Blank Cg 20 10 07 04 Liability Endorsement PDF Form

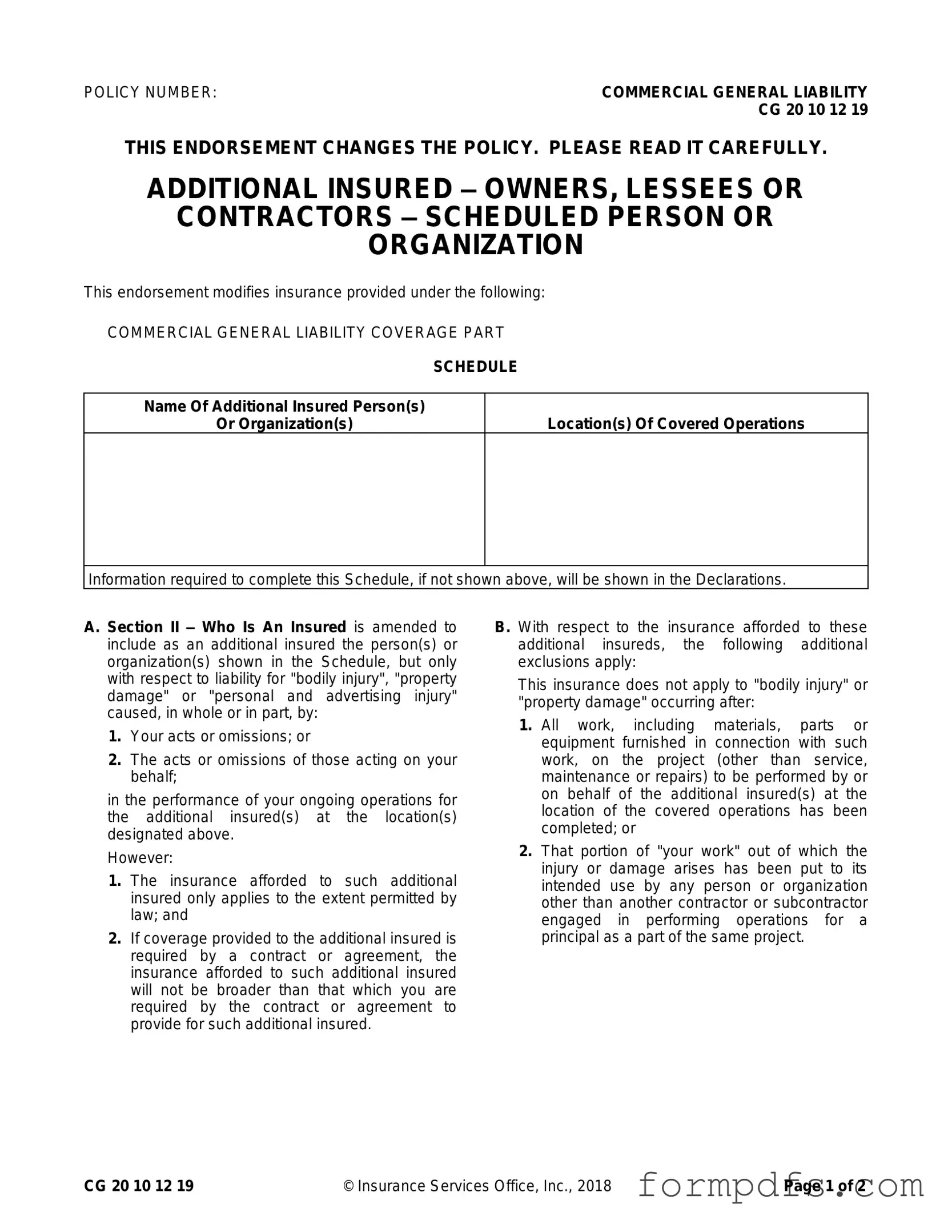

The CG 20 10 07 04 Liability Endorsement form serves as a critical document within the realm of commercial general liability insurance, specifically designed to extend coverage to additional insured parties. This endorsement modifies existing policies to include owners, lessees, or contractors as additional insured entities, provided that their inclusion aligns with the terms outlined in a contract or agreement. The form specifies that the additional insureds are protected against claims related to bodily injury, property damage, or personal and advertising injury that may arise from the actions or omissions of the primary insured or their representatives during ongoing operations at designated locations. However, it is important to note that the coverage is limited to what is legally permissible and cannot exceed the scope outlined in any contractual obligations. Furthermore, the endorsement introduces specific exclusions, stating that coverage does not apply if the injury or damage occurs after the completion of work or if the work has been put to its intended use by someone other than another contractor involved in the project. Additionally, the limits of insurance for these additional insureds are clearly defined, ensuring that the maximum payout aligns with either the contractual requirements or the policy limits, whichever is lower. This comprehensive approach underscores the necessity for careful consideration of the terms and conditions set forth in the CG 20 10 07 04 form when managing liability risks in commercial operations.

More PDF Templates

Lease Agreement Florida Template - Tenant rights regarding early termination due to military duty are protected.

In the context of transferring vehicle or vessel ownership, it's important to be aware of available resources, including the All California Forms, which provide essential documents to facilitate this process, including the necessary regulations and requirements detailed in the California Form REG 262.

Affidavit of Support Form I-134 - Non-citizens can file the I-134 to invite friends or relatives to the U.S.

Documents used along the form

When dealing with the CG 20 10 07 04 Liability Endorsement form, several other documents may be essential to ensure comprehensive coverage and compliance. Each of these forms plays a unique role in the insurance landscape, particularly in commercial general liability contexts. Below is a list of related documents that are commonly used alongside this endorsement.

- Commercial General Liability Insurance Policy (CGL): This foundational document outlines the terms, conditions, and coverage limits of the general liability insurance. It provides the primary framework for what is covered and under what circumstances.

- Certificate of Insurance: Often requested by clients or partners, this document serves as proof that an entity has the necessary insurance coverage. It summarizes key policy details and can be crucial for contract compliance.

- Additional Insured Endorsement: Similar to the CG 20 10 07 04, this endorsement specifically adds additional parties to the insurance policy. It clarifies the extent of coverage for those additional insureds, often required in contracts.

- Contractual Agreement: This legal document outlines the terms between parties involved in a project. It often specifies insurance requirements, including the need for additional insured status, which ties back to the CG 20 10 07 04 form.

- Durable Power of Attorney Form - This important legal document empowers a trusted individual to manage your financial decisions during periods of incapacity, so consider the comprehensive Durable Power of Attorney form options for your peace of mind.

- Waiver of Subrogation: This document prevents the insurer from seeking recovery from a third party after a claim has been paid. It is often included in contracts to protect the interests of all parties involved.

- Indemnity Agreement: This agreement outlines the obligations of one party to compensate another for certain damages or losses. It is often linked to liability concerns and can affect insurance coverage needs.

- Claims Reporting Form: This form is used to formally report any incidents that may lead to a claim. Timely reporting is crucial for ensuring that coverage is upheld and claims are processed efficiently.

Understanding these documents can help ensure that your insurance coverage is adequate and compliant with contractual obligations. Each form serves a distinct purpose, and together, they create a robust framework for managing liability and risk in commercial operations.

Form Breakdown

| Fact Name | Fact Description |

|---|---|

| Policy Number | This endorsement is identified by the policy number CG 20 10 12 19. |

| Purpose | The endorsement adds additional insured status for owners, lessees, or contractors. |

| Coverage Part | It modifies the insurance provided under the Commercial General Liability Coverage Part. |

| Additional Insured | Additional insureds are specified in a schedule and are covered for specific liabilities. |

| Liability Types | Covers bodily injury, property damage, or personal and advertising injury. |

| Conditions | Coverage applies only if the injury or damage is caused by your acts or omissions. |

| Exclusions | Excludes coverage for injuries or damages occurring after project work is completed. |

| Limits of Insurance | The maximum payment for additional insureds is limited to contract requirements or policy limits. |

| Governing Law | State-specific forms may be governed by local insurance laws; check your state's regulations. |

More About Cg 20 10 07 04 Liability Endorsement

What is the purpose of the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement form is designed to extend liability coverage to additional insured parties, such as owners, lessees, or contractors. This means that if a claim arises from your actions or those acting on your behalf during your operations for these additional insureds, they will be covered under your general liability insurance policy.

Who qualifies as an additional insured under this endorsement?

The additional insureds are specified in a schedule attached to the endorsement. These may include individuals or organizations that you are contractually obligated to add as additional insureds. The coverage is limited to liability arising from your acts or omissions while performing operations for them at designated locations.

What types of injuries or damages are covered?

This endorsement covers claims related to bodily injury, property damage, or personal and advertising injury. However, the coverage only applies if the injury or damage is caused, in whole or in part, by your actions or those of your representatives during the performance of your ongoing operations.

Are there any exclusions to the coverage provided?

Yes, there are specific exclusions. Coverage does not apply to bodily injury or property damage occurring after all work on the project has been completed or after the work has been put to its intended use by someone other than another contractor or subcontractor engaged in the same project.

How does this endorsement affect the limits of insurance?

The endorsement does not increase your policy's limits of insurance. If coverage for the additional insured is required by a contract, the maximum amount payable will be the lesser of the amount required by that contract or the available limits of your insurance policy.

What should I do if I need to add an additional insured?

If you need to add an additional insured, ensure that their name and the relevant operations are included in the schedule attached to the endorsement. It is essential to review any contracts or agreements to determine the specific requirements for coverage and to ensure compliance.

Is this endorsement standard across all insurance policies?

No, while the CG 20 10 07 04 form is a common endorsement, the specifics can vary by insurance provider and policy. Always review your policy documents and consult with your insurance agent to understand the exact terms and conditions applicable to your coverage.

Cg 20 10 07 04 Liability Endorsement: Usage Steps

Filling out the CG 20 10 07 04 Liability Endorsement form requires careful attention to detail. This form is essential for adding additional insured parties to a commercial general liability policy. Completing it accurately ensures that all necessary parties are covered under the specified conditions. The following steps will guide you through the process of filling out the form.

- Locate the Policy Number: At the top of the form, find the section labeled "POLICY NUMBER." Enter the relevant policy number associated with your commercial general liability coverage.

- Identify the Additional Insured: In the section labeled "Name Of Additional Insured Person(s) Or Organization(s)," write the names of the individuals or organizations you wish to add as additional insureds.

- Specify Locations: In the "Location(s) Of Covered Operations" section, provide the addresses or descriptions of the locations where the covered operations will take place.

- Review Declarations: If any additional information required to complete the schedule is not shown above, check the Declarations page of your policy for this information.

- Check Legal Compliance: Ensure that the coverage provided to the additional insureds aligns with any contracts or agreements you have in place. This includes confirming that the coverage does not exceed what is required by those documents.

- Understand Exclusions: Familiarize yourself with the exclusions mentioned in the form. This includes understanding the conditions under which coverage may not apply, such as after project completion or intended use of the work.

- Limits of Insurance: Be aware that the limits of insurance for the additional insureds cannot exceed the amounts required by any contract or the available limits of your policy.

- Sign and Date: Finally, ensure that the form is signed and dated as required, confirming the accuracy of the information provided.