Valid Deed of Trust Template

The Deed of Trust form plays a crucial role in real estate transactions, serving as a key legal instrument that secures a loan by establishing a lien on the property. This document involves three parties: the borrower, the lender, and a neutral third party known as the trustee. The borrower transfers the legal title of the property to the trustee, who holds it as security for the loan until the borrower repays the debt. In addition to outlining the terms of the loan, the Deed of Trust specifies the rights and responsibilities of each party involved. It includes important details such as the loan amount, interest rate, payment schedule, and the consequences of default. Understanding the nuances of this form is essential for both lenders and borrowers, as it not only protects the lender’s investment but also clarifies the borrower’s obligations. By navigating the complexities of the Deed of Trust, individuals can better safeguard their interests in real estate transactions.

Other Deed of Trust Templates:

What Is a Deed in Lieu - This form shows the willingness of the homeowner to relinquish the property to mitigate negative impacts on their credit score.

Printable Quitclaim Deed - A way to pass property without going through probate.

The use of the Alabama Transfer-on-Death Deed form is an essential strategy for property owners who wish to streamline the transfer of their estates to heirs. By effectively utilizing the Transfer-on-Death Deed, individuals can ensure that their real estate bypasses the probate process, providing a direct transfer to beneficiaries. This method not only simplifies estate management but also offers peace of mind, knowing that your property will be handled according to your wishes.

Gift Deed Rules - Utilizing a Gift Deed may simplify the process of transferring ownership, especially for real estate or significant assets.

Documents used along the form

A Deed of Trust is an important document in real estate transactions, especially when securing a loan. Along with the Deed of Trust, several other forms and documents are commonly used. Each serves a specific purpose in the process of securing financing for a property. Below is a list of these documents.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It details the loan amount, interest rate, and repayment schedule.

- Loan Application: The borrower submits this form to the lender to request a loan. It includes personal and financial information necessary for the lender to assess creditworthiness.

- Georgia Deed Form: For accurate property transfers, reference the necessary Georgia deed form steps to ensure compliance and proper documentation.

- Title Insurance Policy: This policy protects the lender against any claims or issues related to the property’s title. It ensures that the title is clear of any liens or disputes.

- Disclosure Statements: These documents provide important information about the loan terms and costs. They help the borrower understand their financial obligations.

- Property Appraisal: An appraisal assesses the property's value. This document is crucial for the lender to determine how much they are willing to lend.

- Closing Statement: This document summarizes all the financial transactions involved in the closing process. It outlines the final costs and fees associated with the loan and property purchase.

- Mortgage or Deed of Trust Recordation: This form is filed with the local government to officially record the Deed of Trust. It makes the lender's interest in the property public and enforceable.

Understanding these documents can help borrowers navigate the loan process more effectively. Each form plays a crucial role in ensuring that both the lender's and borrower's interests are protected throughout the transaction.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Deed of Trust is a legal document that secures a loan by transferring the title of the property to a trustee until the loan is paid off. |

| Parties Involved | The Deed of Trust involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. |

| Governing Law | The laws governing Deeds of Trust vary by state. For example, in California, it is governed by California Civil Code Section 2920. |

| Foreclosure Process | If the borrower defaults, the trustee can initiate a non-judicial foreclosure process, which is typically faster than judicial foreclosure. |

| Recording Requirement | To be enforceable against third parties, a Deed of Trust must be recorded with the appropriate county office where the property is located. |

More About Deed of Trust

What is a Deed of Trust?

A Deed of Trust is a legal document used in real estate transactions. It involves three parties: the borrower, the lender, and a third party known as the trustee. When a borrower takes out a loan to purchase property, the Deed of Trust secures the loan by giving the trustee the right to hold the title to the property until the loan is paid off. If the borrower defaults on the loan, the trustee can sell the property to repay the lender.

How does a Deed of Trust differ from a mortgage?

While both a Deed of Trust and a mortgage serve to secure a loan, they have key differences. A mortgage typically involves only two parties: the borrower and the lender. In contrast, a Deed of Trust includes a trustee who holds the title to the property. This arrangement can simplify the foreclosure process. In many states, a Deed of Trust allows for a non-judicial foreclosure, meaning the lender can foreclose without going to court, which can save time and costs.

What are the main components of a Deed of Trust?

A Deed of Trust usually includes several important components. First, it identifies the parties involved—the borrower, the lender, and the trustee. It also describes the property being secured. Additionally, the document outlines the terms of the loan, including the amount borrowed, interest rates, and repayment schedule. Finally, it specifies what happens if the borrower defaults on the loan, detailing the rights of the lender and the trustee.

Do I need a lawyer to create a Deed of Trust?

While it is not legally required to have a lawyer draft a Deed of Trust, it is highly recommended. Real estate transactions can be complex, and a lawyer can help ensure that the document meets all legal requirements and protects your interests. A lawyer can also provide guidance on state-specific laws and regulations that may affect the Deed of Trust.

What happens if I default on a loan secured by a Deed of Trust?

If you default on a loan secured by a Deed of Trust, the lender can initiate foreclosure proceedings. The trustee will typically handle this process. If the Deed of Trust allows for non-judicial foreclosure, the trustee can sell the property without going to court. You will receive notice of the foreclosure, and there may be a period during which you can cure the default or redeem the property. It’s crucial to understand your rights and options in this situation, so seeking legal advice is advisable.

Deed of Trust: Usage Steps

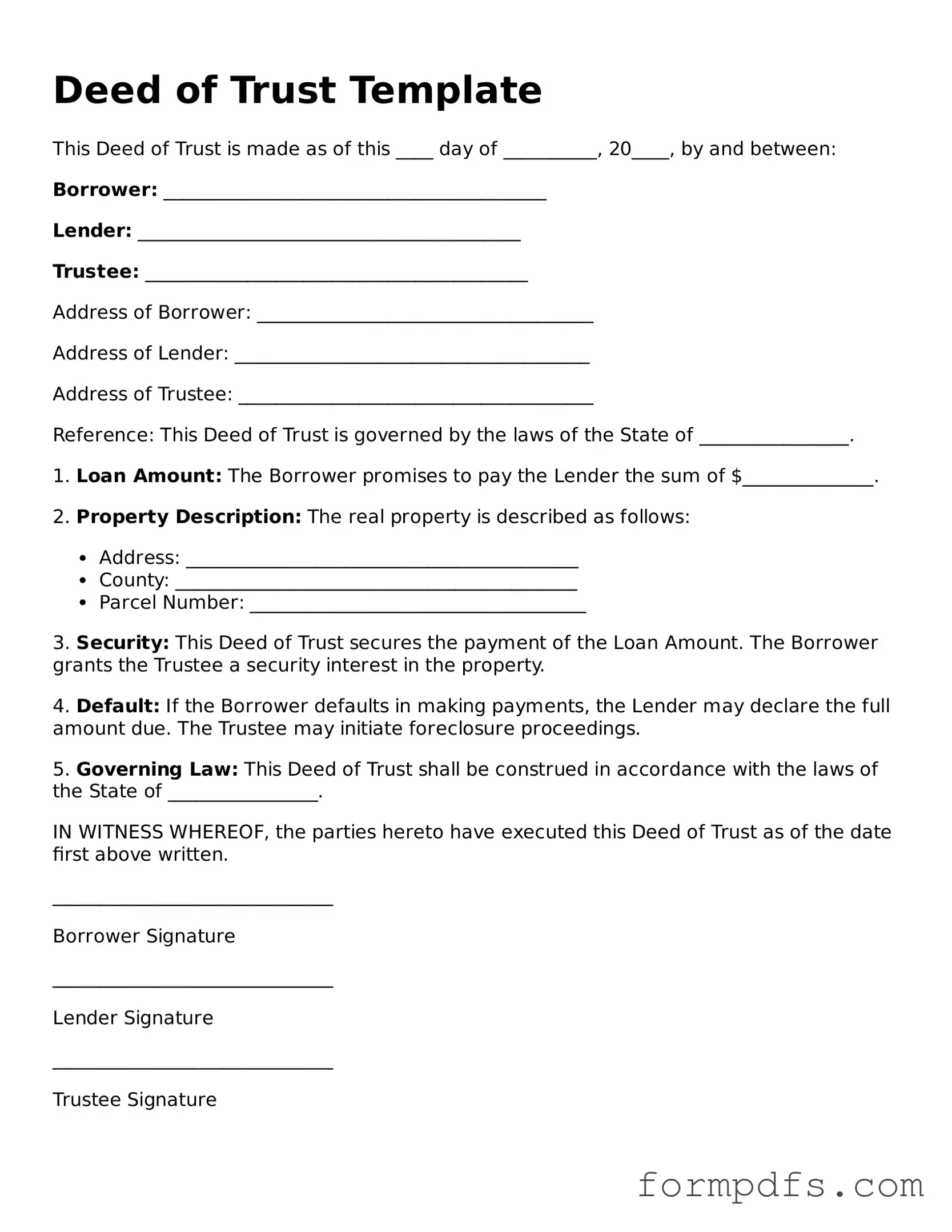

Once you have the Deed of Trust form ready, it’s important to fill it out carefully. This document is essential for securing a loan against a property. Follow these steps to ensure that you complete the form correctly.

- Start with the date at the top of the form. Write the date when you are filling out the document.

- Enter the names of the parties involved. This includes the borrower and the lender. Make sure to include full legal names.

- Provide the address of the property being secured. This should be the complete address, including city and state.

- Fill in the loan amount. This is the total amount of money being borrowed.

- Include the terms of the loan. Specify the interest rate and the repayment schedule.

- Sign the document. The borrower must sign in the designated area to validate the agreement.

- Have the document notarized. A notary public must witness the signing and provide their seal.

- Make copies of the completed form for your records. Keep one for yourself and provide one to the lender.

After completing the form, you will need to file it with the appropriate county office to make it official. This step is crucial for the document to be legally binding.