Blank Adp Pay Stub PDF Form

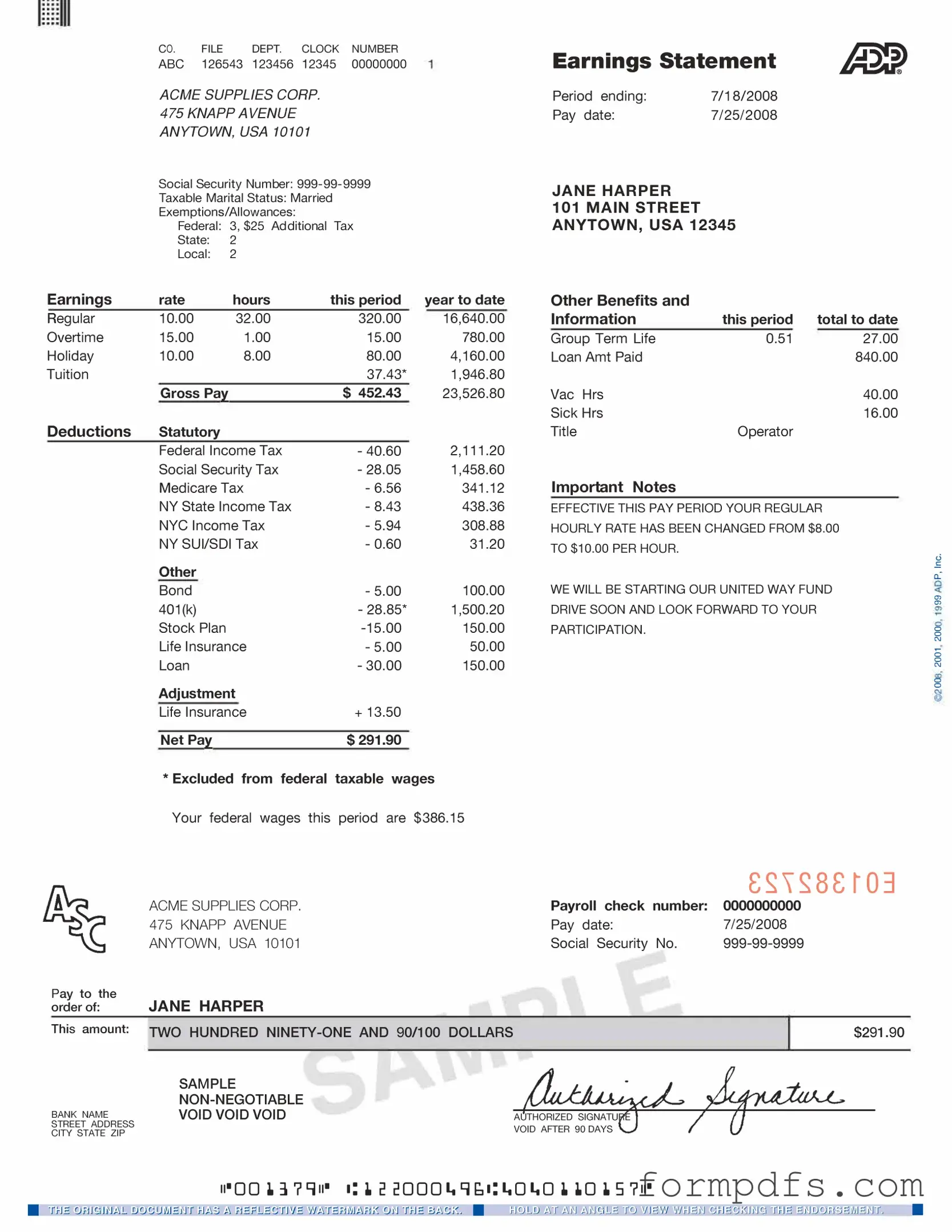

The ADP Pay Stub form is a crucial document for employees, serving as a detailed record of earnings and deductions for each pay period. It provides a comprehensive breakdown of gross wages, which includes regular pay, overtime, bonuses, and any other forms of compensation. Employees can easily track their deductions, such as federal and state taxes, Social Security, and Medicare contributions, ensuring transparency in their take-home pay. Additionally, the pay stub often includes information about benefits, such as health insurance premiums and retirement contributions, allowing individuals to see how these affect their overall compensation. Understanding the layout and details of the ADP Pay Stub form is essential for employees to verify the accuracy of their payments and to make informed financial decisions. By familiarizing themselves with this document, employees can better manage their finances and ensure compliance with tax regulations.

More PDF Templates

Soccer Evaluation Form - Exhibits creativity in play, making unpredictable decisions.

To successfully initiate your device protection claim and ensure that all necessary details are accurately captured, it is essential to complete the required documentation. You can conveniently access the necessary materials online and begin the process by using the Fill PDF Forms link provided.

Can You Do a Change of Address at Any Post Office - The PS 3575 ensures accurate record-keeping for postal services.

Documents used along the form

The ADP Pay Stub form is an essential document for employees, providing a clear breakdown of earnings, deductions, and net pay. However, several other forms and documents often accompany it to ensure accurate payroll processing and compliance. Below is a list of related documents that may be useful for both employees and employers.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld. It is essential for filing income tax returns.

- W-4 Form: Employees use this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from paychecks.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account, providing convenience and security.

- Time Sheet: Employees often fill out time sheets to track hours worked. This document is crucial for calculating pay based on hours or overtime worked.

- Boat Bill of Sale: This essential document records the transfer of ownership of a vessel, including vital details about the transaction. For more information, you can access the Boat Bill of Sale form.

- Employee Benefits Enrollment Form: This form allows employees to enroll in various benefits programs, such as health insurance or retirement plans, and is often completed during the onboarding process.

- Pay Rate Change Form: When an employee's pay rate changes, this form documents the adjustment. It ensures that payroll records are updated accurately.

- Leave Request Form: Employees use this form to formally request time off. It helps employers manage staffing and payroll during absences.

Understanding these documents can help both employees and employers navigate payroll processes more effectively. Keeping them organized and accessible ensures smooth operations and compliance with tax regulations.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for each pay period. |

| Components | The pay stub includes information such as gross pay, taxes withheld, benefits deductions, and any other withholdings. |

| Frequency | Pay stubs are typically issued on a bi-weekly or monthly basis, depending on the employer's payroll schedule. |

| State-Specific Requirements | Some states require specific information to be included on pay stubs, such as California's requirement for detailed hours worked and pay rates. |

| Access | Employees can often access their pay stubs online through an employee portal or receive them via email or physical mail. |

| Legal Compliance | Employers must comply with federal and state labor laws regarding the issuance of pay stubs, including the Fair Labor Standards Act (FLSA). |

| Record Keeping | Employees should keep pay stubs for their records, as they can be useful for tax purposes and verifying income. |

| Tax Information | Pay stubs show the amount of federal, state, and local taxes withheld, which helps employees understand their tax obligations. |

| Benefits Overview | The form often outlines contributions to benefits such as health insurance, retirement plans, and other deductions. |

| Discrepancies | If there are discrepancies in pay, employees should address them with their employer promptly to ensure corrections are made. |

More About Adp Pay Stub

What is an ADP pay stub?

An ADP pay stub is a document provided by ADP, a payroll processing company, that details an employee's earnings for a specific pay period. It includes information such as gross wages, deductions, and net pay. Employees can use this document for various purposes, including tax filing and verifying income.

How can I access my ADP pay stub?

You can access your ADP pay stub online through the ADP employee portal. After logging in with your credentials, navigate to the pay statements section. If you are unsure about your login information, you may need to contact your employer's HR department for assistance.

What information is included on the ADP pay stub?

The ADP pay stub typically includes your name, employee ID, pay period dates, gross pay, various deductions (such as taxes and benefits), and your net pay. Additional details may be provided, such as hours worked, overtime, and year-to-date earnings, giving you a comprehensive view of your compensation.

What should I do if I notice an error on my pay stub?

If you find an error on your pay stub, it is important to address it promptly. First, review the pay stub carefully to confirm the mistake. Then, contact your HR department or payroll administrator to discuss the issue. They can help investigate the discrepancy and make necessary corrections.

Can I receive my ADP pay stub via mail?

How often are ADP pay stubs issued?

ADP pay stubs are typically issued according to your employer's payroll schedule. Common schedules include weekly, bi-weekly, or monthly pay periods. Your employer should provide this information, allowing you to know when to expect your pay stub each time.

What should I do if I cannot access my ADP pay stub online?

If you are having trouble accessing your ADP pay stub online, first ensure that you are using the correct website and your login credentials are accurate. If problems persist, try clearing your browser cache or using a different browser. If you still cannot access it, reach out to your HR department or ADP customer support for further assistance.

Adp Pay Stub: Usage Steps

Completing the ADP Pay Stub form is a straightforward process. This guide will help you fill out the necessary information accurately. Follow these steps to ensure that all required fields are completed correctly.

- Start with your personal information. Enter your name, address, and employee ID at the top of the form.

- Next, locate the section for pay period details. Fill in the start and end dates of the pay period.

- In the earnings section, list your gross pay. This is the total amount earned before any deductions.

- Identify and record any deductions. Common deductions include taxes, health insurance, and retirement contributions.

- Calculate your net pay. This is the amount you take home after all deductions have been made.

- Review all entered information for accuracy. Make sure there are no typos or missing data.

- Finally, sign and date the form at the bottom to confirm that the information is correct.