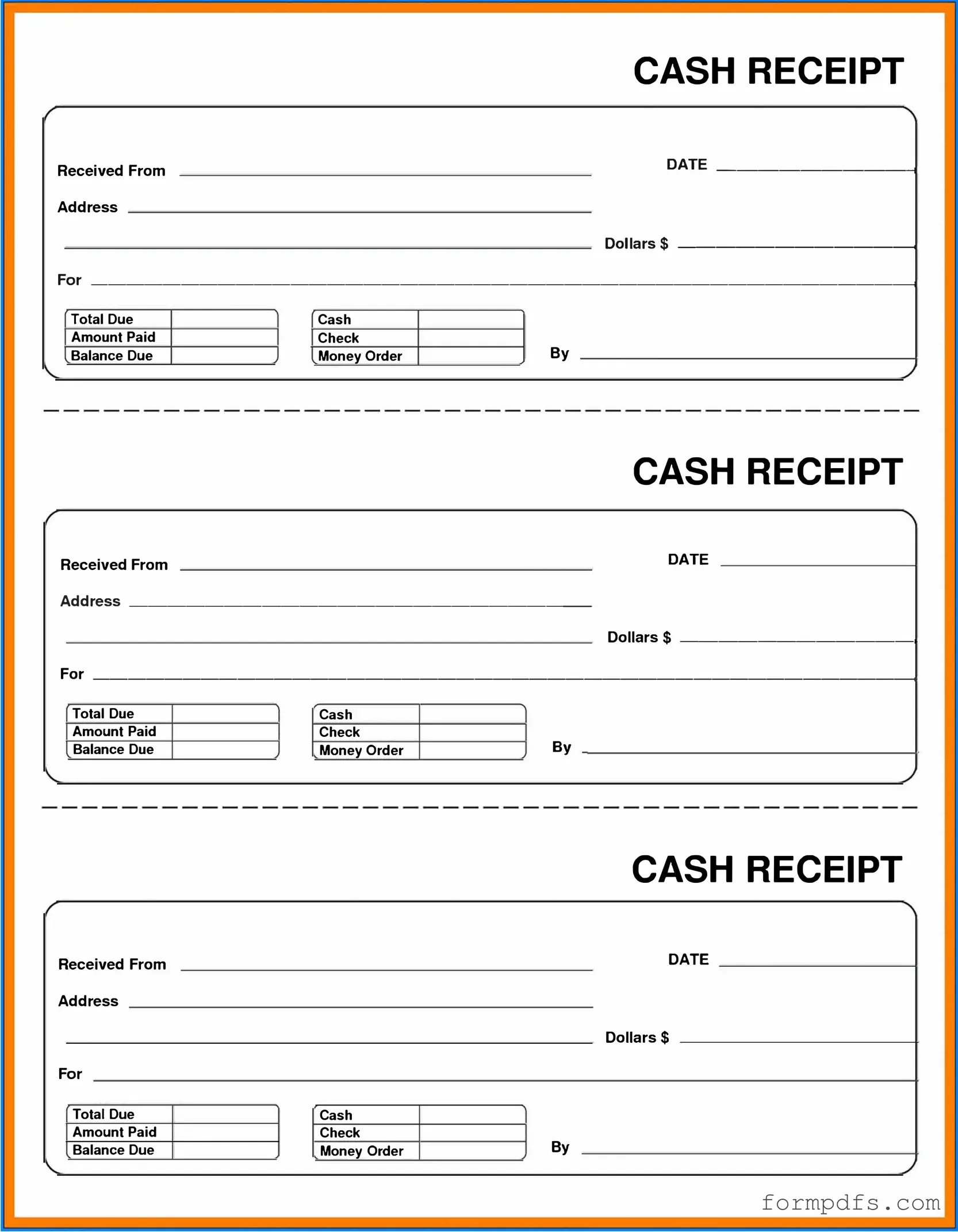

Blank Cash Receipt PDF Form

The Cash Receipt form is an essential document in financial transactions, serving as a formal acknowledgment of payments received. It plays a critical role in maintaining accurate records for both businesses and customers. This form typically includes key details such as the date of the transaction, the amount received, the method of payment, and the name of the individual or entity making the payment. Additionally, it may feature a unique receipt number for tracking purposes, which helps in organizing and retrieving records when needed. By providing a clear breakdown of the transaction, the Cash Receipt form helps prevent disputes and ensures transparency in financial dealings. Its importance extends beyond mere record-keeping; it also aids in budgeting and financial planning, making it a vital tool for effective cash management.

More PDF Templates

Progressive Logo Transparent - The make and model help identify your vehicle.

The California LLC-1 form is necessary for entrepreneurs aiming to set up a business entity in the state, and understanding this process can be simplified with resources like All California Forms, which provide comprehensive guidance on the paperwork needed and the statutory requirements involved.

Change of Rater Ncoer - The educational and training background of the rated NCO is documented in the form.

Form 589 - Your asylum claim must be articulated clearly on the I-589.

Documents used along the form

The Cash Receipt form is an essential document for recording cash transactions. However, it is often used in conjunction with several other forms and documents to ensure accurate financial tracking and compliance. Below is a list of related documents that are commonly utilized alongside the Cash Receipt form.

- Invoice: An invoice details the goods or services provided to a customer, including pricing and payment terms. It serves as a request for payment and helps track what is owed.

- Payment Voucher: This document authorizes the payment to be made. It typically includes details about the transaction, such as the amount and purpose, and is used for internal approval processes.

- Deposit Slip: A deposit slip is used when cash or checks are deposited into a bank account. It provides a record of the transaction and is often required by banks for processing deposits.

- Receipt Acknowledgment: This document confirms that a customer has received a receipt for their payment. It can be important for record-keeping and customer relations.

- Transaction Log: A transaction log is a comprehensive record of all cash transactions. It helps in tracking cash flow and reconciling accounts at the end of a reporting period.

- Dirt Bike Bill of Sale: This document serves as proof of purchase and ownership transfer for dirt bikes in New York State, providing legal protection to both buyers and sellers. For more information, visit smarttemplates.net/fillable-new-york-dirt-bike-bill-of-sale.

- Credit Memo: A credit memo is issued to customers when a refund or credit is applied to their account. It adjusts the amount owed and serves as a formal record of the transaction.

- Expense Report: This document details business expenses incurred by employees. It is used for reimbursement purposes and helps maintain accurate financial records.

- Bank Reconciliation Statement: This statement compares the cash balance on the company’s books to the bank’s records. It helps identify discrepancies and ensures that all transactions are accounted for.

Using these documents in conjunction with the Cash Receipt form can streamline financial processes and enhance record-keeping accuracy. Each plays a vital role in ensuring that transactions are properly documented and that financial reporting remains transparent and reliable.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form serves as a record of cash transactions, documenting the receipt of cash payments from customers or clients. |

| Components | This form typically includes fields for the date, amount received, payer's information, and a description of the transaction. |

| Record Keeping | Organizations must retain Cash Receipt forms for accounting purposes, ensuring accurate financial records and compliance with tax laws. |

| State-Specific Forms | Some states may have specific requirements for Cash Receipt forms, governed by local accounting regulations or tax laws. |

| Legal Compliance | Using a Cash Receipt form helps organizations comply with financial regulations, providing a clear audit trail for cash transactions. |

| Electronic Versions | Many businesses now utilize electronic Cash Receipt forms, which can streamline the process and improve record accuracy. |

| Internal Controls | Implementing a standardized Cash Receipt form can enhance internal controls, reducing the risk of theft or misappropriation of funds. |

| Training | Employees involved in handling cash should receive training on properly completing and managing Cash Receipt forms to ensure accuracy and compliance. |

More About Cash Receipt

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof of payment for both the payer and the recipient. This form typically includes details such as the date of the transaction, the amount received, the purpose of the payment, and the names of both parties involved. It helps maintain clear financial records for businesses and individuals alike.

When should I use a Cash Receipt form?

You should use a Cash Receipt form whenever you receive cash payments. This could be for services rendered, sales transactions, or any other situation where cash changes hands. Using this form ensures that you have a reliable record of the transaction, which can be helpful for accounting and tax purposes.

How do I fill out a Cash Receipt form?

Filling out a Cash Receipt form is straightforward. Start by entering the date of the transaction. Next, write the name of the person or business making the payment. Then, specify the amount received and describe the reason for the payment. Finally, both parties should sign the form to acknowledge the transaction. Keep a copy for your records.

Can I create my own Cash Receipt form?

Yes, you can create your own Cash Receipt form. Just ensure it includes all the necessary details, such as the date, payer's name, amount, purpose, and signatures. Many templates are available online if you prefer to use a pre-made version. Customizing a form can also help meet your specific needs.

Is a Cash Receipt form legally binding?

A Cash Receipt form is generally considered a legal document. It serves as evidence of a transaction and can be used in disputes if necessary. However, the enforceability may depend on the completeness of the information provided and the context of the transaction. Always keep accurate records to support your claims.

What should I do with the Cash Receipt form after it’s filled out?

After filling out the Cash Receipt form, both parties should keep a copy for their records. This helps maintain accurate financial documentation. Store the forms in a safe place, as they may be needed for future reference, tax filings, or in case of any disputes related to the transaction.

Cash Receipt: Usage Steps

Once you have the Cash Receipt form in front of you, it’s time to fill it out accurately. This form will help you keep track of the cash transactions you are processing. Follow these steps to ensure everything is completed correctly.

- Start with the date: Write the current date at the top of the form. This is important for record-keeping.

- Enter the receipt number: Fill in the unique receipt number assigned to this transaction.

- Provide the payer's information: Write the name and address of the person or organization making the payment.

- Specify the amount: Clearly write the total amount of cash received. Make sure to double-check the figures.

- Detail the purpose: Describe what the payment is for. This could be for services rendered, a product sold, or any other reason.

- Sign the form: The person receiving the cash should sign the form to acknowledge receipt.

- Keep a copy: Make a photocopy or take a picture of the completed form for your records.

After filling out the form, make sure to store it in a safe place along with any related documents. This will help you maintain organized records for future reference.