Valid Deed Template

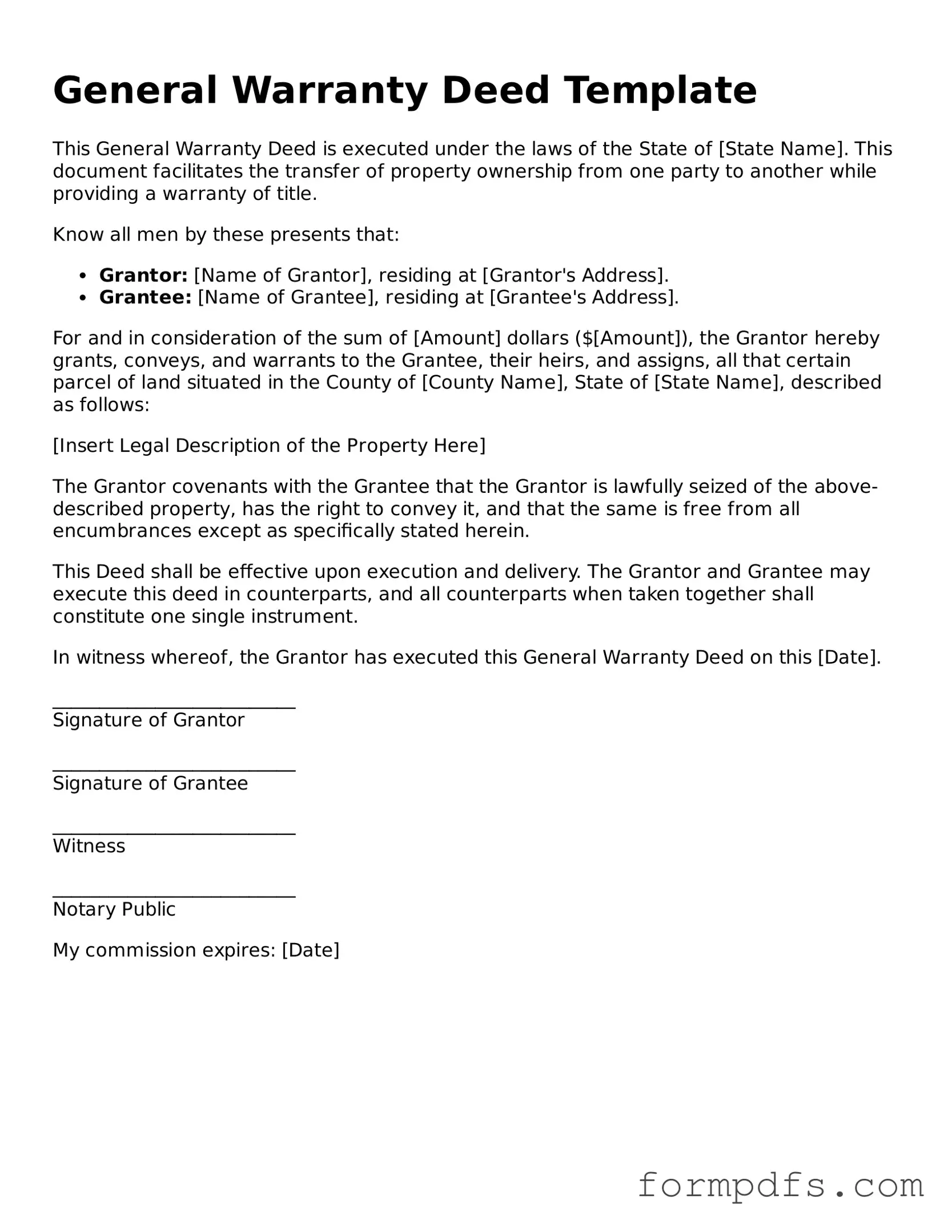

The Deed form is an essential legal document that plays a critical role in property transactions and ownership transfers. It serves as a formal record of an agreement between parties, often detailing the transfer of real estate or other significant assets. This form typically includes key information such as the names of the parties involved, a description of the property, and the terms of the transfer. Additionally, the Deed form may require signatures from witnesses or notaries to ensure its validity. Understanding the components of the Deed form is vital for anyone engaged in buying, selling, or transferring property, as it helps protect the rights of all parties involved. Properly executed, this document can prevent future disputes and clarify ownership, making it a cornerstone of real estate law.

More Forms:

Employees Handbook - This form is critical for fostering a collaborative work environment.

When completing a transaction involving an all-terrain vehicle, it's essential to have the proper documentation; the New York ATV Bill of Sale form provides a reliable way to record such sales. This form not only includes vital details like the vehicle's description and sale price but also confirms the identities of both the buyer and seller. To streamline this process, you can access the necessary template at smarttemplates.net/fillable-new-york-atv-bill-of-sale/, ensuring that the sale is conducted legally and aids in the vehicle's registration.

Army Sworn Statement Form - Users should keep a copy of their statement for personal records.

Deed Forms for Specific US States

Documents used along the form

When dealing with property transactions, the Deed form is just one piece of the puzzle. Several other documents often accompany it to ensure a smooth transfer of ownership and to protect the rights of all parties involved. Here are a few key documents you might encounter:

- Title Insurance Policy: This document protects the buyer against any future claims or disputes regarding the property’s ownership. It ensures that the title is clear and that there are no hidden issues that could arise after the purchase.

- Affidavit of Service: This essential form is used to confirm the delivery of important documents between parties, playing a critical role in maintaining transparency and accountability in legal processes. For more information, see All California Forms.

- Property Survey: A property survey outlines the exact boundaries of the property. It can help identify any encroachments or easements that may affect the ownership and use of the land.

- Closing Statement: This document summarizes all the financial aspects of the transaction. It details the purchase price, closing costs, and any adjustments made during the closing process, ensuring transparency for both the buyer and seller.

- Mortgage Agreement: If the buyer is financing the purchase, this document outlines the terms of the loan. It includes details about the loan amount, interest rate, repayment schedule, and the lender's rights in case of default.

Understanding these documents can help you navigate the complexities of property transactions. Each plays a crucial role in protecting your interests and ensuring a successful transfer of ownership.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A deed is a legal document that conveys ownership of property from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special purpose deeds, each serving different legal purposes. |

| State-Specific Forms | Many states have specific requirements for deed forms, governed by local property laws. For example, California follows the California Civil Code. |

| Execution Requirements | Most deeds must be signed by the grantor and may require notarization to be legally binding. |

| Recording | Deeds should be recorded with the local county recorder's office to provide public notice and protect the rights of the new owner. |

More About Deed

What is a Deed form?

A Deed form is a legal document used to convey property rights from one party to another. It serves as proof of ownership and outlines the terms of the transfer. Typically, the Deed includes information about the property, the parties involved, and any conditions or restrictions associated with the transfer. It is important for establishing clear ownership and can be essential in legal proceedings related to the property.

What types of Deeds are there?

There are several types of Deeds, each serving different purposes. The most common types include Warranty Deeds, which guarantee that the seller holds clear title to the property; Quitclaim Deeds, which transfer whatever interest the seller has without any guarantees; and Special Purpose Deeds, which are used for specific situations, such as transferring property into a trust. Understanding the differences can help you choose the right Deed for your needs.

How do I fill out a Deed form?

Filling out a Deed form requires careful attention to detail. Start by entering the names of the parties involved in the transaction, clearly identifying the grantor (seller) and grantee (buyer). Next, include a legal description of the property, which can usually be found in previous Deeds or property tax records. Finally, ensure that all required signatures are present, and consider having the document notarized to enhance its validity. Double-check for accuracy to avoid potential issues later.

Do I need a lawyer to create a Deed form?

While it is possible to create a Deed form without legal assistance, consulting a lawyer is often recommended. A legal professional can provide guidance on the specific requirements for your state and ensure that the Deed is properly executed. This can help prevent future disputes or complications regarding ownership. If you are unsure about the process or the implications of the Deed, seeking legal advice can be a wise investment.

Deed: Usage Steps

Completing a Deed form is an important step in the process of transferring property ownership. After filling out the form, you will need to ensure it is signed, notarized, and filed with the appropriate local government office to finalize the transfer.

- Begin by gathering all necessary information, including the names of the parties involved, the property description, and any relevant legal details.

- At the top of the form, clearly write the title of the document, typically “Deed” or “Warranty Deed.”

- In the first section, fill in the names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a complete and accurate description of the property being transferred. This should include the legal description, which can often be found in previous deeds or property tax records.

- Indicate the consideration or payment amount for the property transfer. This is often a nominal amount, such as $1, unless otherwise specified.

- Include any specific terms or conditions of the transfer, if applicable. This may involve easements or restrictions that affect the property.

- Leave space for the signatures of both the grantor and the grantee. Ensure both parties sign the document in the presence of a notary public.

- Once signed, take the document to a notary public for notarization. The notary will verify the identities of the signers and affix their seal to the document.

- Finally, submit the completed and notarized Deed form to the local county recorder's office or land registry office. This step is crucial for making the transfer official and public.