Blank Cash Drawer Count Sheet PDF Form

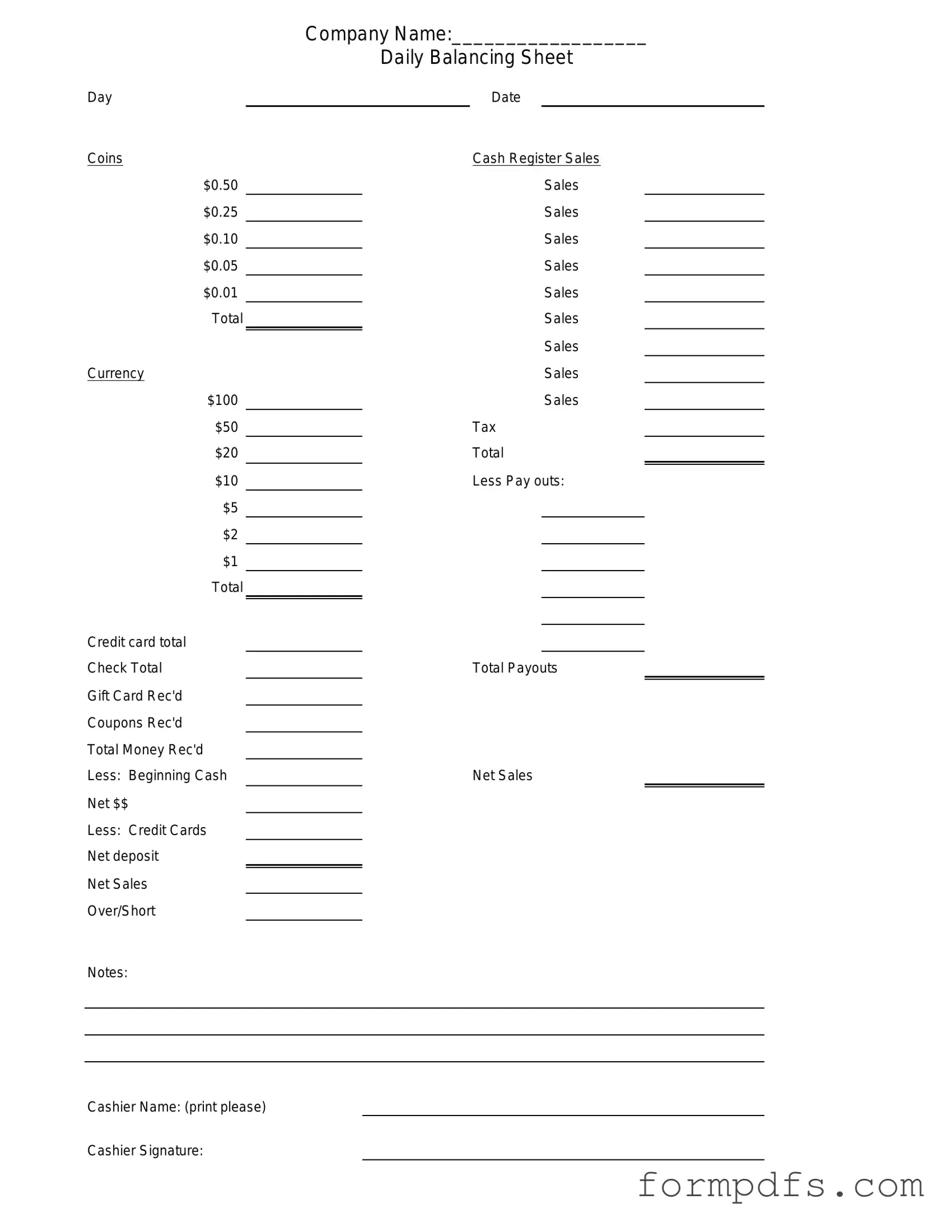

The Cash Drawer Count Sheet form serves as an essential tool for businesses that manage cash transactions, particularly in retail environments. This straightforward yet vital document helps track the amount of cash present in a cash drawer at the beginning and end of a shift or business day. By systematically recording the denominations of bills and coins, the form not only aids in maintaining accurate financial records but also assists in identifying discrepancies that may arise during cash handling. Additionally, it can serve as a valuable reference for auditing purposes, ensuring that employees adhere to cash management protocols. The form typically includes sections for noting the date, the employee's name, and the total cash counted, allowing for easy organization and review. With its user-friendly layout, the Cash Drawer Count Sheet empowers businesses to streamline their cash handling processes, promoting accountability and transparency in financial operations.

More PDF Templates

Excel Bar Chart - Collect industry trends impacting the project.

For those looking to establish their business in California, understanding the requirements for creating your Articles of Incorporation document is essential. This foundational form serves as a pathway to formal registration and offers vital details about your corporation’s structure and purpose. For more information, you can visit the guide on preparing Articles of Incorporation.

Purpose of Nda - This agreement ensures that all parties benefit from introductions that lead to business transactions.

Affidavit of Support Form I-134 - Potential sponsors should assess their own finances before applying.

Documents used along the form

The Cash Drawer Count Sheet form is an essential document used to track the cash in a register at the end of a shift or business day. It helps ensure accountability and accuracy in cash handling. Alongside this form, several other documents are often utilized to maintain financial records and support cash management processes. Below is a list of these related forms and documents.

- Daily Sales Report: This document summarizes the total sales for a specific period, detailing cash, credit, and other payment methods. It provides a comprehensive view of daily revenue.

- Cash Register Tape: A printed record from the cash register that shows individual transactions. This tape serves as a chronological log of sales and can be cross-referenced with the Cash Drawer Count Sheet.

- Deposit Slip: Used to document the amount of cash and checks being deposited into a bank account. It includes details such as the date, amount, and account number.

- Dirt Bike Bill of Sale: A vital document for buyers and sellers in New York, ensuring legal protection during the transaction process. For more information, visit https://smarttemplates.net/fillable-new-york-dirt-bike-bill-of-sale.

- Expense Report: This form tracks business expenses incurred during a specific period. It is important for reconciling cash flow and ensuring accurate financial reporting.

- Cash Handling Policy: A written guideline outlining procedures for cash management, including cash drawer handling, deposits, and security measures. This policy helps mitigate risks related to cash handling.

- Reconciliation Report: A document that compares cash on hand with sales records and bank deposits. It identifies discrepancies and ensures that all cash transactions are accounted for.

- Petty Cash Log: This log tracks small cash expenditures made for minor business expenses. It helps in managing and reconciling the petty cash fund.

- Inventory Count Sheet: Used to record the quantity of products on hand. This document can be important for understanding the relationship between cash flow and inventory levels.

These documents collectively support effective cash management and financial oversight. Maintaining accurate records across these forms is crucial for the integrity of financial operations within a business.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to document the cash on hand at the beginning and end of a business day. |

| Importance | This form helps in maintaining accurate financial records and ensures accountability for cash transactions. |

| Components | Typically includes fields for date, starting cash amount, cash sales, cash paid out, and ending cash amount. |

| Frequency of Use | It is commonly filled out daily, especially in retail and hospitality businesses. |

| Accuracy | Accurate completion of this sheet is crucial to prevent discrepancies in cash handling. |

| Signature Requirement | Often, a manager or supervisor must sign the form to verify the count and the information provided. |

| Record Keeping | Businesses should keep these forms for a specified period, usually for tax and auditing purposes. |

| State-Specific Regulations | Some states may have specific requirements regarding cash handling and documentation; check local laws. |

| Template Availability | Many businesses use templates for the Cash Drawer Count Sheet to ensure consistency and ease of use. |

| Software Integration | Some point-of-sale systems integrate cash drawer counting features, reducing the need for manual forms. |

More About Cash Drawer Count Sheet

What is a Cash Drawer Count Sheet?

A Cash Drawer Count Sheet is a document used by businesses to record the amount of cash in a cash drawer at the end of a shift or business day. This sheet helps ensure accountability and accuracy in cash handling, making it easier to identify discrepancies or losses.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for maintaining accurate financial records. It helps track cash flow and ensures that the amount of cash in the drawer matches the sales recorded. This practice can prevent theft and errors, promoting better financial management.

How do I fill out a Cash Drawer Count Sheet?

To fill out a Cash Drawer Count Sheet, start by entering the date and the name of the person responsible for the cash drawer. Then, count the cash in the drawer, including bills and coins. Record each denomination separately, and calculate the total cash amount. Finally, sign and date the form to confirm the count.

What should I do if the cash counted does not match the expected amount?

If the cash counted does not match the expected amount, investigate the discrepancy. Review transaction records for the day, check for any errors in counting, and ensure that all sales have been recorded. Document any findings on the Cash Drawer Count Sheet and report the issue to a supervisor.

How often should I complete a Cash Drawer Count Sheet?

It is best practice to complete a Cash Drawer Count Sheet at the end of each shift or business day. This regularity helps maintain accurate records and allows for timely identification of any issues related to cash handling.

Can I use a digital version of the Cash Drawer Count Sheet?

Yes, many businesses choose to use digital versions of the Cash Drawer Count Sheet. Digital forms can streamline the counting process, reduce paperwork, and make it easier to store and access records. Ensure that the digital version captures all necessary information for accountability.

Who should have access to the Cash Drawer Count Sheet?

Access to the Cash Drawer Count Sheet should be limited to authorized personnel, such as managers and cashiers. This restriction helps maintain security and ensures that only trained individuals handle cash and financial records.

Cash Drawer Count Sheet: Usage Steps

After gathering your cash drawer and ensuring you have all necessary materials, it’s time to fill out the Cash Drawer Count Sheet. This form will help you accurately record the cash amounts and ensure accountability. Follow these steps carefully to complete the form correctly.

- Start with the date at the top of the form. Write the current date clearly.

- Locate the section for the cashier's name. Enter your full name as it appears on your identification.

- Find the area designated for the starting cash amount. Write down the total cash you began with in the drawer.

- Count the cash in the drawer. This includes all bills and coins. Make sure to count each denomination separately.

- Record the amount for each denomination in the corresponding section of the form.

- Add up the total cash counted. Write this total in the designated "Total Cash" box.

- Double-check your calculations for accuracy. If everything matches, proceed to the next step.

- Sign and date the form at the bottom to confirm that the count is accurate.

Once you have completed the Cash Drawer Count Sheet, submit it to your supervisor or the designated person for review. Ensure that you keep a copy for your records, as this will be important for future reference.