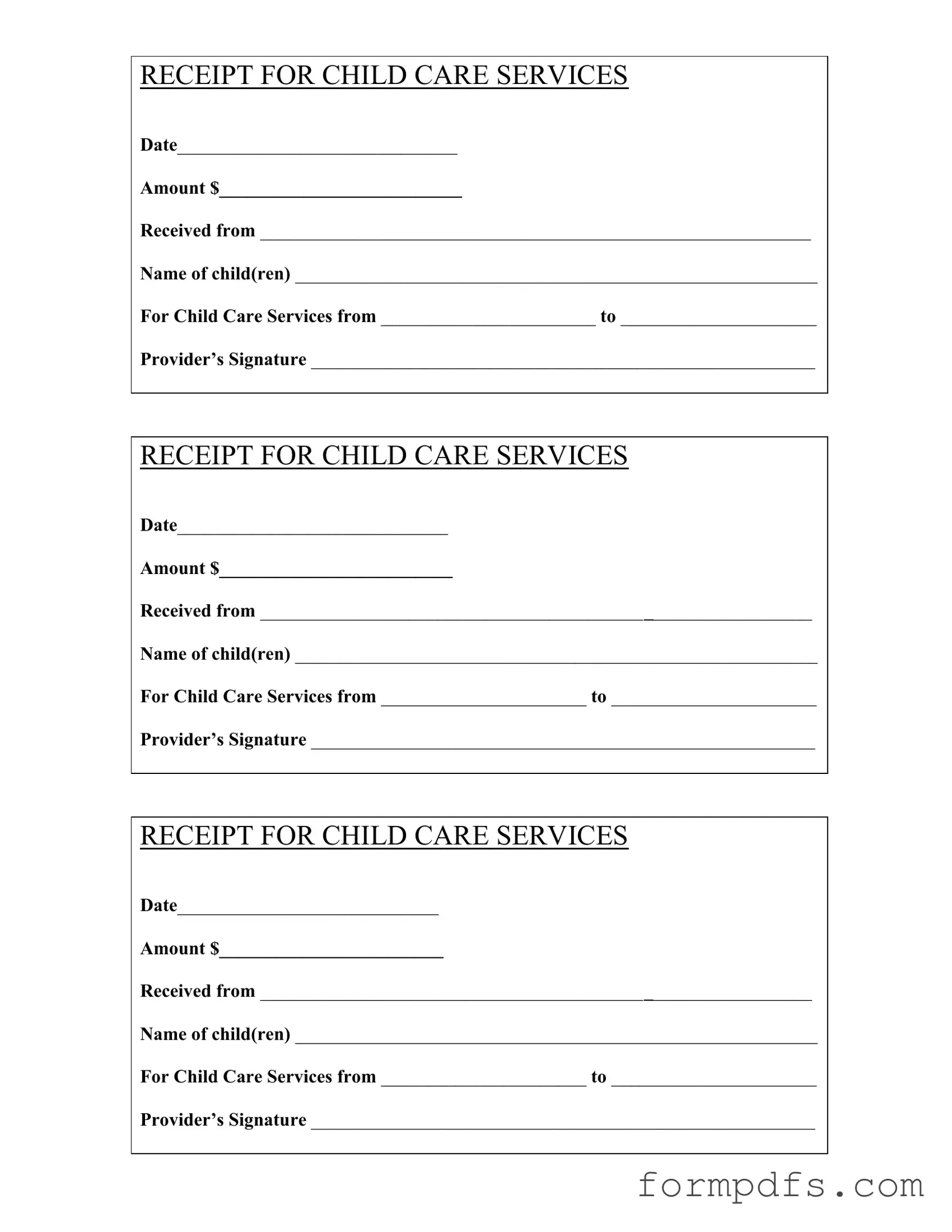

Blank Childcare Receipt PDF Form

The Childcare Receipt form serves as a crucial document for parents and childcare providers alike, facilitating clear communication and record-keeping regarding childcare services rendered. This form includes essential details such as the date of service, the total amount paid, and the name of the child or children receiving care. Additionally, it specifies the period during which the childcare services were provided, ensuring both parties are aligned on the timeframe of care. The provider’s signature at the bottom of the form adds a layer of authenticity and acknowledgment, confirming that the service has been delivered as agreed. By utilizing this form, parents can maintain accurate records for budgeting and potential tax deductions, while providers can document their services for professional and financial purposes. Overall, the Childcare Receipt form is an important tool in the childcare industry, promoting transparency and accountability in transactions between families and caregivers.

More PDF Templates

I983 Sign in Ink - Part of the application process for a STEM Optional Practical Training, the I-983 ensures compliance with regulations.

When planning for unforeseen circumstances, it's vital to utilize a critical Durable Power of Attorney document that empowers a trusted individual to handle your financial responsibilities, ensuring that your interests are protected and your decisions are respected.

Facial Release Form - By signing, you accept the terms related to the facial service.

Cuddle Application - Meet like-minded individuals looking for closeness and comfort.

Documents used along the form

When managing childcare expenses, several documents often accompany the Childcare Receipt form. These documents help maintain accurate records and provide clarity for both providers and parents. Below are four commonly used forms and documents.

- Childcare Agreement: This document outlines the terms of service between the childcare provider and the parent. It includes details such as hours of operation, payment terms, and responsibilities of both parties.

- Boat Bill of Sale: When purchasing a boat in New York, it's important to complete a https://smarttemplates.net/fillable-new-york-boat-bill-of-sale to ensure the transaction is legal and all necessary details are documented.

- Enrollment Form: This form collects essential information about the child, including emergency contacts, allergies, and medical history. It ensures that the provider has all necessary details to care for the child effectively.

- Payment Ledger: A payment ledger tracks all transactions between the parent and the childcare provider. It records dates, amounts paid, and any outstanding balances, ensuring transparency in financial matters.

- Tax Document (Form 2441): This form is used for claiming the Child and Dependent Care Credit on tax returns. Parents must provide information about the childcare provider and the amount spent on care to qualify for tax benefits.

These documents work together to create a comprehensive record of childcare arrangements, ensuring both parties are informed and protected. Keeping these forms organized can simplify communication and financial management for parents and providers alike.

Form Breakdown

| Fact Name | Description |

|---|---|

| Date of Service | The receipt must include the specific date when the childcare services were provided. This ensures clarity regarding the time frame of care received. |

| Amount Paid | The total amount paid for the childcare services should be clearly stated on the receipt. This amount reflects the financial transaction between the provider and the client. |

| Recipient Information | The name of the individual who received the childcare services must be included. This identifies the parent or guardian responsible for the payment. |

| Child's Name | Listing the names of the child or children receiving care is essential. This provides a direct link between the service provided and the recipient. |

| Provider's Signature | The signature of the childcare provider must be present on the receipt. This serves as verification that the service was rendered and payment was accepted. |

More About Childcare Receipt

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as proof of payment for childcare services. It documents the amount paid, the date of service, and the names of the children receiving care. This form is important for parents who may need to claim childcare expenses for tax purposes or for reimbursement from employers. Keeping a record of these receipts helps ensure that parents have the necessary documentation when required.

What information do I need to fill out on the Childcare Receipt form?

To complete the Childcare Receipt form, you will need to provide several key pieces of information. First, write the date on which the payment was made. Next, indicate the total amount paid for the childcare services. You should also include your name as the person making the payment and the names of the children who received care. Lastly, the form requires the signature of the childcare provider, confirming that the service was rendered and payment was received.

How can I use the Childcare Receipt form for tax purposes?

What should I do if I lose my Childcare Receipt form?

If you lose your Childcare Receipt form, it is essential to contact your childcare provider as soon as possible. They can issue a duplicate receipt or provide a new one. Make sure to explain the situation and provide any necessary details, such as the date of service and the amount paid. Keeping a digital copy or taking a photo of the receipt after receiving it can help prevent this issue in the future.

Childcare Receipt: Usage Steps

After obtaining the Childcare Receipt form, you will need to fill it out accurately to ensure proper documentation of the childcare services provided. Follow these steps carefully to complete the form.

- Write the date in the space provided next to "Date." Ensure it is the date you are filling out the form.

- Enter the amount paid for the childcare services in the space next to "Amount $."

- Fill in the name of the person or entity from whom the payment was received in the section labeled "Received from."

- List the names of the child(ren) receiving care in the area marked "Name of child(ren)." Include all relevant names.

- Indicate the start and end dates for the childcare services in the section that states "For Child Care Services from" and "to." Be specific about the dates.

- Have the childcare provider sign the form in the area marked "Provider’s Signature." This confirms the receipt of payment.