Blank Alabama Mvt 20 1 PDF Form

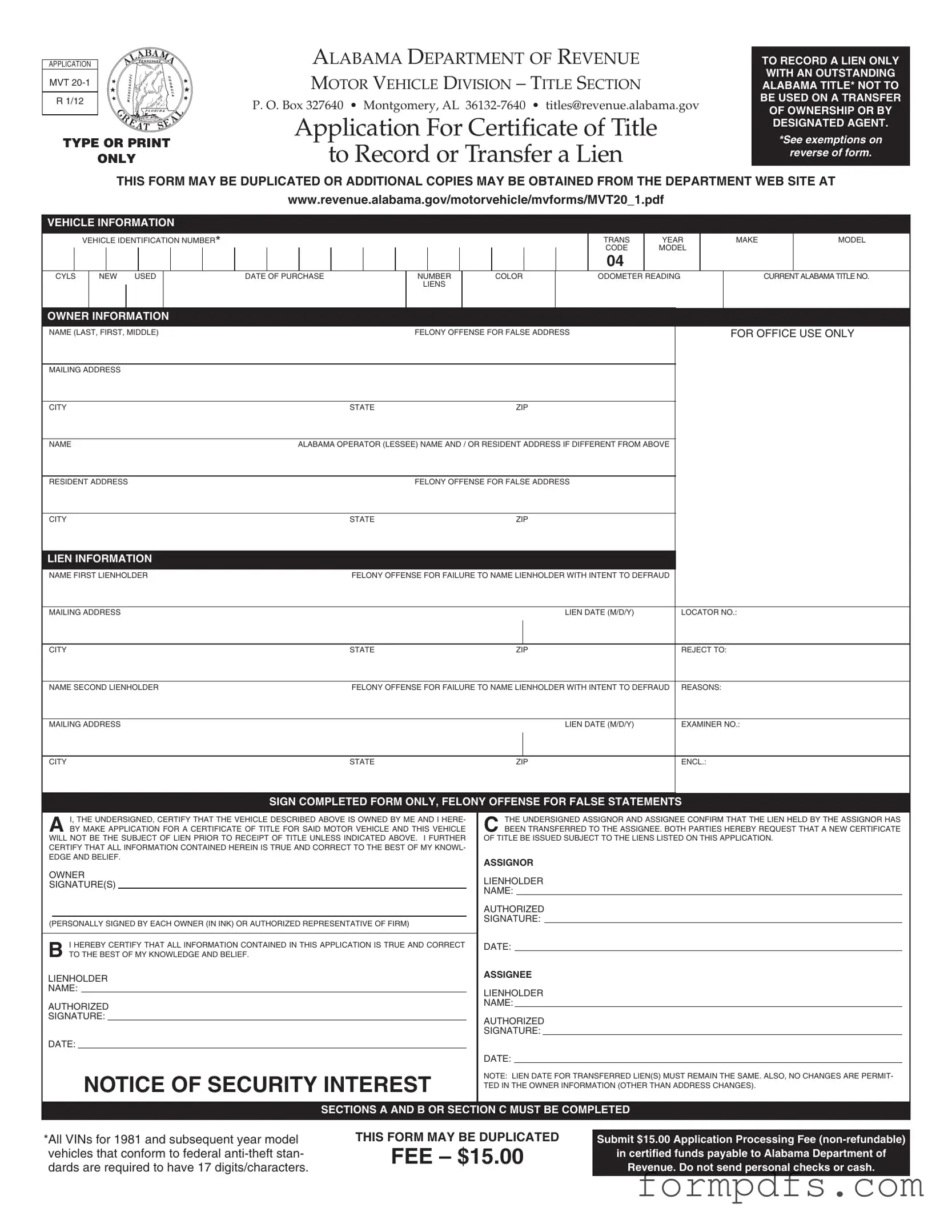

The Alabama Mvt 20 1 form is an essential document for those looking to record or transfer a lien on a motor vehicle in Alabama. This form is specifically designed for situations where there is an outstanding Alabama title, and it cannot be used for transferring ownership or by designated agents. It includes vital sections that require detailed vehicle information, such as the vehicle identification number (VIN), make, model, and odometer reading, alongside owner and lienholder details. Applicants must ensure that all information matches what is on the current title, with the exception of mailing addresses. The process requires a $15 application fee, which must be submitted in certified funds. Additionally, the form must be completed legibly to avoid delays, as illegible submissions will be returned. Importantly, certain exemptions apply, such as for vehicles older than 35 years or specific types of trailers, which do not require a title. Understanding the nuances of this form is crucial for ensuring compliance with Alabama's vehicle title regulations.

More PDF Templates

How to Make Pay Stubs If Self Employed - Many freelancers secure loans or leases with the help of their documented income via this pay stub.

For those interested in acquiring an all-terrain vehicle, understanding the process is crucial; thus, it may be beneficial to explore our guide on the necessary steps, including the completion of the essential ATV Bill of Sale form found here.

Bdsm Kink Checklist - Examine your views on long-term versus short-term dynamics.

Documents used along the form

When dealing with vehicle titles and liens in Alabama, several forms and documents may accompany the Alabama MVT 20 1 form. Each of these documents serves a specific purpose and is essential for ensuring that all legal requirements are met. Below is a list of commonly used forms that complement the MVT 20 1.

- MVT 5-1E: This form is utilized by designated agents to record liens. Unlike the MVT 20 1, which is specifically for lien recording by lienholders, the MVT 5-1E is designed for agents acting on behalf of lienholders or owners.

- MVT 4-1: This application is used to apply for a new title when ownership of a vehicle is being transferred. It is essential for situations where a vehicle changes hands, ensuring that the new owner is legally recognized.

- Affidavit of Service: When involved in legal proceedings, it is important to complete the detailed Affidavit of Service documentation to verify the delivery of legal papers effectively.

- MVT 2-1: This form is necessary for applying for a duplicate title. If the original title is lost or damaged, this form allows the owner to request a replacement, maintaining the legal status of ownership.

- MVT 7-1: This document is used to notify the Alabama Department of Revenue about a change of address for the vehicle owner. Keeping the department updated helps ensure that all correspondence regarding the vehicle is directed to the correct address.

- MVT 10-1: This form is for applying for a title for a vehicle that does not have a title, often referred to as a "title application for an untitled vehicle." It is crucial for vehicles that were previously unregistered or for which a title was never issued.

- MVT 1-1: This is the application for a certificate of title for a motor vehicle. It is the primary document used to establish ownership and is typically required when a vehicle is purchased from a dealer or individual.

- MVT 8-1: This form is used for reporting a vehicle as stolen. If a vehicle is reported stolen, this document alerts the state and law enforcement, helping to prevent further fraudulent activities related to the vehicle.

Understanding these forms and their purposes is essential for anyone involved in vehicle ownership or transactions in Alabama. Each document plays a critical role in ensuring compliance with state laws and protecting the rights of vehicle owners and lienholders alike.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The MVT 20-1 form is specifically used to apply for a certificate of title to record or transfer a lien on a vehicle. |

| Eligibility | This form can only be used for vehicles with an outstanding Alabama title and cannot be used for transfers of ownership. |

| Governing Law | The form is governed by Section 32-8-61 of the Code of Alabama 1975, which outlines the requirements for creating a security interest in a vehicle. |

| Filing Fee | A non-refundable application processing fee of $15.00 must be submitted with the form in certified funds. |

| Supporting Documents | The current Alabama title for the vehicle must accompany the application, along with the title fee. |

| Exemptions | Certain vehicles, such as those over 35 years old or specific trailers, may be exempt from titling requirements as per regulations effective January 1, 2012. |

More About Alabama Mvt 20 1

What is the purpose of the Alabama MVT 20 1 form?

The Alabama MVT 20 1 form is specifically designed for lienholders to record or transfer a lien on a vehicle that has an outstanding Alabama title. It is important to note that this form cannot be used for transferring ownership of the vehicle or by designated agents. The form ensures that a lien is properly recorded in accordance with Alabama law.

Who should complete the MVT 20 1 form?

The form should be completed by the lienholder, which is the entity or individual who has a security interest in the vehicle. This may include banks, credit unions, or other financial institutions that have provided a loan for the vehicle. The vehicle owner also needs to provide their information, as both parties must certify the accuracy of the details provided.

What information is required on the MVT 20 1 form?

The form requires various pieces of information, including the vehicle identification number (VIN), make, model, year, color, and current odometer reading. Additionally, the owner's name and address, as well as the lienholder's name and address, must be included. It is essential that this information matches what appears on the surrendered Alabama title, except for address changes.

Is there a fee associated with submitting the MVT 20 1 form?

Yes, there is a non-refundable application processing fee of $15. This fee must be submitted in certified funds payable to the Alabama Department of Revenue. Personal checks and cash are not accepted. It is advisable to ensure that the payment accompanies the completed form to avoid any processing delays.

What supporting documents are needed with the MVT 20 1 form?

When submitting the MVT 20 1 form, it is necessary to include the current Alabama title for the vehicle. This title serves as proof of ownership and is required to process the lien recording. Without the title, the application cannot be completed.

Are there any exemptions for using the MVT 20 1 form?

Yes, there are specific exemptions. For instance, no certificate of title will be issued for manufactured homes, trailers, or vehicles that are more than 20 or 35 model years old, depending on the type of vehicle. Additionally, low-speed vehicles, which are defined by specific criteria, are also exempt from titling. These exemptions mean that if a vehicle falls under these categories, the MVT 20 1 form cannot be used.

How should the MVT 20 1 form be filled out?

The form must be typed or printed clearly. Illegible forms will be returned, so attention to detail is crucial. Each section of the form must be completed accurately, including vehicle information and owner details. Both the assignor and assignee must sign the form to certify that all information is true and correct.

What happens after the MVT 20 1 form is submitted?

After submission, the Alabama Department of Revenue will review the application. If everything is in order and the fee has been paid, the lien will be recorded, and a new certificate of title will be issued that reflects the lien information. If there are any issues, such as missing information or payment, the application may be returned for correction.

Where can I obtain additional copies of the MVT 20 1 form?

Additional copies of the MVT 20 1 form can be obtained from the Alabama Department of Revenue's website. The form is available for download, allowing users to print as many copies as needed. This ensures that all lienholders have access to the necessary documentation for their transactions.

Alabama Mvt 20 1: Usage Steps

Once you have gathered all necessary information and documents, you can begin filling out the Alabama MVT 20 1 form. Ensure that you have the current Alabama title for the vehicle and a certified payment for the application processing fee. Follow these steps carefully to complete the form accurately.

- Start by entering the vehicle's information. Fill in the Vehicle Identification Number (VIN), year, make, model, color, and odometer reading.

- Indicate whether the vehicle is new or used.

- Provide the current Alabama title number.

- Next, enter your personal information as the owner. Include your name, mailing address, city, state, and zip code.

- If your address differs from your mailing address, fill in the resident address section.

- List the first lienholder’s information. Include their name, mailing address, city, state, and zip code.

- Fill in the lien date for the first lienholder.

- If applicable, provide the second lienholder’s information in the same manner as the first.

- In the certification section, sign the form where indicated. Ensure that the signature is in ink and includes the date.

- Prepare to submit the form along with the $15.00 application processing fee in certified funds, ensuring that personal checks or cash are not included.

After completing the form, double-check all entries for accuracy. Once verified, submit the form along with the required documents to the Alabama Department of Revenue. Processing times may vary, so be sure to allow sufficient time for your application to be reviewed and approved.