Valid Articles of Incorporation Template

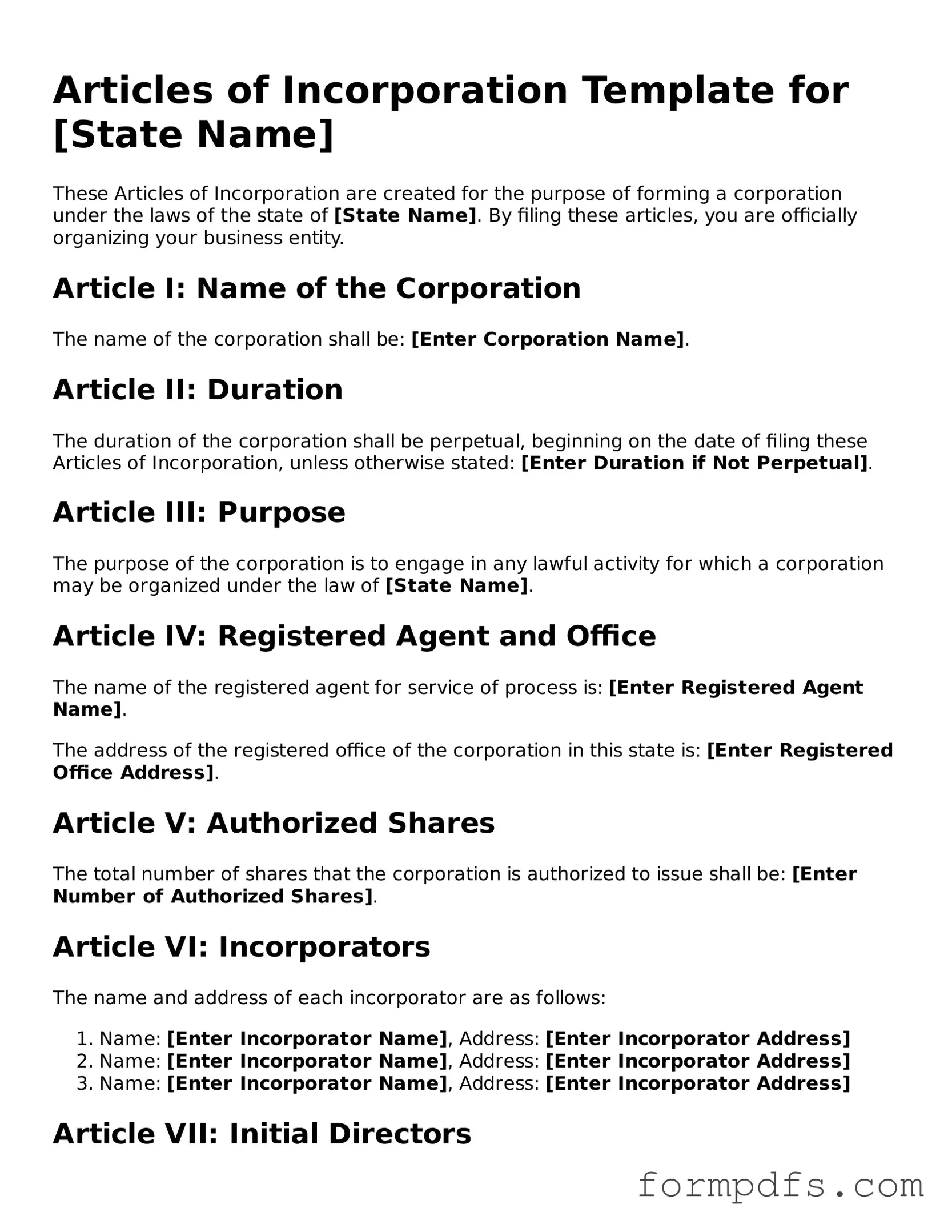

The Articles of Incorporation form serves as a foundational document for establishing a corporation in the United States. This essential paperwork outlines critical information about the business, including its name, purpose, and the address of its principal office. Additionally, it identifies the registered agent, who will receive legal documents on behalf of the corporation. Shareholder details, including the number of shares the corporation is authorized to issue, are also specified, helping to define ownership structure. Furthermore, the form may include provisions regarding the management of the corporation and the duration of its existence. By carefully completing the Articles of Incorporation, business owners not only comply with state requirements but also lay the groundwork for their company’s governance and operational framework.

More Forms:

Identification Affidavit of Identity - This form is typically used to verify one's identity for legal purposes.

When engaging in a vehicle sale, utilizing a Texas Vehicle Purchase Agreement form can safeguard both the buyer and seller by clearly defining the terms of the transaction. To ensure you have a solid framework for your agreement, you may refer to resources available at OnlineLawDocs.com, which provide necessary templates and guidance for drafting this essential document.

Electrical Panel Schedule Template - Each circuit listed includes the amperage and voltage specifications for clarity.

Conditional Progress Release California - Essential for contractors who want to maintain rights while settling partial payments.

Articles of Incorporation Forms for Specific US States

Documents used along the form

When starting a corporation, the Articles of Incorporation are essential, but they are not the only documents required. Several other forms and documents often accompany this foundational document to ensure compliance with state and federal regulations. Below is a brief overview of some of these important documents.

- Bylaws: Bylaws outline the internal rules and procedures for the corporation. They govern how the corporation will operate, including details on meetings, voting, and the responsibilities of officers and directors.

- Initial Report: Some states require an initial report shortly after incorporation. This document typically includes information about the corporation's officers, directors, and business address, ensuring that the state has current contact information.

- Last Will and Testament: A smarttemplates.net/fillable-last-will-and-testament form is crucial for controlling asset distribution upon death, designating an executor, and detailing final wishes to avoid ambiguities.

- Employer Identification Number (EIN): An EIN is necessary for tax purposes. It serves as a unique identifier for the business and is required for opening bank accounts, hiring employees, and filing tax returns.

- State Business License: Depending on the nature of the business and its location, a state business license may be required. This license ensures that the corporation is authorized to operate legally within the state.

These documents, alongside the Articles of Incorporation, play a crucial role in establishing a corporation's legal framework. Understanding each one is vital for ensuring that the business is set up properly and in compliance with all applicable laws.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation serve as a formal document that establishes a corporation's existence in the eyes of the state. It outlines the basic information about the corporation, such as its name, purpose, and the number of shares it is authorized to issue. |

| Governing Law | The Articles of Incorporation are governed by state-specific laws, which vary by jurisdiction. For instance, in Delaware, they are regulated under Title 8 of the Delaware Code, while in California, the governing law is found in the Corporations Code, Sections 200-220. |

| Filing Requirements | To create a corporation, the Articles of Incorporation must be filed with the appropriate state agency, usually the Secretary of State. Each state has its own filing fees and requirements, which must be adhered to for the corporation to be legally recognized. |

| Amendments | Corporations may need to amend their Articles of Incorporation over time. This process requires filing an amendment form with the state and may involve additional fees. Changes could include alterations to the corporation's name, purpose, or structure. |

More About Articles of Incorporation

What is the Articles of Incorporation form?

The Articles of Incorporation form is a legal document that establishes a corporation in the United States. It outlines essential details about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. This document is filed with the state government to officially create the corporation and grant it legal recognition.

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is necessary to legally form a corporation. This process provides the corporation with limited liability protection, meaning that the personal assets of the owners are generally protected from business debts and liabilities. Additionally, this filing is often required to open a business bank account and obtain financing.

What information is required in the Articles of Incorporation?

The Articles of Incorporation typically require the following information: the corporation's name, its purpose, the address of the principal office, the name and address of the registered agent, the number of shares authorized to be issued, and the names of the incorporators. Each state may have specific requirements, so it is important to check local regulations.

How do I choose a name for my corporation?

The name of your corporation must be unique and not already in use by another business entity in your state. It should also comply with state naming rules, which often require the inclusion of terms like "Corporation," "Incorporated," or abbreviations such as "Corp." or "Inc." Conducting a name search through the state’s business registry can help ensure your desired name is available.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If changes are necessary, such as altering the corporation's name or increasing the number of authorized shares, you must file an amendment with the state. This process usually involves submitting a specific form and paying a filing fee.

How long does it take to process the Articles of Incorporation?

The processing time for Articles of Incorporation varies by state. In some states, it can take a few days to a couple of weeks. Expedited processing options may be available for an additional fee. It is advisable to check with the specific state agency handling the filings for the most accurate timeframes.

What is a registered agent, and why is it important?

A registered agent is an individual or business entity designated to receive legal documents and official correspondence on behalf of the corporation. Having a registered agent is important because it ensures that the corporation can be reached for legal matters. The registered agent must have a physical address in the state of incorporation and be available during business hours.

Do I need to pay a fee to file the Articles of Incorporation?

Yes, there is typically a filing fee associated with submitting the Articles of Incorporation. The amount varies by state and can range from $50 to several hundred dollars. It is essential to check the specific fee schedule of the state where you are incorporating.

Is legal assistance required to file the Articles of Incorporation?

Legal assistance is not required to file the Articles of Incorporation, but it can be beneficial. While many individuals successfully complete the process on their own, consulting with a legal professional can help ensure compliance with state laws and regulations, particularly for complex corporations or unique situations.

Articles of Incorporation: Usage Steps

After obtaining the Articles of Incorporation form, you are ready to begin the process of officially establishing your corporation. Follow these steps carefully to ensure that you complete the form accurately.

- Gather necessary information: Collect details about your corporation, including its name, address, and purpose.

- Determine the number of shares: Decide how many shares of stock your corporation will issue and their par value.

- Identify the registered agent: Choose a registered agent who will receive legal documents on behalf of your corporation.

- Provide incorporator details: Fill in the name and address of the incorporator(s) responsible for filing the Articles.

- Complete the form: Fill out all required sections of the Articles of Incorporation form accurately.

- Review the form: Double-check all information for accuracy and completeness to avoid delays.

- Sign the form: Ensure that the incorporator(s) sign the document as required.

- Submit the form: File the completed Articles of Incorporation with the appropriate state agency along with any required fees.

Once you have submitted the form, the state will process it and, if everything is in order, you will receive confirmation of your corporation's formation. Keep this confirmation for your records, as it will be important for future business operations.