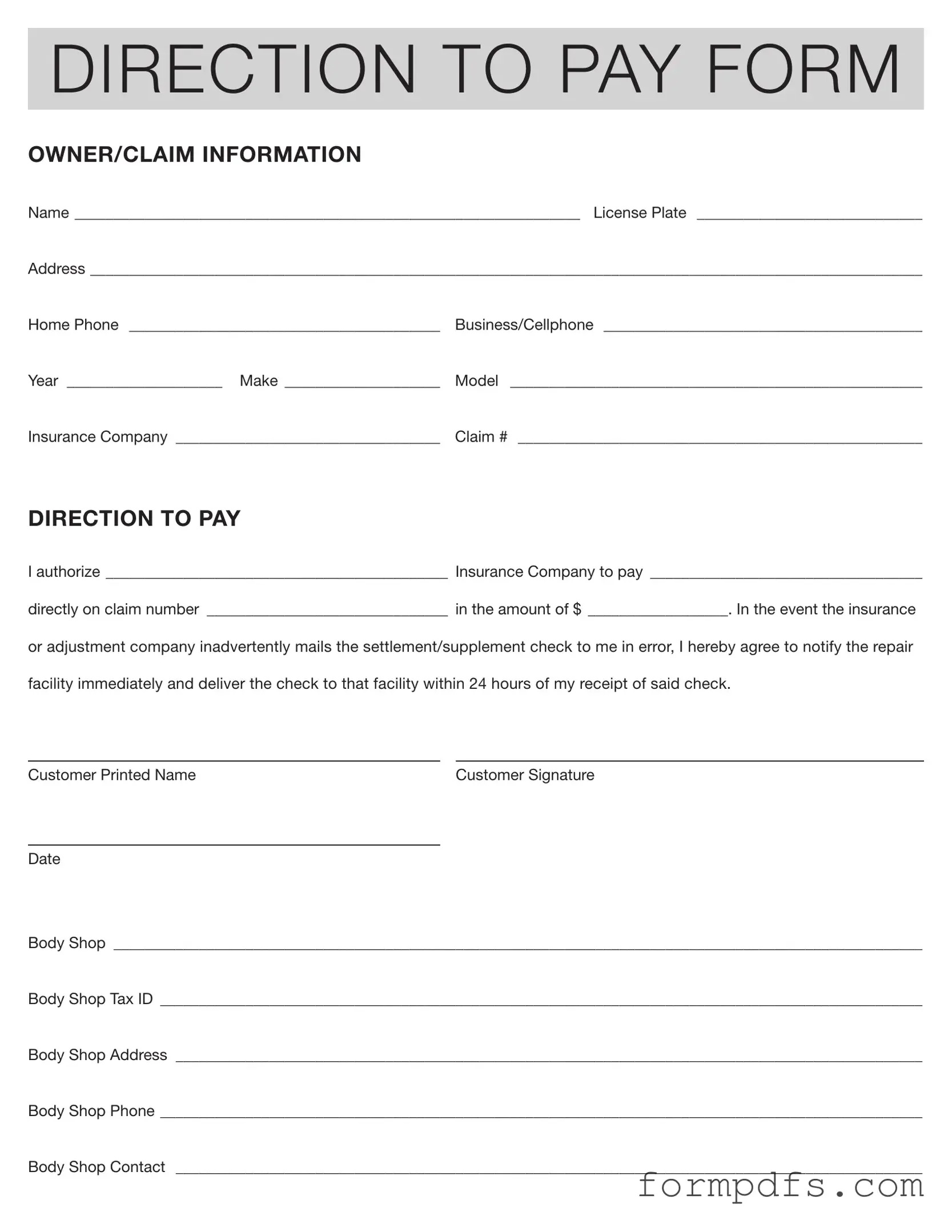

Blank Authorization And Direction Pay PDF Form

The Authorization and Direction Pay form serves as a crucial document in the claims process, streamlining communication between vehicle owners, insurance companies, and repair facilities. This form captures essential information about the claimant, including their name, address, and contact details, as well as specifics about the vehicle involved in the claim, such as the license plate, year, make, and model. Additionally, it identifies the insurance company and the claim number, ensuring that all parties are on the same page. The heart of the form lies in the direction to pay section, where the claimant authorizes the insurance company to issue payment directly to the designated repair facility. This not only simplifies the payment process but also helps prevent delays in vehicle repairs. Should the insurance company mistakenly send the payment to the claimant instead, the form requires prompt action to notify the repair facility and return the check within 24 hours. The inclusion of the body shop's information, including tax ID and contact details, further solidifies the transaction, creating a clear line of accountability and communication. This comprehensive approach fosters a smoother claims experience for all parties involved.

More PDF Templates

Rochdale Village Application - A vibrant community for families and individuals.

Blank Pdf Invoice - Enjoy a user-friendly interface for easy invoice design.

Additionally, it is important to utilize a reliable template for your transaction to ensure all necessary information is included. For a comprehensive and easy-to-use form, you can visit smarttemplates.net/fillable-motor-vehicle-bill-of-sale, which provides a fillable Motor Vehicle Bill of Sale that meets legal standards.

Hvac Job Application - Your military service background can provide valuable experience insights.

Documents used along the form

The Authorization and Direction Pay form is a crucial document used in the claims process, particularly in the context of vehicle repairs following an accident. However, several other forms and documents are often utilized alongside it to ensure a smooth and efficient transaction. Below is a list of these related documents, each serving a specific purpose in the process.

- Claim Submission Form: This form is submitted to the insurance company to initiate the claims process. It includes details about the incident, the parties involved, and the extent of the damages.

- Repair Estimate: A detailed estimate provided by the repair shop outlining the costs associated with the necessary repairs. This document helps the insurance company assess the claim's validity and determine the payout amount.

- Proof of Loss Form: This document is typically required by the insurance company to substantiate the claim. It includes a declaration of the damages and losses incurred, often accompanied by supporting documentation.

- Authorization to Release Information: This form allows the insurance company to obtain relevant information from third parties, such as repair shops or medical providers, to process the claim effectively.

- Body Shop Agreement: This agreement outlines the terms and conditions between the vehicle owner and the repair facility. It often includes payment terms, warranty details, and the scope of work to be performed.

- Settlement Agreement: Once the claim is approved, this document outlines the terms of the settlement between the insurance company and the policyholder. It details the amount to be paid and any conditions attached to the settlement.

- DMV Application Form: Essential for obtaining driver's licenses, the Ca DMV DL 44 form is used for applications, renewals, and changes in personal information, and can be found along with other necessary documentation such as All California Forms.

- Release of Liability: This form is signed by the claimant to release the insurance company from any further claims related to the incident after receiving the settlement. It protects the insurer from future disputes regarding the same claim.

- Direct Deposit Authorization: If the claimant prefers to receive payments electronically, this form allows the insurance company to deposit funds directly into the claimant's bank account, expediting the payment process.

Understanding these documents can significantly enhance the claims process experience. Each form plays a vital role in ensuring that all parties are informed and that the necessary steps are taken to resolve the claim efficiently. Keeping these documents organized and accessible can help streamline communication and reduce potential delays.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Authorization and Direction to Pay form allows a claimant to authorize their insurance company to pay a repair facility directly for services rendered. |

| Claimant Information | The form requires detailed information about the claimant, including their name, address, and contact numbers, ensuring proper identification and communication. |

| Insurance Company | The form must clearly state the insurance company responsible for the claim, which is crucial for processing payments accurately. |

| Payment Amount | The claimant must specify the amount authorized for payment, which should align with the agreed-upon repair costs. |

| Notification Requirement | If the insurance company sends the payment to the claimant by mistake, the claimant is required to notify the repair facility and deliver the check within 24 hours. |

| State-Specific Law | In many states, including California, the use of this form is governed by the California Insurance Code, which mandates proper authorization for direct payments to repair shops. |

More About Authorization And Direction Pay

What is the purpose of the Authorization and Direction Pay form?

The Authorization and Direction Pay form is used to instruct an insurance company to pay a specific amount directly to a repair facility for services rendered. This ensures that the payment is handled efficiently and directly between the insurer and the repair shop.

Who needs to fill out this form?

The form must be completed by the vehicle owner or claimant. This includes providing personal information, such as name, address, and contact details, along with information about the vehicle and the insurance claim.

What information is required on the form?

Essential information includes the vehicle owner's name, license plate number, address, phone numbers, vehicle year, make, model, insurance company name, and claim number. Additionally, the repair facility's details, including name, tax ID, address, and contact information, must also be provided.

How do I authorize payment to the repair facility?

To authorize payment, fill in the insurance company's name, the repair facility's name, the claim number, and the amount to be paid. Your signature and date are also required to validate the authorization.

What should I do if I receive a check from the insurance company?

If you inadvertently receive a check from the insurance company, you must notify the repair facility immediately. You are required to deliver the check to the facility within 24 hours of receipt to ensure proper handling of the payment.

Is there a deadline for submitting this form?

While there is no specific deadline stated in the form, it is advisable to submit it as soon as possible after the claim has been approved. Timely submission helps expedite the payment process to the repair facility.

Can I change the payment amount after submitting the form?

Once the form is submitted, any changes to the payment amount must be communicated to the insurance company and the repair facility. It is best to clarify any adjustments before submitting the form to avoid confusion.

What happens if the repair facility does not receive the payment?

If the repair facility does not receive the payment, they should contact the insurance company to inquire about the status of the payment. The vehicle owner should also follow up to ensure that the authorization was processed correctly.

Is this form legally binding?

Yes, once signed, the Authorization and Direction Pay form is a legal document that authorizes the insurance company to make payment as specified. Both the vehicle owner and the repair facility are expected to adhere to the terms outlined in the form.

Where can I obtain this form?

The Authorization and Direction Pay form can typically be obtained from your insurance company, your repair facility, or downloaded from the insurance company’s website. Ensure you have the most current version to avoid any issues.

Authorization And Direction Pay: Usage Steps

After completing the Authorization and Direction Pay form, it will be submitted to the insurance company to facilitate the payment process. Ensure all information is accurate to avoid delays. Follow these steps carefully to fill out the form correctly.

- Write your full name in the space provided for the owner/claim information.

- Enter your license plate number accurately.

- Fill in your complete address, including street, city, state, and zip code.

- Provide your home phone number.

- Include your business or cellphone number.

- Indicate the year of the vehicle involved in the claim.

- Specify the make of the vehicle.

- Write the model of the vehicle.

- Enter the name of your insurance company.

- Provide your claim number.

- In the direction to pay section, write the name of the insurance company that will be making the payment.

- Identify the repair facility by writing its name in the designated space.

- Fill in the claim number again in the provided area.

- Write the amount to be paid directly to the repair facility.

- Sign your name in the customer signature section.

- Print your name in the customer printed name section.

- Enter the date on which you are filling out the form.

- Complete the body shop information, including the name, tax ID, address, phone number, and contact person.