Blank Broker Price Opinion PDF Form

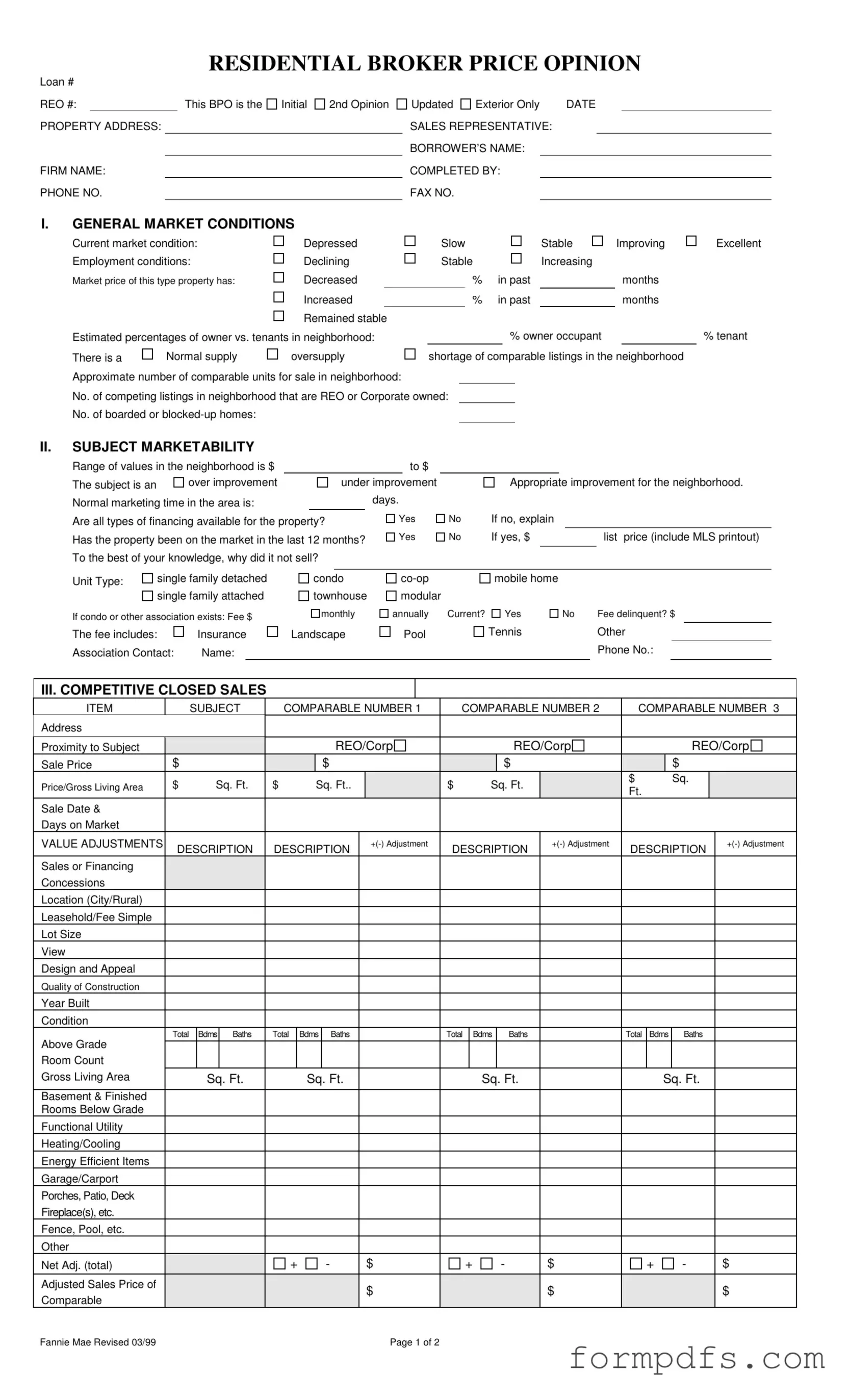

The Broker Price Opinion (BPO) form serves as a vital tool in the real estate industry, particularly for lenders and real estate professionals assessing property values. This comprehensive document provides a structured approach to evaluating a property’s worth by considering various factors, including current market conditions, competitive sales data, and property specifics. It begins with general market conditions, where the analyst notes the state of the local real estate market—whether it is stable, improving, or depressed. Employment conditions and the percentage of owner-occupied versus rental properties in the area are also highlighted, giving a clearer picture of the neighborhood dynamics. The BPO includes a detailed analysis of comparable properties, presenting their sale prices, features, and market performance. By comparing these properties, the form helps establish a range of values for the subject property. Additionally, it addresses potential repairs and marketing strategies, suggesting how to position the property for sale. Finally, the form concludes with a suggested market value, taking into account all analyzed data, and provides space for comments on any unique property considerations. This holistic approach not only aids in determining a fair market price but also guides decision-making for both buyers and sellers.

More PDF Templates

What Do I Need to Get My Car Inspected in Pa - Be ready to upload supporting documents if emailing your packet.

When dealing with the sale of a vehicle, it's important to have the proper documentation to ensure a smooth transaction. A Motor Vehicle Bill of Sale form is essential, as it helps to confirm the sale and protect both parties involved. For those looking to create or access a reliable template, you can visit smarttemplates.net/fillable-motor-vehicle-bill-of-sale for a fillable version that can simplify the process.

Affidavit of Support - Providing accurate information on the I-864 is vital for approval.

Documents used along the form

The Broker Price Opinion (BPO) form is a vital tool in real estate transactions, especially for lenders and investors. It provides an estimated value of a property based on various market factors. Alongside the BPO, several other documents often accompany it to provide a comprehensive view of the property’s value and condition. Here’s a list of some key forms and documents that are frequently used in conjunction with the BPO.

- Comparative Market Analysis (CMA): This report analyzes recent sales of similar properties in the area to determine a competitive market price. It helps sellers and buyers understand the local market dynamics.

- Homeschool Letter of Intent: This form is essential for parents intending to educate their children at home, as it notifies local school districts of their decision. For more information on how to properly complete the form, visit All California Forms.

- Property Inspection Report: This document details the physical condition of the property, including any needed repairs. It is essential for assessing the property’s marketability.

- Appraisal Report: Conducted by a licensed appraiser, this report provides an unbiased estimate of a property's value based on various factors, including location, condition, and recent sales.

- Listing Agreement: This contract outlines the terms between the seller and the real estate agent. It includes details about the listing price, duration, and commission structure.

- Purchase Agreement: This legally binding document outlines the terms of the sale between the buyer and seller, including the purchase price and contingencies.

- Title Report: This report provides information about the property’s ownership history and any liens or encumbrances. It is crucial for ensuring clear ownership transfer.

- Disclosure Statement: Sellers are often required to disclose known issues with the property, such as structural problems or environmental hazards. This document protects both parties in the transaction.

- Repair Estimates: These documents outline the costs associated with necessary repairs identified during inspections. They help buyers and sellers understand potential financial obligations.

- Market Trends Report: This report analyzes broader market trends, including price fluctuations and inventory levels, to provide context for the property’s value.

- Financing Options Document: This outlines available financing options for potential buyers, including loan types and eligibility criteria. It helps buyers understand their purchasing power.

These documents, when used together with the Broker Price Opinion, create a clearer picture of the property’s value and marketability. They assist in making informed decisions for buyers, sellers, and lenders alike.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of BPO | A Broker Price Opinion (BPO) is used to estimate the value of a property, often for lenders or real estate investors. |

| Components of BPO | The BPO includes an analysis of market conditions, property characteristics, and comparable sales data. |

| Market Conditions | Market conditions can be categorized as depressed, stable, or improving, influencing the property's estimated value. |

| Financing Availability | Information regarding the availability of financing options for the property is essential. It can impact buyer interest and marketability. |

| State-Specific Regulations | Each state may have specific laws governing the use of BPOs, including requirements for real estate licensing and disclosure. |

More About Broker Price Opinion

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion is a document that provides an estimate of a property's value, typically prepared by a real estate broker or agent. It assesses the current market conditions, compares similar properties, and evaluates the subject property’s features. BPOs are often used by lenders to determine the value of a property in situations such as foreclosures or short sales.

How is a BPO different from an appraisal?

While both a BPO and an appraisal aim to estimate a property's value, they differ in their purpose and process. An appraisal is a more formal evaluation conducted by a licensed appraiser, often required by lenders for mortgage purposes. A BPO, on the other hand, is typically less formal and quicker to produce. It is based on the broker’s expertise and market knowledge rather than a detailed analysis of the property.

What information is included in a BPO?

A BPO includes various sections that cover general market conditions, the subject property's marketability, competitive closed sales, and competitive listings. It typically details the property's address, condition, and any necessary repairs. Additionally, it compares the subject property to similar properties that have recently sold, providing insights into the local real estate market.

Who typically requests a BPO?

Real estate agents, lenders, and financial institutions commonly request BPOs. They may need this information to make informed decisions regarding the sale or financing of a property. Investors looking to purchase distressed properties may also seek BPOs to understand the potential value and necessary improvements.

How is the value determined in a BPO?

The value in a BPO is determined through a combination of market analysis and comparisons with similar properties. Brokers assess the current market conditions, review recent sales of comparable properties, and consider the unique features of the subject property. Adjustments may be made based on differences in size, condition, and location to arrive at a fair market value.

What factors can affect the accuracy of a BPO?

Several factors can influence the accuracy of a BPO. These include the broker’s experience, the quality of the data used, and the current state of the real estate market. Additionally, if the property has unique characteristics or if there are significant changes in the market since the last comparable sale, these can lead to variations in the estimated value. Therefore, it’s essential for the broker to stay informed about local trends and conditions.

Broker Price Opinion: Usage Steps

Filling out the Broker Price Opinion (BPO) form is an essential step in assessing the value of a property. This process involves collecting various data points about the property and the surrounding market conditions. By following these steps, you can ensure that you complete the form accurately and efficiently.

- Begin by entering the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, and PHONE NO..

- Indicate whether this is an Initial, 2nd Opinion, or Updated BPO, and specify if it's Exterior Only.

- Enter the DATE and the name of the SALES REPRESENTATIVE.

- Provide the BORROWER’S NAME and the name of the person COMPLETED BY.

- Include the FAX NO. for further communication.

- In the GENERAL MARKET CONDITIONS section, assess the current market condition (Depressed, Slow, Stable, Improving) and employment conditions (Declining, Stable, Increasing).

- Indicate the market price changes for the property type in the past months (Decreased, Increased, Remained stable) and provide estimated percentages of owner vs. tenants in the neighborhood.

- Note the supply situation of comparable listings in the neighborhood (Normal, oversupply, shortage) and approximate number of comparable units for sale.

- Fill in the number of competing listings that are REO or Corporate owned, as well as the number of boarded or blocked-up homes.

- In the SUBJECT MARKETABILITY section, provide the range of values in the neighborhood and assess the subject property’s improvement status.

- Specify the normal marketing time in days and whether all types of financing are available for the property.

- If the property has been on the market in the last 12 months, include the list price and reasons for not selling.

- Identify the Unit Type (e.g., single family detached, condo) and provide details about any associated fees.

- In the COMPETITIVE CLOSED SALES section, list comparable properties, their sale prices, and relevant adjustments.

- Complete the MARKETING STRATEGY section by indicating the condition of the property (As-is, Minimal Repairs).

- Document the occupancy status and identify the most likely buyer type.

- Itemize all necessary repairs and check those recommended for successful marketing.

- Calculate the GRAND TOTAL FOR ALL REPAIRS.

- In the COMPETITIVE LISTINGS section, list comparable properties and their respective details.

- Determine the MARKET VALUE based on the competitive closed sales.

- Provide any COMMENTS regarding the property, including positives, negatives, and special concerns.

- Finally, sign and date the form to complete the process.