Blank Business Credit Application PDF Form

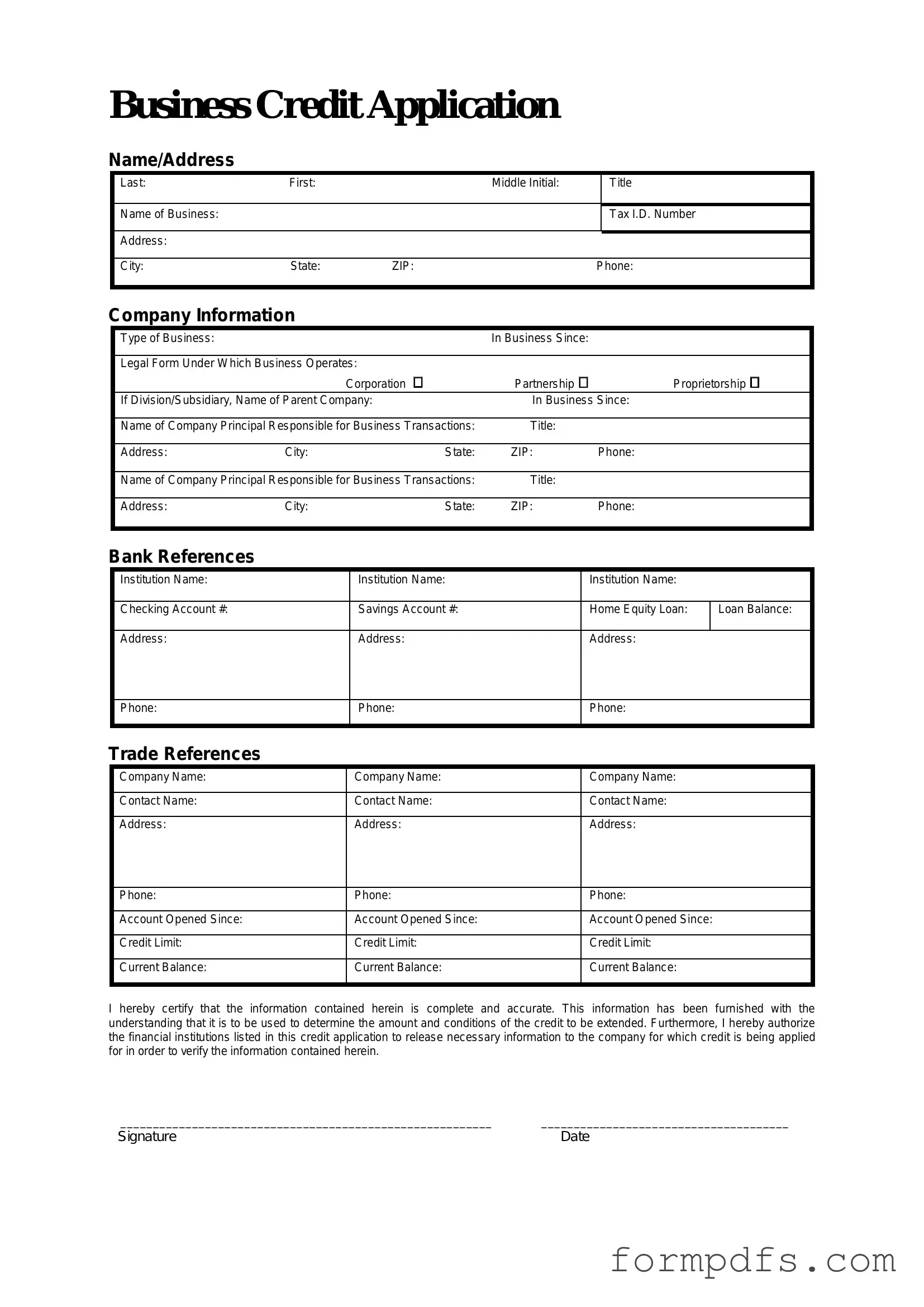

When seeking credit for your business, completing a Business Credit Application form is a crucial step. This form typically requests essential information about your business, including its legal structure, ownership details, and financial history. You will need to provide contact information, such as the business address and phone number, as well as details about your business's banking relationships. Additionally, the form may require you to disclose your business's annual revenue and the length of time it has been operating. By gathering this information, lenders can assess your creditworthiness and determine the terms of any potential credit. Completing the application accurately and thoroughly is vital, as it can significantly influence the lender's decision. Understanding each section of the form will help you present your business in the best possible light, ensuring that you have the best chance of obtaining the credit you need to grow and succeed.

More PDF Templates

Soccer Evaluation Form - Acts as a natural leader with strong communication skills.

When selling a vehicle, it is crucial to provide a clear record of the transaction, which can be accomplished using a Bill of Sale. This document not only serves as proof of purchase but also includes essential details such as the item description and sale price. For those looking to simplify this process, utilizing a templates can be very helpful, such as the Vehicle Sale Receipt, which ensures all necessary information is accurately captured.

Where to Fax Form 433-d - The form collects data on your income, expenses, and assets.

Documents used along the form

When applying for business credit, several documents may accompany the Business Credit Application form. Each document serves a specific purpose and helps lenders assess the creditworthiness of your business. Below is a list of commonly used forms and documents that can support your application.

- Business Plan: This document outlines your business goals, strategies, and financial projections. It provides lenders with insight into your operational plans and market understanding.

- Financial Statements: Include your balance sheet, income statement, and cash flow statement. These documents give a clear picture of your business's financial health and performance.

- Tax Returns: Providing personal and business tax returns for the past few years helps verify income and financial stability. Lenders often require these to assess risk.

- Asurion F-017-08 MEN Form: This form is crucial for ensuring efficient assistance with device issues or warranty claims. To complete the form, visit PDF Documents Hub.

- Bank Statements: Recent bank statements reflect your business's cash flow and spending habits. They can help lenders evaluate your ability to repay a loan.

- Ownership Documents: This includes articles of incorporation or partnership agreements. These documents establish the legal structure of your business and identify its owners.

- Personal Guarantee: A personal guarantee may be required, which means you agree to be personally responsible for the debt if the business cannot repay it.

- Credit Report: A copy of your business credit report can provide lenders with information about your credit history and any outstanding debts.

- References: Providing references from suppliers or other lenders can strengthen your application. These references can vouch for your business's reliability and creditworthiness.

Submitting these documents along with your Business Credit Application can enhance your chances of approval. Be sure to check with your lender for any specific requirements they may have.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is designed to gather essential information from businesses seeking credit. It helps lenders assess creditworthiness. |

| Information Required | Typically, applicants need to provide details such as business name, address, tax ID, ownership structure, and financial statements. |

| Governing Laws | In the United States, the Fair Credit Reporting Act (FCRA) governs the use of consumer credit information in business credit applications. |

| Impact on Credit Score | Submitting a Business Credit Application can affect your business credit score. Multiple applications in a short time may raise red flags. |

| State-Specific Forms | Some states may have specific requirements or forms. For example, California requires compliance with the California Consumer Privacy Act (CCPA). |

| Submission Process | Once completed, the application is submitted to the lender, who will review the information and make a decision regarding credit approval. |

More About Business Credit Application

What is the Business Credit Application form?

The Business Credit Application form is a document that businesses fill out to request credit from suppliers or lenders. It collects essential information about your business, such as its legal name, address, financial history, and credit references. This information helps lenders assess your business's creditworthiness before extending credit terms.

Who should fill out the Business Credit Application form?

Any business looking to establish a line of credit with a supplier or lender should complete this form. Whether you're a startup or an established company, providing accurate information is crucial for a smooth credit approval process.

What information do I need to provide?

You will need to provide details like your business name, address, and type of business entity. Additionally, you'll include your tax identification number, financial statements, and references from other creditors. The more complete your application, the easier it is for lenders to evaluate your request.

How long does it take to process the application?

The processing time can vary based on the lender's policies and the completeness of your application. Generally, it can take anywhere from a few days to a couple of weeks. It's a good idea to follow up with the lender if you haven't received a response within that timeframe.

What happens if my application is denied?

If your application is denied, you will usually receive a notification explaining the reasons. Common reasons for denial include insufficient credit history, poor credit scores, or incomplete information. You can often address these issues and reapply after making necessary improvements.

Can I update my application after submission?

Yes, if you realize that you need to update any information after submitting your application, contact the lender as soon as possible. They may allow you to provide the updated information or guide you through the process of resubmitting your application with the correct details.

Business Credit Application: Usage Steps

Completing the Business Credit Application form is an important step in establishing a credit relationship with a lender. Once you have filled out the form, the lender will review your information to assess your business's creditworthiness and determine the terms of credit that may be offered.

- Gather Required Information: Collect all necessary details about your business, including your legal business name, address, and contact information.

- Business Structure: Indicate the type of business entity you operate, such as a sole proprietorship, partnership, or corporation.

- Owner Information: Provide personal information for the business owner(s), including names, addresses, and Social Security numbers.

- Business Financials: Include relevant financial information, such as annual revenue, number of employees, and years in operation.

- Trade References: List at least three trade references, including their contact information and the nature of your business relationship.

- Banking Information: Provide details about your business bank account, including the bank name, account number, and type of account.

- Signature: Sign and date the application to certify that the information provided is accurate and complete.

Once the form is filled out, review it for accuracy before submitting it to the lender. This will help ensure a smooth application process and increase the likelihood of favorable credit terms.