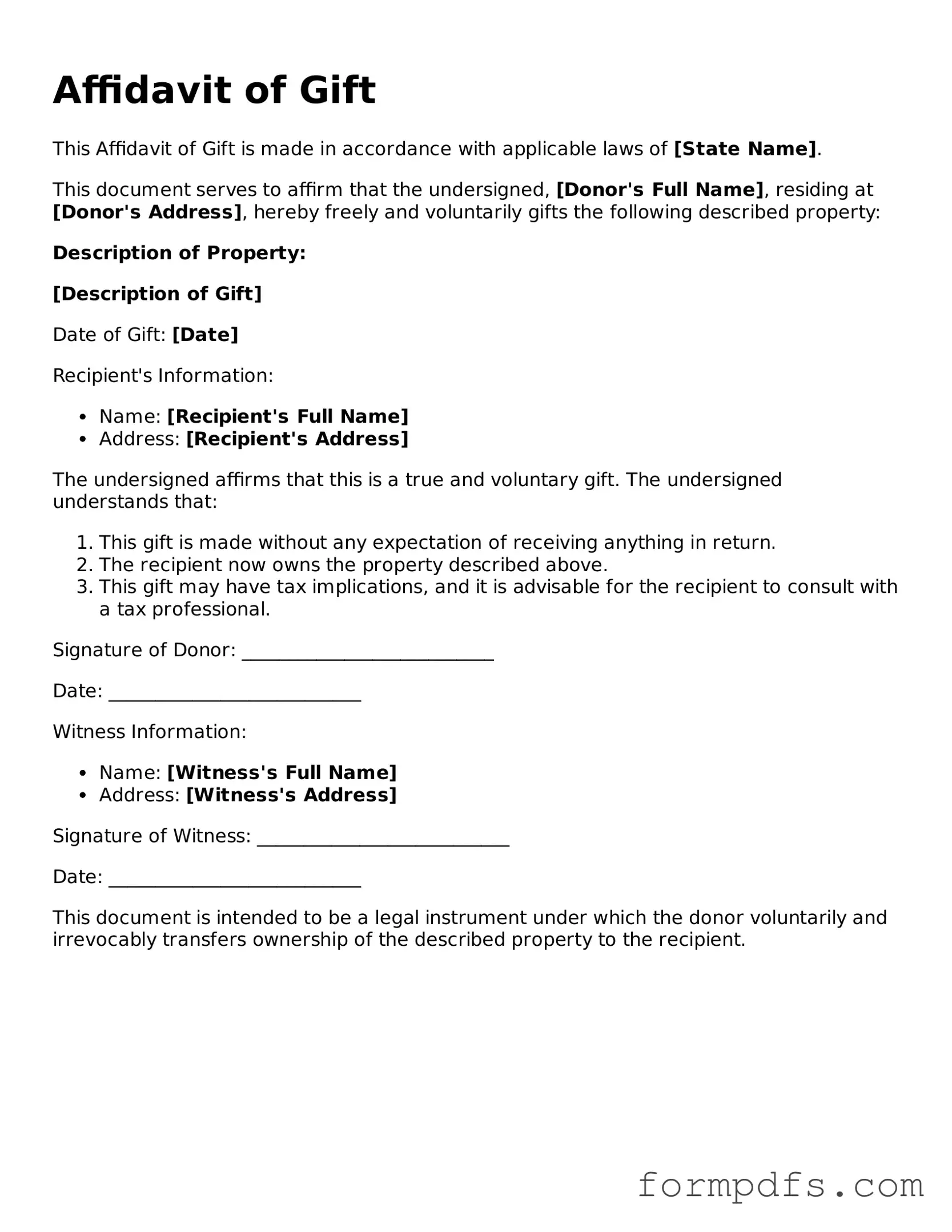

Valid Affidavit of Gift Template

The Affidavit of Gift form serves as an essential tool for individuals looking to make a gift of property, whether it be cash, real estate, or personal items. This document not only formalizes the intent to give but also provides important legal protections for both the giver and the recipient. By detailing the specifics of the gift, such as its value and the relationship between the parties involved, the form helps to clarify any potential misunderstandings that could arise later. Additionally, it may include a statement affirming that the gift is made without any expectation of repayment or compensation, reinforcing the voluntary nature of the transaction. Understanding the components of the Affidavit of Gift is crucial, as it can impact tax implications and eligibility for certain benefits. With this form in hand, both parties can proceed with confidence, knowing that their intentions are clearly documented and legally recognized.

Other Affidavit of Gift Templates:

Proof of Residency Template - Schools and other institutions may utilize this document to validate residency claims for scholarships.

When engaging in a sale, it is crucial to understand the importance of a reliable Arizona bill of sale document. This essential guide to the bill of sale ensures that all parties involved are protected and that the transfer of ownership is officially recorded. For more information, you can refer to this thorough Arizona bill of sale form guide.

Single Status Certificate Usa - A Single Status Affidavit helps clarify your affairs and intentions openly.

Documents used along the form

The Affidavit of Gift form is often used in various legal and financial contexts to document the transfer of property or assets as a gift. However, several other forms and documents may accompany it to ensure clarity and compliance with relevant laws. Below is a list of these documents, each serving a specific purpose.

- Gift Tax Return (Form 709): This form is filed with the IRS to report gifts that exceed the annual exclusion amount. It helps ensure that any applicable gift taxes are calculated and paid.

- Deed of Gift: This legal document formally transfers ownership of real property or personal property from one person to another without any exchange of money. It serves as proof of the transfer.

- Bill of Sale: Used primarily for personal property, this document provides evidence of the sale or transfer of ownership. It includes details about the item and the parties involved.

- Letter of Intent: Although not legally binding, this document outlines the giver's intentions regarding the gift. It can clarify the reasons for the gift and any conditions attached to it.

- Trust Documents: If the gift is placed in a trust, these documents outline the terms of the trust, including how the assets will be managed and distributed.

- Power of Attorney: This document allows one person to act on behalf of another in legal or financial matters. It may be necessary if the giver is unable to sign the Affidavit of Gift themselves.

- Vehicle Purchase Agreement: This essential document formalizes the sale of a vehicle in California, detailing transaction terms and vehicle specifics. For comprehensive resources, see All California Forms.

- Tax Identification Number (TIN): Both the giver and the recipient may need to provide their TINs for tax purposes, especially if the gift is significant and requires reporting.

These documents work together with the Affidavit of Gift form to provide a comprehensive framework for the legal transfer of gifts. Understanding each document's purpose can help ensure that the process is smooth and compliant with applicable laws.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | An Affidavit of Gift is a legal document used to declare the transfer of property or assets as a gift without any exchange of money. |

| Purpose | This form is primarily used to clarify the intent behind the gift and to provide a record for tax purposes. |

| Notarization | Typically, the Affidavit of Gift must be notarized to ensure its authenticity and to validate the signatures of the parties involved. |

| Tax Implications | Gifts above a certain value may be subject to federal gift tax, so it's essential to understand the limits and requirements. |

| State-Specific Forms | Some states have their own versions of the Affidavit of Gift, governed by state laws regarding property transfer. |

| Common Uses | Commonly used for real estate, vehicles, and other significant assets, this form helps avoid disputes over ownership. |

| Eligibility | Anyone can gift property, but the donor must have the legal capacity to do so, meaning they must be of sound mind and legal age. |

| Revocation | Once an Affidavit of Gift is executed, it generally cannot be revoked unless specific conditions are met. |

| Legal Advice | Consulting with a legal professional is advisable to ensure compliance with applicable laws and to understand the implications of gifting. |

| Record Keeping | It's important to keep a copy of the Affidavit of Gift for personal records and potential future legal needs. |

More About Affidavit of Gift

What is an Affidavit of Gift?

An Affidavit of Gift is a legal document that confirms the transfer of property or assets from one person to another as a gift. It serves as proof that the donor willingly gave the gift without expecting anything in return. This document is often used for tax purposes and can help clarify ownership in the event of disputes.

When should I use an Affidavit of Gift?

You should use an Affidavit of Gift when you are transferring property or assets to someone else as a gift. This can include real estate, vehicles, or other valuable items. It is particularly important when the value of the gift exceeds a certain amount, as it may have tax implications for both the giver and the recipient.

What information is required in the Affidavit of Gift?

The Affidavit of Gift typically requires the names and addresses of both the donor and the recipient. It should describe the gift in detail, including its value and any relevant identification numbers, such as a vehicle identification number (VIN) for cars. The document must also include a statement affirming that the gift is given voluntarily and without consideration.

Do I need witnesses or notarization for the Affidavit of Gift?

While requirements can vary by state, it is generally a good practice to have the Affidavit of Gift notarized. Notarization adds an extra layer of authenticity and can help prevent disputes in the future. Some states may also require witnesses to sign the document, so it’s advisable to check local laws.

Are there tax implications associated with an Affidavit of Gift?

Yes, there can be tax implications. The IRS allows individuals to gift a certain amount each year without incurring gift tax. If the value of the gift exceeds this annual exclusion limit, the donor may need to file a gift tax return. It is important for both the donor and recipient to be aware of these limits and consult a tax professional if needed.

Can an Affidavit of Gift be revoked?

Once the gift is made and the Affidavit of Gift is signed, it generally cannot be revoked. However, if the donor can prove that the gift was made under duress or fraud, they may have grounds to contest the transfer. It is important for both parties to understand the implications of the gift before proceeding.

How do I obtain an Affidavit of Gift form?

You can obtain an Affidavit of Gift form from various sources, including online legal document providers, local government offices, or through an attorney. Ensure that the form you choose complies with your state’s requirements to avoid any legal issues.

Affidavit of Gift: Usage Steps

After completing the Affidavit of Gift form, it is important to review the information provided for accuracy. Once finalized, the form will need to be submitted to the appropriate entity as required.

- Obtain a copy of the Affidavit of Gift form.

- Fill in the date at the top of the form.

- Provide the full name and address of the donor.

- Include the full name and address of the recipient.

- Clearly describe the gift being made, including any relevant details such as value and type.

- Sign the form in the designated area, ensuring that the signature is dated.

- Have the form notarized by a licensed notary public.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the appropriate agency or recipient as required.