particular tasks or comprehensive in scope. Understanding the implications and responsibilities associated with this form is crucial for both the principal and the agent, as it establishes a framework for decision-making that respects the principal's preferences and values.

Other Durable Power of Attorney Templates:

Ca Reg 260 - You can maintain peace of mind while empowering a trusted individual to act on your behalf.

Before finalizing your vehicle sale, ensure you have the necessary documentation, including the Motor Vehicle Bill of Sale form, which is vital for a smooth transaction. This form not only protects your interests but also provides clarity about the sale details, ensuring a transparent exchange between the buyer and seller.

Sample Power of Attorney - This Power of Attorney serves to protect your interests in real estate dealings.

Power of Attorney for Child Florida - This Power of Attorney serves to protect your child’s interests in your absence.

Durable Power of Attorney Forms for Specific US States

Documents used along the form

When preparing a Durable Power of Attorney, it's essential to consider additional documents that may complement or enhance your estate planning. Below is a list of commonly used forms that can work alongside a Durable Power of Attorney.

- Last Will and Testament: This document outlines how your assets should be distributed after your death. It can specify guardianship for minors and other important final wishes.

- ATV Bill of Sale: This document is essential for the purchase or sale of all-terrain vehicles in Arizona, ensuring a clear transfer of ownership and compliance with state regulations. For more information, you can refer to Legal PDF Documents.

- Living Will: A Living Will details your preferences for medical treatment in situations where you cannot communicate your wishes, particularly regarding life-sustaining measures.

- Healthcare Proxy: This form designates someone to make medical decisions on your behalf if you are unable to do so. It can complement a Living Will by providing an advocate for your healthcare choices.

- Revocable Living Trust: A Revocable Living Trust allows you to manage your assets during your lifetime and specifies how they should be distributed after your death, often avoiding probate.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document specifically grants someone the authority to manage your financial affairs, including banking and property transactions.

- Beneficiary Designations: Certain assets, like life insurance and retirement accounts, require specific beneficiary designations. These should be updated to align with your overall estate plan.

- HIPAA Release Form: This form allows healthcare providers to share your medical information with designated individuals, ensuring they can make informed decisions on your behalf.

- Asset Inventory List: An inventory list details all your assets, making it easier for your agent and beneficiaries to understand your estate and manage it accordingly.

- Letter of Instruction: While not a legal document, a Letter of Instruction provides guidance to your loved ones regarding your wishes, funeral arrangements, and important contacts.

These documents can work together to ensure that your wishes are respected and that your affairs are managed according to your preferences. Taking the time to prepare them can provide peace of mind for you and your loved ones.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney is a legal document that grants someone the authority to act on another person's behalf in financial or legal matters, even if the person becomes incapacitated. |

| Durability | This type of power of attorney remains effective even after the principal becomes incapacitated, unlike a standard power of attorney which ceases to be effective under such circumstances. |

| Principal and Agent | The individual who creates the Durable Power of Attorney is known as the principal, while the person designated to act on their behalf is referred to as the agent or attorney-in-fact. |

| State-Specific Forms | Each state has its own specific Durable Power of Attorney form. It is essential to use the form that complies with the laws of the state where the principal resides. |

| Governing Laws | In the United States, the Uniform Power of Attorney Act serves as a model for many states, but each state may have variations. For example, California's Durable Power of Attorney is governed by the California Probate Code. |

| Execution Requirements | Most states require the Durable Power of Attorney to be signed by the principal in the presence of a notary public and/or witnesses to be valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. This revocation should be documented in writing. |

| Agent's Duties | The agent has a fiduciary duty to act in the best interest of the principal, which includes making decisions that align with the principal’s wishes and financial well-being. |

More About Durable Power of Attorney

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual (the principal) to designate someone else (the agent) to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. The DPOA can cover financial matters, healthcare decisions, or both, depending on how it is drafted.

Why should I consider a Durable Power of Attorney?

A DPOA is essential for planning ahead. It ensures that your financial and healthcare decisions are managed by someone you trust if you are unable to make those decisions yourself. This can prevent potential disputes among family members and provide peace of mind knowing that your affairs will be handled according to your wishes.

Who can be appointed as an agent in a Durable Power of Attorney?

Any competent adult can serve as an agent. This could be a family member, friend, or even a professional such as an attorney or financial advisor. It is crucial to choose someone who understands your values and wishes, as they will be responsible for making significant decisions on your behalf.

What powers does a Durable Power of Attorney grant the agent?

The powers granted can vary widely depending on the language used in the document. Generally, the agent may have the authority to manage financial accounts, pay bills, make investments, and handle real estate transactions. If the DPOA includes healthcare decisions, the agent may also make medical choices and access health records. It's essential to specify the powers clearly to avoid confusion.

How do I create a Durable Power of Attorney?

Creating a DPOA typically involves drafting the document, which can be done using templates or with the help of an attorney. The principal must sign the document in the presence of a notary public or witnesses, depending on state laws. It’s important to check local requirements to ensure the DPOA is valid.

Can I revoke a Durable Power of Attorney?

Yes, a DPOA can be revoked at any time as long as the principal is mentally competent. To revoke the DPOA, the principal should notify the agent in writing and may also need to inform any institutions or individuals that relied on the original document. Creating a new DPOA will automatically revoke any previous versions.

What happens if I don’t have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, a court may appoint a guardian or conservator to manage your affairs. This process can be lengthy, expensive, and may not align with your wishes. Having a DPOA in place allows you to maintain control over who makes decisions for you.

Is a Durable Power of Attorney the same as a regular Power of Attorney?

No, a regular Power of Attorney typically becomes invalid if the principal becomes incapacitated. In contrast, a Durable Power of Attorney remains effective in such situations. The "durable" aspect is what differentiates it and provides ongoing authority to the agent.

Can a Durable Power of Attorney be used in different states?

A DPOA is generally valid across state lines, but it’s crucial to ensure that the document complies with the laws of the state where it will be used. Some states have specific requirements or forms, so it may be wise to consult with a local attorney if you plan to use a DPOA in a different state.

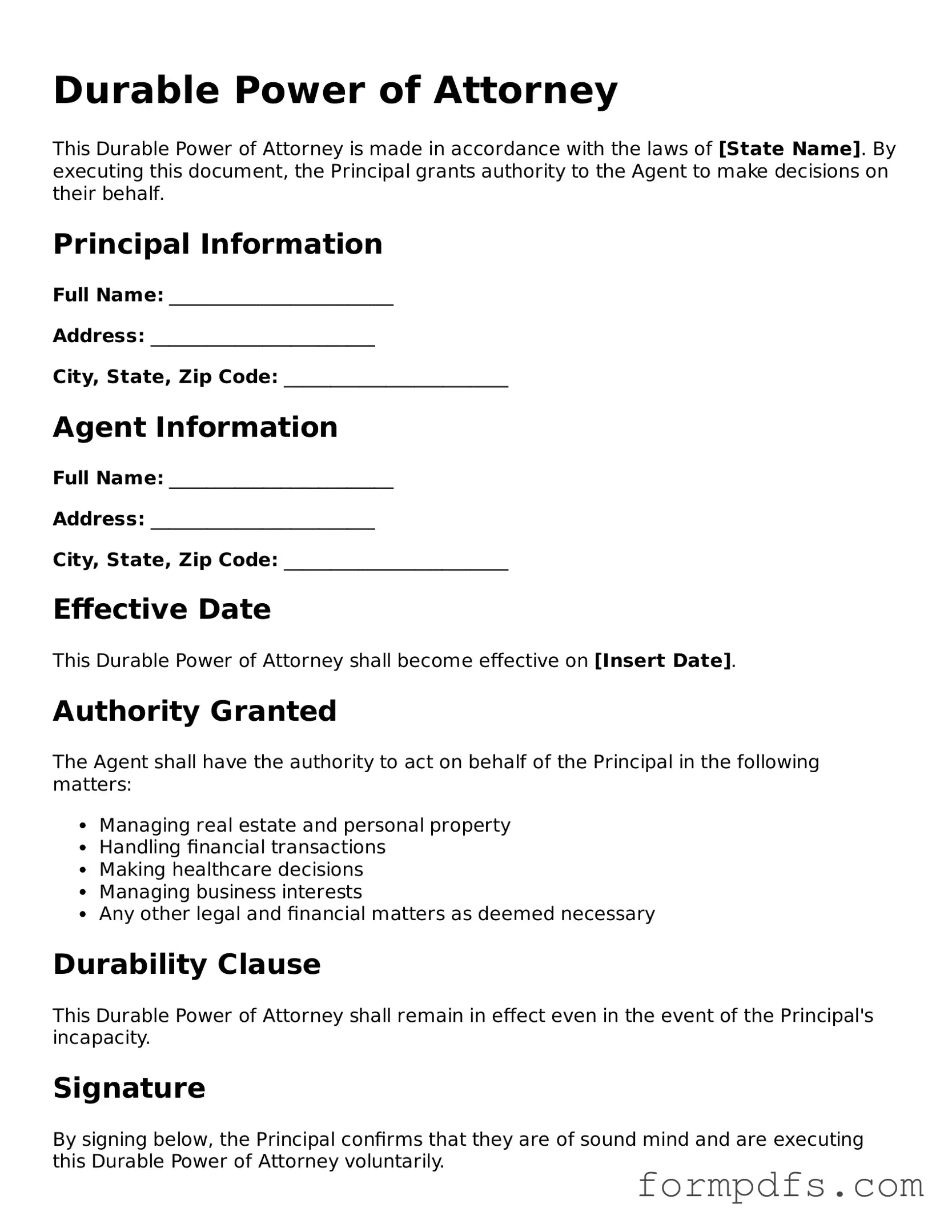

Durable Power of Attorney: Usage Steps

Completing a Durable Power of Attorney form is an important step in designating someone to make decisions on your behalf. After filling out the form, it must be signed and notarized to ensure its validity. Follow these steps carefully to ensure all necessary information is accurately provided.

- Obtain the Durable Power of Attorney form. This can typically be found online or through legal offices.

- Begin by entering your full name and address at the top of the form. This identifies you as the principal.

- Next, provide the full name and address of the person you are appointing as your agent. This individual will act on your behalf.

- Specify the powers you wish to grant to your agent. You may select general powers or limit them to specific areas, such as financial or medical decisions.

- Indicate when the powers will begin. You can choose for them to start immediately or at a specified future date.

- Sign and date the form in the designated area. Ensure your signature matches your legal name.

- Have the form notarized. This step is crucial for the document to be legally binding.

- Make copies of the signed and notarized form. Keep one for your records and provide copies to your agent and any relevant institutions.