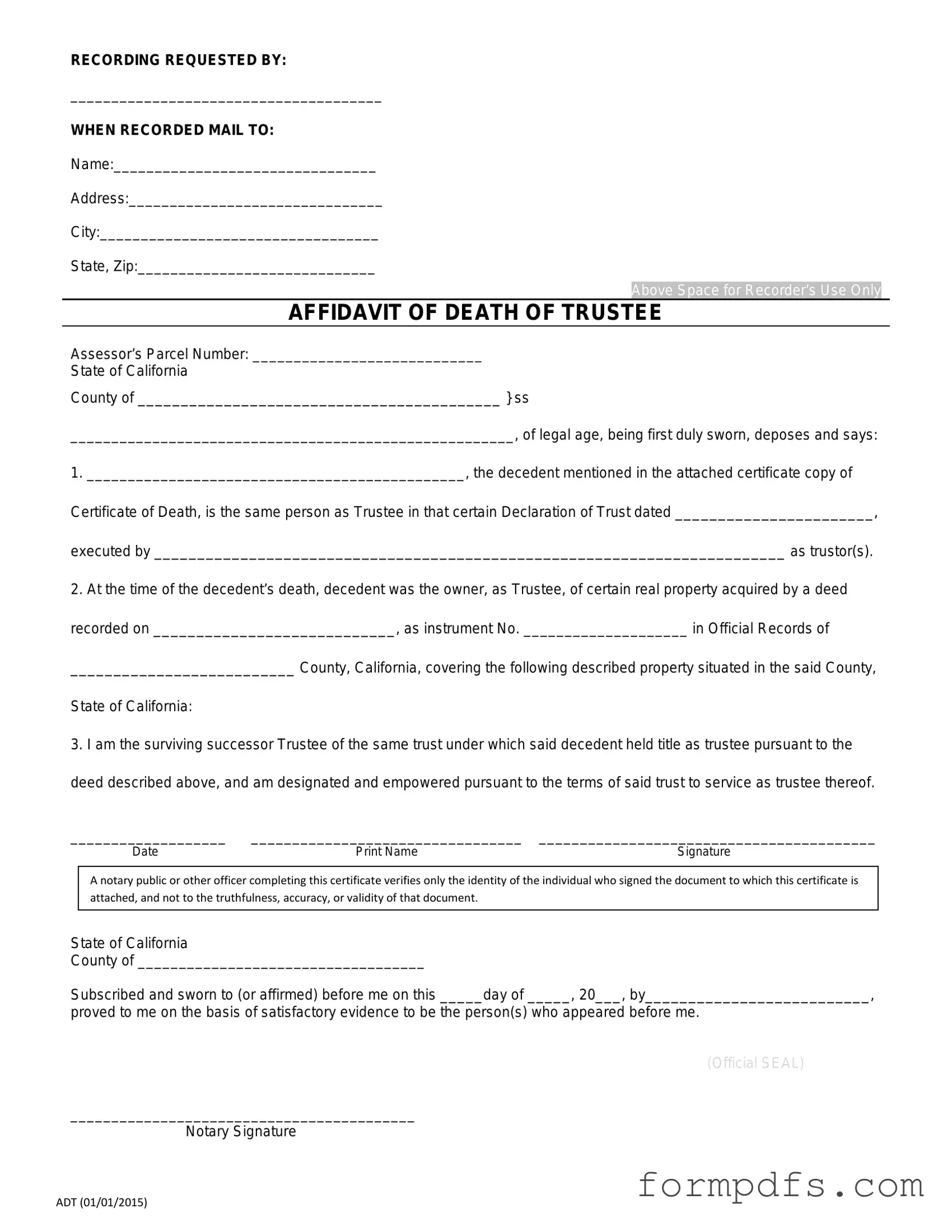

Blank California Affidavit of Death of a Trustee PDF Form

The California Affidavit of Death of a Trustee form serves as an essential legal document in the context of trust administration. When a trustee passes away, this form is utilized to formally acknowledge their death and facilitate the transition of responsibilities to successor trustees. It provides a clear record of the trustee's demise, which is crucial for the proper management of the trust's assets. By completing this affidavit, the successor trustee can demonstrate their authority to act on behalf of the trust, ensuring that the trust's terms are honored and that beneficiaries receive their rightful entitlements. Additionally, the form typically requires relevant information, such as the deceased trustee's name, date of death, and details about the trust itself. Filing this affidavit with the appropriate county recorder’s office helps to publicize the change in trusteeship, protecting the interests of all parties involved. Understanding the importance of this form can help ensure a smooth transition and preserve the integrity of the trust administration process.

More PDF Templates

Sports Physical Form Printable - The form provides a comprehensive look at the student’s health before sports commence.

The process of submitting the California Homeschool Letter of Intent form is essential for parents who wish to take charge of their child's education at home. This form not only serves to notify local school districts of their decision but also plays a vital role in adhering to state regulations. By completing and submitting this document, parents can ensure that they are on the right path towards establishing an effective learning environment. For those interested in more resources, they can refer to All California Forms to access a variety of necessary documentation related to homeschooling.

4506 T - It emphasizes the importance of maintaining accurate records for financial health.

Medication Administration Record Pdf Fillable - Additional notes may be added regarding any special instructions related to medication administration.

Documents used along the form

The California Affidavit of Death of a Trustee form is an important document used to establish the death of a trustee in a trust. This form is often accompanied by other documents that help clarify the legal status of the trust and facilitate the transition of responsibilities. Below is a list of other forms and documents commonly used in conjunction with the Affidavit of Death of a Trustee.

- Trust Document: This is the original trust agreement that outlines the terms and conditions under which the trust operates. It specifies the roles and responsibilities of the trustees and beneficiaries.

- Death Certificate: A certified copy of the deceased trustee's death certificate is usually required. This document serves as official proof of the trustee's death and may be needed for various legal processes.

- Notice to Beneficiaries: This document informs the beneficiaries of the trust about the death of the trustee and may outline the next steps in the administration of the trust. It ensures that all interested parties are kept informed.

- Certificate of Trust: This document provides a summary of the trust's existence and its terms without disclosing all the details contained in the trust document. It can be used to verify the trust's legitimacy when dealing with third parties.

- Trustee Resignation Letter: If applicable, this letter formally documents the resignation of the deceased trustee and may need to be submitted to the court or other relevant parties involved in the trust administration.

- New Trustee Appointment Document: This document is used to appoint a new trustee to replace the deceased. It outlines the authority granted to the new trustee and may require signatures from the beneficiaries.

- Motor Vehicle Bill of Sale: This document is essential for the official recording of the sale and transfer of a vehicle, providing verification of the transaction and ownership change. For more details, visit smarttemplates.net/fillable-motor-vehicle-bill-of-sale/.

- Inventory of Trust Assets: A detailed list of the assets held within the trust. This inventory is essential for the new trustee to understand the trust's holdings and responsibilities.

Each of these documents plays a vital role in ensuring that the trust administration process proceeds smoothly after the death of a trustee. It is important for all parties involved to understand their roles and responsibilities as they navigate this transition.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The California Affidavit of Death of a Trustee is used to confirm the death of a trustee and to facilitate the transfer of trust assets to the remaining trustees or beneficiaries. |

| Governing Law | This form is governed by the California Probate Code, specifically sections related to trusts and estates. |

| Who Can File | The affidavit can be filed by any successor trustee or beneficiary of the trust after the death of the original trustee. |

| Required Information | Essential details include the name of the deceased trustee, the date of death, and the name of the trust. |

| Notarization | The affidavit must be signed under penalty of perjury and is typically notarized to ensure authenticity. |

| Effect on Trust | Filing this affidavit helps to clarify the trust’s administration and allows remaining trustees to manage or distribute trust assets accordingly. |

More About California Affidavit of Death of a Trustee

What is the California Affidavit of Death of a Trustee form?

The California Affidavit of Death of a Trustee form is a legal document used to formally declare the death of a trustee of a trust. This affidavit serves to notify beneficiaries and other interested parties about the trustee's passing and helps facilitate the transfer of responsibilities and assets according to the terms of the trust. It is an important step in ensuring that the trust is administered correctly after the trustee's death.

Who can file the Affidavit of Death of a Trustee?

The affidavit can be filed by any individual who has a vested interest in the trust, typically a successor trustee or a beneficiary. It is essential that the person filing the affidavit has the authority to act on behalf of the trust and is aware of the necessary details surrounding the deceased trustee's death.

What information is required to complete the affidavit?

To complete the affidavit, you will need to provide the full name of the deceased trustee, the date of their death, and details about the trust, including its name and date of establishment. Additionally, you may need to include information about the successor trustee, if applicable. Documentation such as a death certificate may also be required to validate the claim.

Is a death certificate necessary for the affidavit?

While a death certificate is not always required to file the affidavit, it is highly recommended. Including a copy of the death certificate can help substantiate the claim and provide clarity to all parties involved. Some institutions may specifically request it before recognizing the changes in trustee status.

Where should the Affidavit of Death of a Trustee be filed?

The affidavit should be filed in the county where the trust is administered or where the deceased trustee resided at the time of their death. It is advisable to check with local county offices to ensure compliance with specific filing requirements and to understand any additional steps that may be necessary.

What happens after the affidavit is filed?

Once the affidavit is filed, it serves as official notice of the trustee's death. The successor trustee can then assume their responsibilities and manage the trust assets according to the trust's terms. Beneficiaries will also be informed of the change in trustee status, allowing for a smooth transition in trust administration.

Are there any deadlines for filing the affidavit?

There is no specific deadline for filing the Affidavit of Death of a Trustee; however, it is advisable to file it as soon as possible after the trustee's death. Prompt action helps to avoid potential complications and ensures that the trust can continue to operate smoothly without unnecessary delays.

What if there are disputes regarding the trustee's death or the trust?

If there are disputes regarding the trustee's death or the terms of the trust, it may be necessary to seek legal counsel. Disagreements can arise among beneficiaries or between the successor trustee and beneficiaries. Resolving these issues swiftly is crucial to prevent further complications in trust administration.

Can the affidavit be amended after it is filed?

Yes, the affidavit can be amended if new information comes to light or if there was an error in the original filing. It is important to follow the proper procedures for amending legal documents to ensure that all parties are informed and that the trust administration remains valid and enforceable.

California Affidavit of Death of a Trustee: Usage Steps

Once you have gathered the necessary information, you will be ready to complete the California Affidavit of Death of a Trustee form. This document serves to formally notify interested parties of the trustee's passing and is crucial for the administration of the trust. Following these steps will help ensure that you fill out the form correctly.

- Obtain the California Affidavit of Death of a Trustee form. This can be found online or at a local courthouse.

- Begin by entering the name of the deceased trustee in the designated space at the top of the form.

- Provide the date of death of the trustee. Ensure this is accurate, as it is a critical piece of information.

- Fill in the name of the trust that the deceased trustee was managing.

- Include the date the trust was created. This information can typically be found in the trust document.

- List the names and addresses of the current trustees, if any, who will be taking over the responsibilities.

- Sign the form in the presence of a notary public. This step is essential to validate the affidavit.

- Make copies of the completed form for your records and for any interested parties who may require it.

- File the original affidavit with the appropriate court or office as required by local regulations.

After submitting the form, keep an eye on any correspondence from the court or other relevant parties. They may require additional information or documentation as part of the trust administration process.