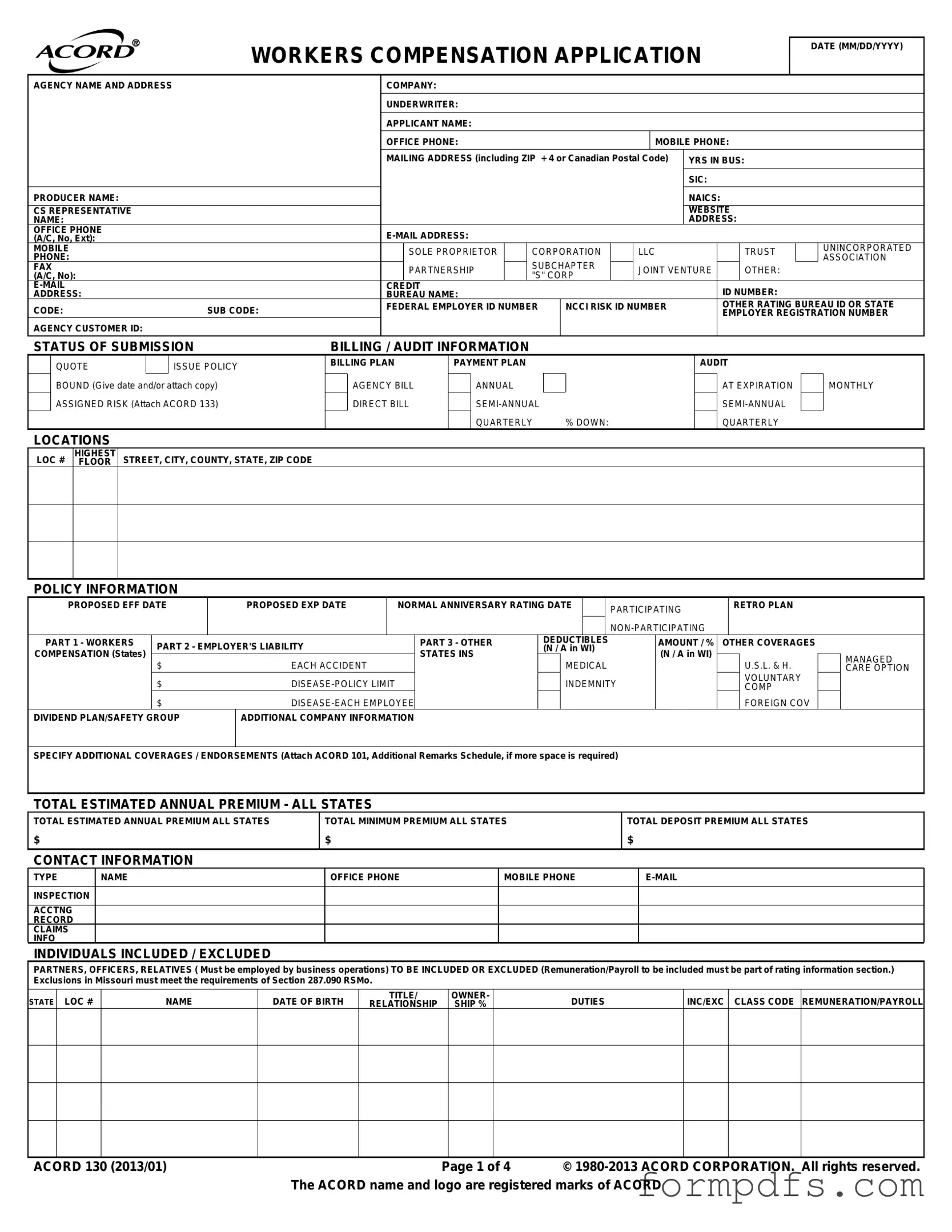

Blank Acord 130 PDF Form

The ACORD 130 form plays a crucial role in the realm of workers' compensation insurance, serving as a comprehensive application that businesses must complete to secure coverage. This form gathers essential information about the applicant, including their business structure, years in operation, and the nature of their business activities. Key details such as the agency name, underwriter, and contact information are prominently featured, ensuring that all parties involved have a clear understanding of the applicant's identity. The form also requires specifics about the business's estimated annual payroll and the classification of employees, which are vital for determining premium rates. Furthermore, it addresses important aspects like prior insurance coverage, loss history, and any unique operational risks that may impact the underwriting process. By meticulously detailing these elements, the ACORD 130 form not only facilitates the underwriting process but also helps in tailoring the coverage to meet the specific needs of the business, ultimately promoting a safer work environment for employees.

More PDF Templates

Does Florida Have an Estate Tax - All applications of the form must maintain compliance with Florida statutes regarding estate tax regulations.

When completing a transaction involving a vehicle in California, it's vital to utilize the California Motor Vehicle Bill of Sale form, which not only provides essential details about the vehicle and the transaction but also serves to safeguard both buyer and seller. To ensure you have the proper documentation, you can access the form here.

Imm 5645 - Provide accurate relationship details for each family member listed.

Blank Pdf Invoice - Create a professional appearance with minimal effort.

Documents used along the form

The ACORD 130 form is essential for applying for workers' compensation insurance. However, several other documents are often used alongside it to provide additional information and facilitate the underwriting process. Below is a list of these commonly used forms and documents.

- ACORD 133: This form is the "Workers Compensation Assigned Risk Plan Application." It is used when applying for coverage under the assigned risk plan, which is available to businesses that cannot obtain insurance through the standard market.

- ACORD 101: The "Additional Remarks Schedule" allows applicants to provide extra information or comments that may not fit in the primary application. This is particularly useful for explaining unique business operations or additional coverage needs.

- Motorcycle Bill of Sale - This document represents the transaction between a seller and a buyer for the sale of a motorcycle. For more information, visit onlinelawdocs.com.

- Loss Run Reports: These reports detail a business's claims history over a specified period, typically five years. Insurers use this information to assess risk and determine premiums based on past claims experience.

- State Rating Worksheet: This document provides detailed information about the applicant's operations, including employee classifications, payroll estimates, and other pertinent data that affect the insurance rating and premium calculation.

- Notice of Information Practices: This document informs applicants about how their personal information will be used and shared during the insurance application process. It ensures compliance with privacy regulations and protects applicants' rights.

Using these forms in conjunction with the ACORD 130 can streamline the application process and ensure that all necessary information is provided for an accurate assessment of coverage needs and risks.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The ACORD 130 form is used to apply for workers' compensation insurance coverage. |

| Application Date | The form requires the applicant to provide the application date in MM/DD/YYYY format. |

| Governing Law | The form is governed by state-specific laws regarding workers' compensation, which may vary by state. |

| Information Required | Applicants must provide detailed business information, including company structure, employee details, and estimated payroll. |

| Exclusions | Certain exclusions apply, such as those outlined in Missouri's Section 287.090 RSMo, which affects coverage eligibility. |

| Signature Requirement | The form must be signed by an authorized representative of the applicant, confirming the accuracy of the information provided. |

More About Acord 130

What is the purpose of the ACORD 130 form?

The ACORD 130 form is primarily used to apply for workers' compensation insurance. It gathers essential information about the applicant's business, including details about the business operations, employee classifications, and estimated payroll. This information helps insurance companies assess the risk associated with providing coverage and determining the appropriate premium rates. By completing this form accurately, businesses can ensure they receive the necessary protection for their employees in case of work-related injuries or illnesses.

What information is required on the ACORD 130 form?

The ACORD 130 form requires a variety of information. Applicants must provide their business name, address, and contact details. Additionally, details about the business structure (such as whether it is a corporation or partnership) and the number of years in operation are needed. The form also asks for specifics about employee classifications, estimated payroll, and prior insurance history, including any claims made in the past five years. Accurate and complete information is crucial to ensure a smooth application process and appropriate coverage.

How does the ACORD 130 form affect my workers' compensation premium?

The information provided on the ACORD 130 form directly influences the calculation of the workers' compensation premium. Insurers use the details about the nature of the business, employee classifications, and payroll estimates to assess risk. Higher-risk businesses may face higher premiums, while those with a safer work environment may benefit from lower rates. Furthermore, factors such as claims history and safety programs can also affect premium costs. Therefore, providing accurate information is essential to obtaining a fair premium rate.

What should I do if I have questions while filling out the ACORD 130 form?

If you have questions while completing the ACORD 130 form, it's advisable to reach out to your insurance agent or broker. They can provide guidance on specific sections of the form and clarify any terminology or requirements. Additionally, they can assist in ensuring that all necessary information is included, which can help expedite the application process. Don't hesitate to ask for help, as accurate completion of the form is vital for obtaining the right coverage for your business.

Acord 130: Usage Steps

Filling out the ACORD 130 form is a straightforward process that requires accurate information about your business and its operations. Follow these steps to complete the form correctly.

- Fill in the Date: Enter the date of application in the format MM/DD/YYYY.

- Agency Information: Provide the agency name and address.

- Company and Underwriter: Enter the name of the company and the underwriter.

- Applicant Information: Fill in the applicant's name, office phone, mobile phone, and mailing address, including ZIP + 4 or Canadian Postal Code.

- Business Information: Indicate the years in business and the Standard Industrial Classification (SIC) code.

- Producer Details: Provide the producer's name, North American Industry Classification System (NAICS) code, and customer service representative's information.

- Business Structure: Check the appropriate box for your business type (e.g., Sole Proprietor, Corporation, LLC, etc.).

- Credit Information: Enter the credit ID number and the Bureau name, along with any relevant codes.

- Employer Identification: Provide the Federal Employer ID Number and any applicable NCCI Risk ID Number.

- Billing Information: Specify the status of submission and select your preferred billing plan.

- Policy Information: Fill in the proposed effective and expiration dates, and indicate the normal anniversary rating date.

- Coverage Details: Complete the sections for workers' compensation, employer's liability, and any additional coverages needed.

- Estimated Premiums: Enter the total estimated annual premium, minimum premium, and deposit premium.

- Contact Information: Provide contact details for individuals involved in inspection, accounting, and claims information.

- Included/Excluded Individuals: List partners, officers, and relatives who are included or excluded from coverage.

- Rating Information: Fill in the state rating worksheet for multiple states, if applicable.

- Loss History: Provide information about prior carriers and loss history for the past five years.

- General Information: Answer all yes/no questions and provide explanations as needed.

- Signature: Ensure the application is signed by an authorized representative, along with the date and producer's signature.

After completing the form, review all entries for accuracy. Make sure all required information is included to avoid delays in processing your application. Once verified, submit the form to your insurance agency for further action.