Valid Deed in Lieu of Foreclosure Template

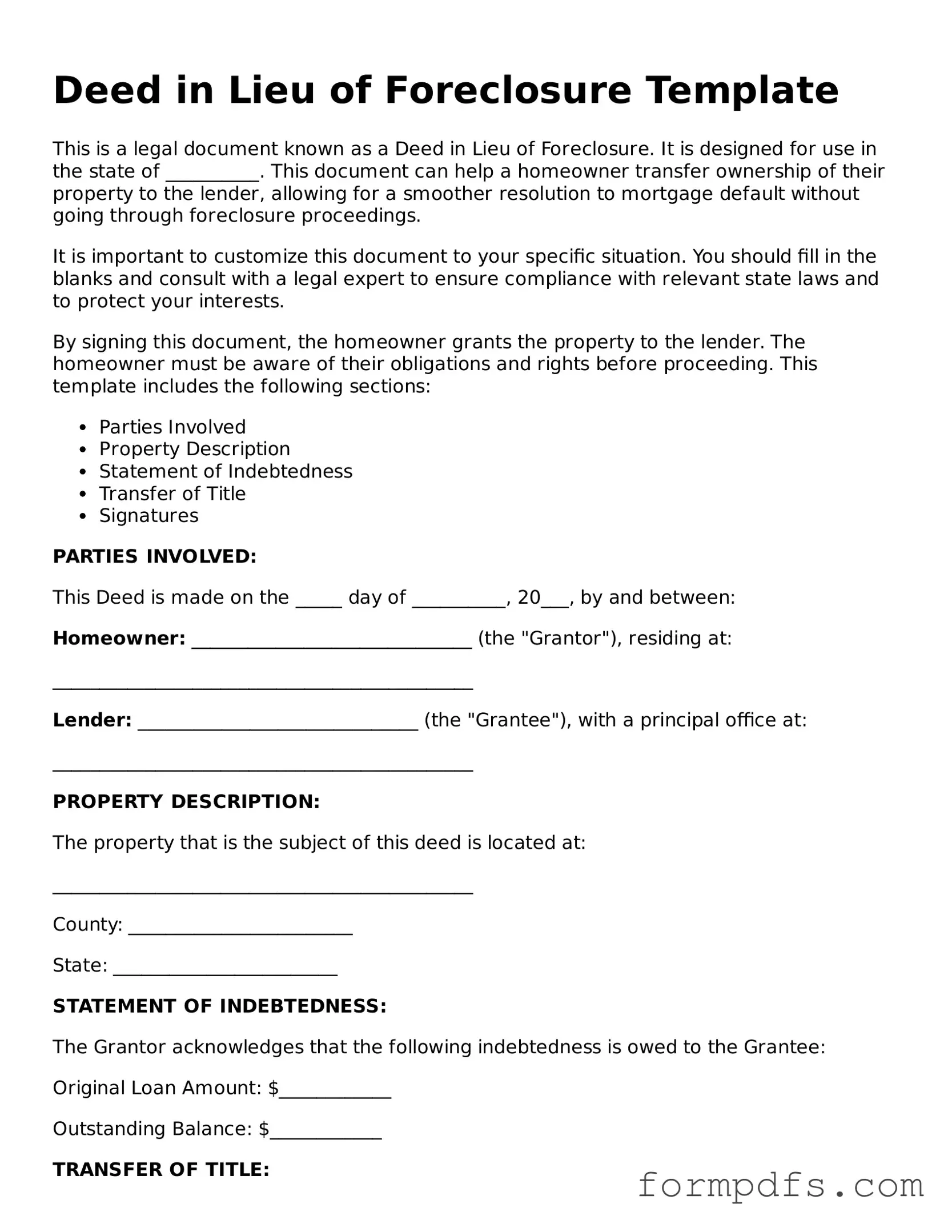

For homeowners facing the distressing prospect of foreclosure, a Deed in Lieu of Foreclosure can offer a viable alternative to help alleviate financial burdens and protect credit ratings. This legal document allows a homeowner to voluntarily transfer the title of their property to the lender, effectively relinquishing ownership in exchange for the cancellation of the mortgage debt. It is a proactive step that can help avoid the lengthy and often painful foreclosure process. The form typically requires the homeowner to provide essential details, such as the property address, the names of all parties involved, and any existing liens on the property. Additionally, it may outline specific conditions that must be met for the transfer to be accepted, including the lender's approval. Understanding the implications of this form is crucial, as it can significantly impact one's financial future. By opting for a Deed in Lieu of Foreclosure, homeowners may find a path toward regaining stability, while lenders can expedite the recovery of their investment without the costs associated with a traditional foreclosure. This option, however, is not without its complexities, and careful consideration should be given to the potential consequences and benefits before proceeding.

Other Deed in Lieu of Foreclosure Templates:

What Is Trust Deed in India - This form is essential for anyone seeking to secure a loan with real estate.

To ensure a smooth leasing process, it's crucial for business owners to understand the specifics of the California Commercial Lease Agreement. This form outlines essential elements such as rental terms, payment obligations, and maintenance responsibilities, safeguarding the rights of both landlords and tenants. For more comprehensive guidelines and resources, you can refer to All California Forms, which provide valuable information on various legal agreements in California.

Life Estate Deed Example - It can help protect your property from being sold to pay off debts after your death.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. Several other forms and documents are often used in conjunction with this process to ensure all legal requirements are met and to facilitate a smooth transition. Below is a list of related documents that may be necessary.

- Loan Modification Agreement: This document outlines the terms of a modification to the existing loan, potentially including changes to the interest rate or repayment schedule to make payments more manageable for the borrower.

- Notice of Default: This notice informs the borrower that they have defaulted on their mortgage payments. It serves as a formal warning that foreclosure proceedings may begin if the situation is not remedied.

- Release of Liability: This document releases the borrower from any further liability for the mortgage debt after the deed is transferred. It provides peace of mind that the borrower will not be pursued for any remaining balance.

- Property Condition Disclosure Statement: This statement requires the borrower to disclose the condition of the property, including any known defects or issues, ensuring the lender is fully informed before accepting the deed.

- Settlement Statement: This document details the financial aspects of the transaction, including any costs associated with the deed transfer, ensuring transparency for both parties involved.

- Affidavit of Title: This sworn statement confirms that the borrower holds clear title to the property, free from any liens or encumbrances, which is crucial for the lender's acceptance of the deed.

- Quitclaim Deed: This form is used to transfer the property title from the borrower to the lender without any warranties, often used in conjunction with a deed in lieu to simplify the transfer process.

- Trailer Bill of Sale: This form serves as a crucial document that records the sale and purchase details of a trailer, ensuring all legal requirements are met and providing vital information, such as its description and the sale price. For more details, visit toptemplates.info/bill-of-sale/trailer-bill-of-sale/.

- Foreclosure Alternatives Agreement: This document outlines the options available to the borrower to avoid foreclosure, including the deed in lieu, and may detail the lender's obligations in the process.

Understanding these documents is essential for homeowners considering a Deed in Lieu of Foreclosure. Each plays a vital role in ensuring a fair and efficient process, ultimately helping borrowers navigate a challenging situation with clarity and support.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a homeowner voluntarily transfers their property title to the lender to avoid foreclosure proceedings. |

| Purpose | This process allows homeowners to walk away from their mortgage obligations while minimizing the impact on their credit score compared to a foreclosure. |

| Eligibility | Homeowners must demonstrate financial hardship and may need to show that they cannot keep up with mortgage payments to qualify. |

| State-Specific Forms | Many states have their own forms for this process. For example, California requires a specific Deed in Lieu of Foreclosure form governed by California Civil Code § 2943. |

| Tax Implications | Homeowners may face tax consequences since the IRS considers forgiven mortgage debt as taxable income under certain circumstances. |

| Process Overview | The process typically involves negotiating with the lender, completing the necessary paperwork, and ensuring that the property is free of liens before the transfer. |

More About Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement in which a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option is typically pursued when the homeowner is unable to keep up with mortgage payments and seeks to mitigate the financial and emotional stress associated with foreclosure. By agreeing to this process, the homeowner can often avoid the lengthy and costly foreclosure proceedings, and it may also have a less severe impact on their credit score compared to a formal foreclosure.

How does the process work?

The process begins when the homeowner contacts their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then evaluate the homeowner's financial situation and the property's value. If both parties agree to proceed, the homeowner will sign a deed that transfers ownership of the property to the lender. It’s essential for homeowners to understand that they may still be responsible for any remaining debt after the property is transferred, depending on the terms negotiated with the lender. Legal advice is often recommended to navigate this process effectively.

What are the benefits of a Deed in Lieu of Foreclosure?

One of the primary benefits is the potential to avoid the lengthy foreclosure process, which can be stressful and damaging to a homeowner's credit. Additionally, a Deed in Lieu of Foreclosure can allow homeowners to walk away from their mortgage obligations more gracefully. In some cases, lenders may agree to forgive any remaining debt, which can provide significant relief. Furthermore, homeowners may be eligible for relocation assistance from the lender, helping them transition to new housing more smoothly.

Are there any drawbacks to consider?

While there are advantages, homeowners should also be aware of the potential drawbacks. A Deed in Lieu of Foreclosure can still negatively impact a homeowner's credit score, although usually less severely than a foreclosure. Additionally, not all lenders accept this option, and some may require the homeowner to demonstrate financial hardship. There can also be tax implications, as the IRS may consider forgiven debt as taxable income. Consulting with a financial advisor or tax professional is wise to understand these factors fully.

Can I still buy another home after a Deed in Lieu of Foreclosure?

Yes, it is possible to purchase another home after completing a Deed in Lieu of Foreclosure, but the timeline and terms may vary. Generally, lenders will consider the impact on your credit score and your overall financial situation. Homebuyers may need to wait a few years before qualifying for a new mortgage, depending on the lender's policies and the specifics of the situation. Rebuilding credit and demonstrating financial stability during this period can significantly enhance chances of securing a new loan in the future.

Deed in Lieu of Foreclosure: Usage Steps

After completing the Deed in Lieu of Foreclosure form, the next step involves submitting it to the lender for review. Once the lender receives the form, they will evaluate the information provided and determine the next actions. This process may include additional documentation or communication regarding the status of the property.

- Begin by downloading the Deed in Lieu of Foreclosure form from a reliable source or your lender's website.

- Read through the entire form carefully to understand the required information.

- Fill in your name and contact information in the designated sections at the top of the form.

- Provide the property address that is subject to the deed.

- Include the legal description of the property, which can usually be found on your mortgage documents or property tax statements.

- Indicate the lender's name and address as it appears on your mortgage agreement.

- State the reason for the deed in lieu of foreclosure, briefly explaining your situation.

- Sign and date the form in the appropriate spaces provided.

- Have the form notarized to ensure its validity.

- Make copies of the completed form for your records.

- Submit the original form to your lender, following any specific submission guidelines they may have.