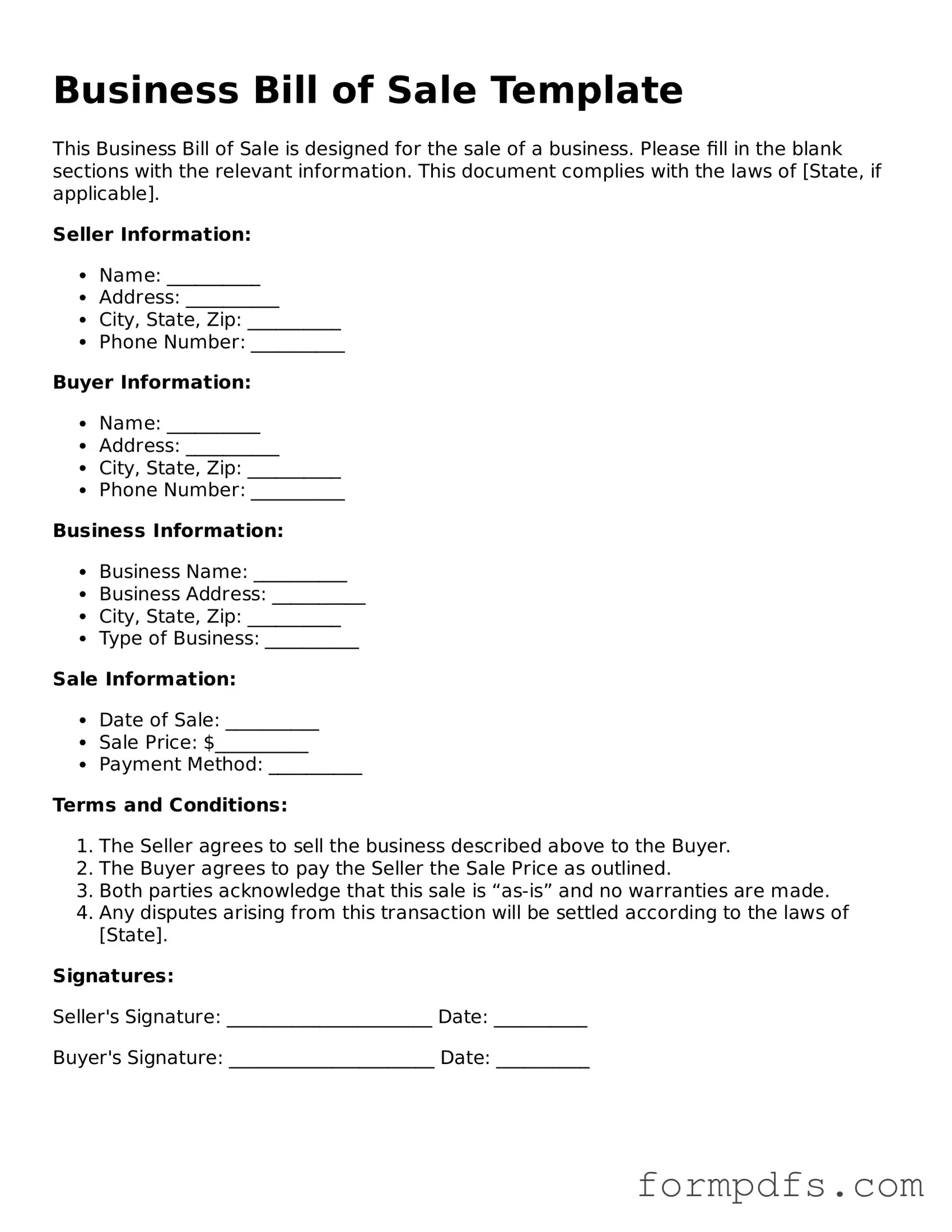

Valid Business Bill of Sale Template

When engaging in the sale of a business, having a clear and comprehensive Business Bill of Sale form is essential for both the buyer and the seller. This document serves as a formal record of the transaction, ensuring that all terms and conditions are agreed upon and legally binding. It typically includes key details such as the names and addresses of both parties, a description of the business being sold, and the sale price. Additionally, it may outline any assets being transferred, such as equipment, inventory, or intellectual property. By detailing these aspects, the form helps protect the interests of both parties and provides a clear framework for the transaction. A well-prepared Business Bill of Sale can also assist in preventing disputes down the line, making it a crucial step in the process of business transfer.

Other Business Bill of Sale Templates:

Furniture Bill - The form may include payment methods used for the transaction.

In addition to establishing ownership, a Trailer Bill of Sale form is essential for providing the necessary documentation that can be referred to during the registration of the trailer. For those looking to draft their own form, resources are available that detail the process and requirements, such as the information found at toptemplates.info/bill-of-sale/trailer-bill-of-sale/.

Documents used along the form

A Business Bill of Sale is an important document when transferring ownership of a business. However, several other forms and documents often accompany it to ensure a smooth transaction. Here’s a brief overview of some of these essential documents.

- Purchase Agreement: This document outlines the terms of the sale, including the purchase price, payment terms, and any conditions that must be met before the sale is finalized.

- Asset List: A detailed inventory of all assets being sold with the business, such as equipment, inventory, and intellectual property. This helps both parties understand what is included in the sale.

- Non-Disclosure Agreement (NDA): This agreement protects sensitive information shared during the sale process. It ensures that both parties keep confidential information private.

- Bill of Sale Form: Essential for documenting the transfer of ownership of a specific item, the Texas Bill of Sale form is crucial for buyers and sellers. For more information, visit All Texas Forms.

- Liabilities Statement: A document that outlines any debts or obligations associated with the business. This is crucial for the buyer to understand what liabilities they may be taking on.

- Tax Clearance Certificate: This certificate verifies that the business has paid all its taxes. It is often required to ensure there are no outstanding tax liabilities that could affect the sale.

- Transfer of Ownership Form: This form officially documents the change in ownership of the business. It may need to be filed with state or local authorities to complete the transfer.

- Employee Agreements: If the business has employees, agreements regarding their employment status and any changes that may occur as a result of the sale should be documented.

Using these documents alongside the Business Bill of Sale can help ensure that the transaction is clear and legally sound. Each document plays a vital role in protecting both the buyer and the seller, leading to a successful business transfer.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | A Business Bill of Sale serves as a legal document that transfers ownership of a business from one party to another. It outlines the terms of the sale and protects both the buyer and seller. |

| Components | This form typically includes details such as the names of the buyer and seller, a description of the business being sold, the sale price, and any warranties or representations made by the seller. |

| State-Specific Laws | Each state may have its own requirements for a Business Bill of Sale. For example, in California, the governing law is the California Commercial Code, while in Texas, it is governed by the Texas Business and Commerce Code. |

| Importance | Having a properly executed Business Bill of Sale is crucial. It provides legal proof of the transaction and can be essential in case of disputes or for tax purposes. |

More About Business Bill of Sale

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. This form provides proof of the transaction and outlines the details of the sale, including the purchase price, the date of the sale, and the identities of the buyer and seller. It helps protect both parties by clearly stating the terms of the agreement.

Why is a Business Bill of Sale important?

This document is important because it serves as a record of the transaction. It can be used for tax purposes, to establish ownership, and to resolve any disputes that may arise after the sale. Additionally, having a written record helps ensure that both parties understand their rights and responsibilities regarding the business or assets being sold.

What information should be included in a Business Bill of Sale?

A Business Bill of Sale should include the names and addresses of both the buyer and seller, a description of the business or assets being sold, the purchase price, and the date of the sale. It may also include any warranties or representations made by the seller, as well as the terms of payment. Including this information helps clarify the agreement and reduces the risk of misunderstandings.

Do I need a lawyer to create a Business Bill of Sale?

While it is not legally required to have a lawyer draft a Business Bill of Sale, consulting one can be beneficial. A lawyer can ensure that the document complies with state laws and adequately protects your interests. If the transaction is complex or involves significant assets, seeking legal advice is a good idea.

Can a Business Bill of Sale be modified after it is signed?

Yes, a Business Bill of Sale can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the amended document. This helps maintain clarity and prevents potential disputes regarding the terms of the sale.

Business Bill of Sale: Usage Steps

Filling out the Business Bill of Sale form is a straightforward process that requires careful attention to detail. Once completed, this form serves as a record of the transaction between the seller and the buyer, ensuring that both parties have a clear understanding of the terms involved. Follow the steps below to fill out the form accurately.

- Obtain the form: Make sure you have the correct Business Bill of Sale form. You can find it online or through your local business resources.

- Provide seller information: Fill in the name, address, and contact information of the seller. Ensure all details are accurate.

- Provide buyer information: Enter the name, address, and contact information of the buyer. Double-check for correctness.

- Describe the business: Clearly describe the business being sold, including its name, location, and any relevant details that define the business.

- Specify the sale price: Indicate the total amount for which the business is being sold. This should be clearly stated to avoid any confusion.

- Include payment terms: Outline how the payment will be made. Will it be a lump sum, or are there installment payments? Specify the timeline for payments.

- Sign and date: Both the seller and buyer must sign and date the form to validate the agreement. Ensure that all signatures are legible.

- Keep copies: After filling out the form, make copies for both the seller and the buyer. This serves as a record of the transaction for both parties.