Blank Auto Insurance Card PDF Form

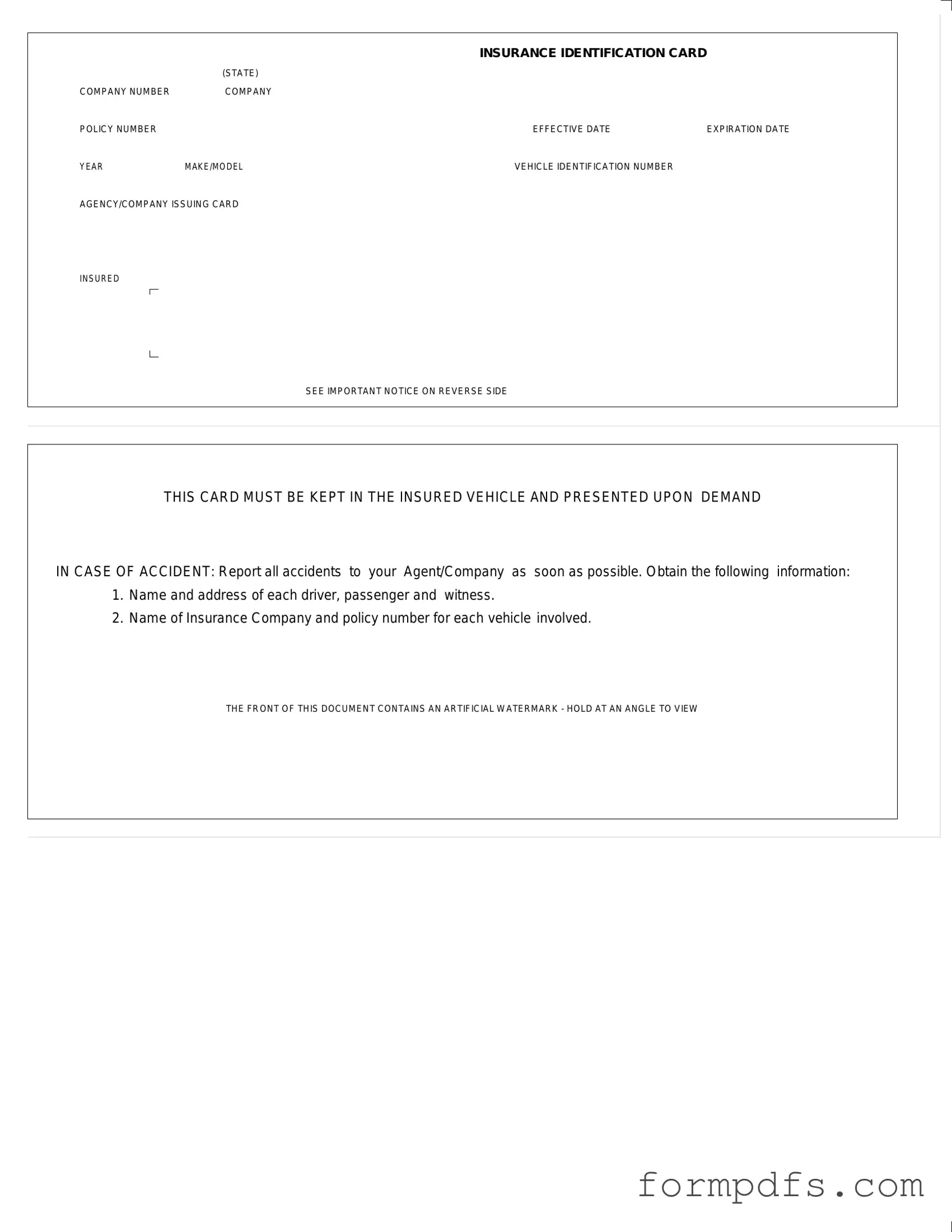

When driving on the roads, having an auto insurance card is not just a good idea; it’s a legal requirement in many states. This essential document serves as proof of insurance and contains vital information that can help in the event of an accident. Typically, the card features the insurance company’s name, policy number, and the effective and expiration dates of the coverage. It also includes details about the vehicle, such as its make, model, and Vehicle Identification Number (VIN). Additionally, the card is issued by the insurance agency and often carries a notice reminding the insured to keep it in the vehicle at all times. In case of an accident, it is crucial to report the incident to the insurance agent as soon as possible and to gather specific information from all parties involved. For example, drivers should note the names and addresses of other drivers, passengers, and witnesses, as well as the insurance details of any other vehicles involved. To ensure authenticity, the front of the card may feature an artificial watermark that can be seen by holding it at an angle. Understanding the importance and contents of the auto insurance card can greatly enhance one’s preparedness on the road.

More PDF Templates

Texas Temporary Tag - The form may be submitted electronically or in person at a county tax office.

In the context of vehicle transactions, having a comprehensive understanding of the necessary paperwork is crucial, particularly the Bill of Sale for Motor Vehicles, which outlines the specifics of the sale, including the vehicle details and the identities of both the seller and buyer. This document not only aids in establishing ownership but also protects the interests of all parties involved.

Hospital Miscarriage Report - Another option indicates the presence of a miscarriage involving fetal products of conception.

Documents used along the form

When it comes to auto insurance, having the right documents on hand is crucial. Along with your Auto Insurance Card, there are several other forms and documents that can be useful. Each one serves a specific purpose and helps ensure you are covered in various situations. Below is a list of common documents you might encounter.

- Policy Declaration Page: This document outlines your coverage details, including limits, deductibles, and the effective dates of your policy. It serves as a summary of your insurance agreement.

- Claims Form: If you need to file a claim, this form is essential. It collects information about the incident and the damages incurred, helping your insurance company process your claim efficiently.

- Proof of Coverage Letter: Sometimes requested by lenders or other parties, this letter confirms that you have active insurance coverage on your vehicle.

- California ATV Bill of Sale Form: When purchasing an All-Terrain Vehicle, it is important to utilize the comprehensive ATV Bill of Sale form to formalize the transaction and transfer ownership legally.

- Vehicle Registration: This document shows that your vehicle is legally registered with the state. It is often required during traffic stops or when filing claims.

- Driving Record: Your driving history can affect your insurance premiums. This document provides a summary of any traffic violations or accidents you may have been involved in.

- Endorsement Forms: If you make changes to your policy, such as adding a new driver or vehicle, endorsement forms update your coverage details accordingly.

- Renewal Notice: This notice reminds you when your policy is up for renewal. It includes information about any changes in coverage or premiums for the upcoming term.

Keeping these documents organized and accessible can save you time and stress. Whether you’re involved in an accident or simply need to verify your coverage, having the right paperwork can make all the difference.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Auto Insurance Card serves as proof of insurance coverage for the vehicle listed on the card. |

| Legal Requirement | Most states require drivers to carry an insurance card in their vehicle to comply with state laws regarding auto insurance. |

| Information Included | The card includes essential details such as the company number, policy number, effective date, and vehicle identification number (VIN). |

| Presentation | Drivers must present the insurance card upon request by law enforcement or in case of an accident. |

| Storage Requirement | The card must be kept in the insured vehicle at all times, as specified by state regulations. |

More About Auto Insurance Card

What is an Auto Insurance Card?

An Auto Insurance Card is a document that proves a vehicle is covered by insurance. It includes essential information such as the insurance company name, policy number, effective dates, and details about the insured vehicle. This card is typically required to be kept in the vehicle at all times.

What information is included on the Auto Insurance Card?

The Auto Insurance Card contains several key pieces of information: the insurance company number, policy number, effective date, expiration date, year, make and model of the vehicle, vehicle identification number (VIN), and the agency or company issuing the card.

Why is it important to keep the Auto Insurance Card in the vehicle?

Keeping the Auto Insurance Card in the vehicle is crucial because it must be presented upon demand during an accident or traffic stop. Law enforcement and other parties involved may request this information to verify insurance coverage.

What should I do if I lose my Auto Insurance Card?

If the Auto Insurance Card is lost, contact your insurance agent or company immediately. They can issue a replacement card. It is important to have a valid card in the vehicle to avoid penalties or complications during an accident.

What should I do if I am involved in an accident?

In the event of an accident, report it to your insurance agent or company as soon as possible. Collect information from all parties involved, including names, addresses, and insurance details. This information is essential for filing a claim.

What does the artificial watermark on the card signify?

The artificial watermark on the Auto Insurance Card serves as a security feature. It helps to prevent fraud and ensures that the document is legitimate. To view the watermark, hold the card at an angle.

How can I check if my Auto Insurance Card is valid?

To verify the validity of your Auto Insurance Card, you can contact your insurance provider. They can confirm that your policy is active and that the details on the card are correct. Additionally, you can check your policy documents for coverage dates.

What happens if I fail to present my Auto Insurance Card when required?

Failure to present your Auto Insurance Card when required can result in fines, penalties, or other legal consequences. It is important to always have the card accessible in your vehicle to avoid such issues.

Can I use a digital version of my Auto Insurance Card?

Many states allow digital versions of the Auto Insurance Card, which can be accessed via mobile apps or websites provided by your insurance company. However, check local laws to ensure that a digital copy is acceptable in your area.

What should I do if my Auto Insurance policy changes?

If your Auto Insurance policy changes, such as a new vehicle or updated coverage, request a new Auto Insurance Card from your insurance provider. It is essential to have the most current information in your vehicle.

Auto Insurance Card: Usage Steps

Completing the Auto Insurance Card form is a straightforward process that requires attention to detail. Ensure that you have all necessary information at hand before starting. This form is essential for verifying your insurance coverage and must be kept in your vehicle.

- Locate the INSURANCE IDENTIFICATION CARD section at the top of the form.

- Fill in the COMPANY NUMBER provided by your insurance provider.

- Enter your COMPANY POLICY NUMBER next. This number identifies your specific insurance policy.

- Record the EFFECTIVE DATE of your insurance coverage, indicating when it began.

- Provide the EXPIRATION DATE to show when your coverage will end.

- Input the YEAR of your vehicle.

- Next, enter the MAKE/MODEL of your vehicle to specify its details.

- Fill in the VEHICLE IDENTIFICATION NUMBER (VIN), which is unique to your vehicle.

- Identify the AGENCY/COMPANY ISSUING CARD to indicate which insurance company issued the card.

- Review all entries for accuracy before finalizing.

After completing the form, keep it in your vehicle as required. In the event of an accident, present this card upon demand and report the incident to your insurance agent as soon as possible. Remember to gather all relevant information from the scene, including details from other drivers and witnesses.