Blank 4 Point Inspection PDF Form

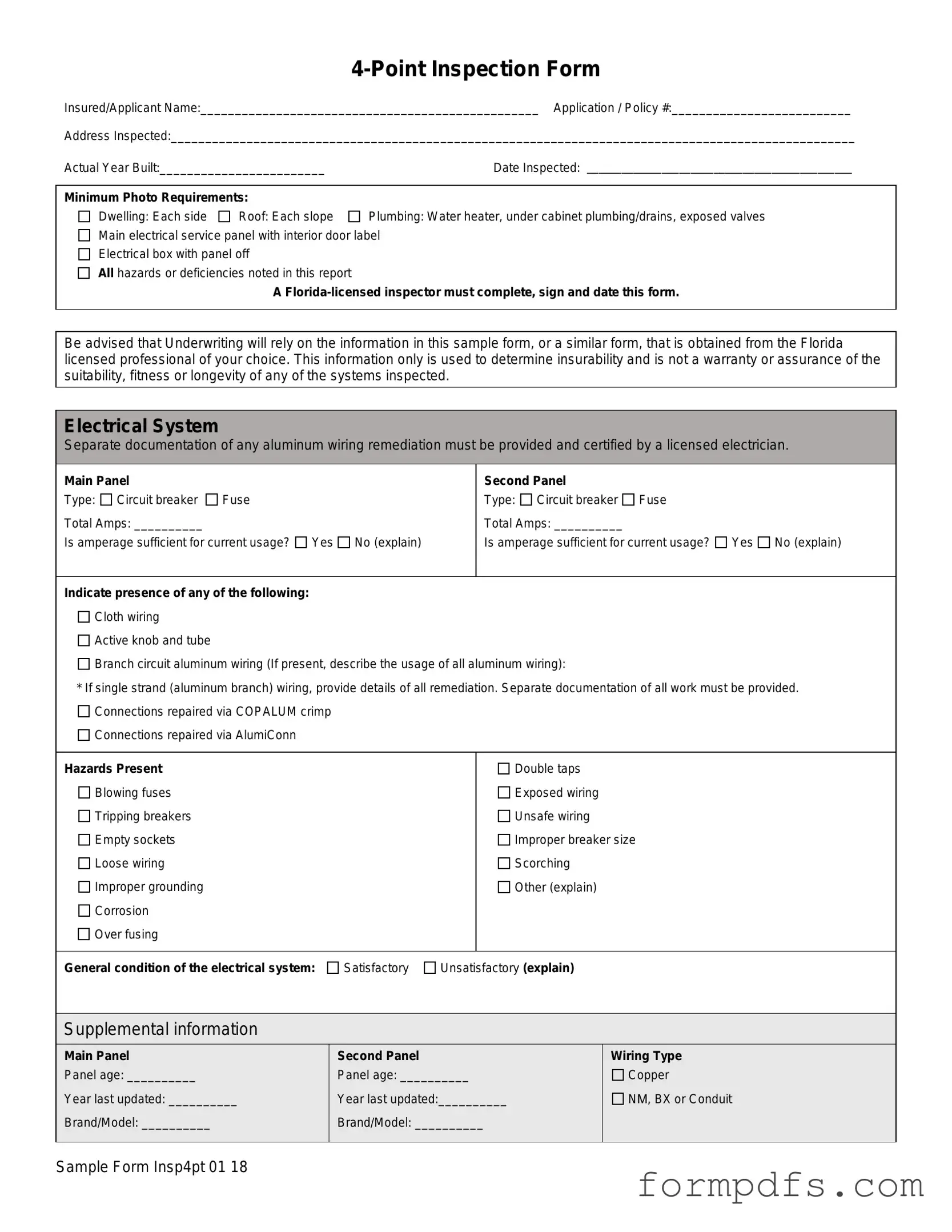

The 4 Point Inspection Form serves as a crucial tool in assessing the condition of a property, particularly for insurance purposes. This form is designed to evaluate four primary systems: the roof, electrical, HVAC, and plumbing. Each section of the form requires detailed information, including the age of the systems, any visible hazards, and whether the systems are functioning properly. For instance, the electrical section not only documents the type of wiring present but also identifies potential issues such as double taps or exposed wiring. Similarly, the HVAC section assesses the operational status of heating and cooling systems, while the plumbing section looks for leaks and the overall condition of fixtures. Additionally, the roof section requires photographs of each slope and notes on its condition, including any signs of damage or leaks. Importantly, this inspection must be performed by a Florida-licensed inspector, who certifies that the information is accurate. The 4 Point Inspection Form is not merely a checklist; it provides essential insights into the insurability of a property, helping both insurers and homeowners understand the current state of critical home systems.

More PDF Templates

Bdsm Kink Checklist - Examine your thoughts on dominance and submission dynamics.

By utilizing the California Judicial Council form, litigants can navigate the complexities of the legal system more effectively, ensuring that they adhere to the required formats and submit accurate information. For comprehensive resources related to these legal documents, refer to All California Forms, which provide further guidance on filling out forms correctly and efficiently.

Free Printable Dl-43 Form - If your license has been compromised, the DL-43 is the first document to address this issue.

How to Add Money to Netspend Card - Be detailed when describing the nature of the unauthorized transaction.

Documents used along the form

The 4-Point Inspection Form is an essential document used to assess the condition of a property’s major systems. Along with this form, several other documents may be required or beneficial in the process of obtaining insurance coverage. Each of these documents serves a specific purpose and provides additional information that can help in the underwriting process.

- Home Inspection Report: This comprehensive document details the overall condition of the home, including structural elements, systems, and any potential issues that may affect safety or value.

- Roof Inspection Report: Conducted by a roofing professional, this report focuses specifically on the roof's condition, including materials, age, and any signs of damage or wear.

- Articles of Incorporation: Essential for establishing a corporation in New York, this document outlines the corporation's name, purpose, and incorporators, initiating the formal recognition of the business. For more details, visit smarttemplates.net/fillable-new-york-articles-of-incorporation.

- HVAC Inspection Report: This document outlines the condition of the heating, ventilation, and air conditioning systems, including maintenance history and any repairs needed.

- Plumbing Inspection Report: This report assesses the plumbing system's condition, identifying any leaks, corrosion, or other issues that could lead to water damage.

- Electrical Inspection Report: This document details the electrical system's condition, including the presence of any hazards, such as outdated wiring or improper grounding.

- Permit History: A record of any permits pulled for renovations or repairs on the property, which can provide insight into the home’s maintenance and upgrades.

- Insurance Application: This form collects essential information about the property and the applicant, helping insurers evaluate risk and determine coverage options.

- Disclosure Statement: A document where the seller discloses known issues with the property, which can include past repairs, damages, or other relevant information.

- Maintenance Records: Documentation of routine maintenance performed on various systems, which can indicate how well the property has been cared for over time.

- Photographic Evidence: Photos documenting the condition of the property and its systems, often required to accompany inspection reports for better clarity and understanding.

Each of these documents complements the 4-Point Inspection Form by providing a more complete picture of the property’s condition. Together, they help ensure that potential risks are identified and addressed, ultimately aiding in the underwriting process and protecting both the insurer and the insured.

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The 4-Point Inspection Form assesses the condition of the roof, electrical, HVAC, and plumbing systems of a property. |

| Inspector Requirement | Only a Florida-licensed inspector can complete, sign, and date the form. |

| Minimum Photo Requirements | Photos of each side of the dwelling, each slope of the roof, and key plumbing and electrical components are required. |

| Electrical System Documentation | Any aluminum wiring remediation must be certified by a licensed electrician, with documentation provided. |

| Condition Certification | The inspector must certify that each system is working as intended and free of visible hazards or deficiencies. |

| Supplemental Information | Details such as the age of systems and types of materials used must be included in the report. |

| Agent Responsibility | The writing agent must review the form to ensure compliance with all rules and requirements before submission. |

| Governing Law | This form is governed by Florida state laws regarding property inspections and insurance underwriting. |

More About 4 Point Inspection

What is a 4-Point Inspection Form?

The 4-Point Inspection Form is a document used primarily in Florida to assess the condition of four major systems in a home: the roof, electrical system, HVAC (heating, ventilation, and air conditioning), and plumbing. This inspection is typically required by insurance companies to determine the insurability of a property. A licensed Florida inspector must complete and sign the form, ensuring that all necessary details and photos are included.

Who needs to complete the 4-Point Inspection Form?

A licensed inspector in Florida must complete the 4-Point Inspection Form. This can include general contractors, residential contractors, building code inspectors, or home inspectors. Each inspector can only certify the section relevant to their trade. For instance, an electrician can only sign off on the electrical portion of the inspection.

What information is required on the form?

The form requires detailed information about the condition of the roof, electrical system, HVAC, and plumbing. It includes questions about the age of each system, any visible hazards, and whether each system is in good working order. Additionally, the form must be accompanied by photos of each system, including the dwelling, roof slopes, and any relevant plumbing and electrical components.

What are the minimum photo requirements for the 4-Point Inspection?

Photos must accompany the 4-Point Inspection Form to provide visual documentation of the property's condition. The minimum requirements include images of each side of the dwelling, each slope of the roof, the water heater, under-cabinet plumbing and drains, exposed valves, the open main electrical panel, and the electrical box with the panel off. Any noted hazards or deficiencies should also be documented with photos.

What happens if a system is found to be unsatisfactory?

If any system is deemed unsatisfactory during the inspection, the inspector must provide detailed comments regarding the issues identified. This may include problems such as leaks, corrosion, or any other visible hazards. The information provided will be crucial for underwriting decisions by insurance companies, as they may require repairs or further evaluations before approving coverage.

Why is a 4-Point Inspection important for insurance purposes?

The 4-Point Inspection is essential for insurance because it helps insurers assess the risk associated with a property. By evaluating the condition of critical systems, insurers can determine whether the property meets their underwriting guidelines. This inspection helps protect both the insurer and the homeowner by identifying potential hazards before they lead to more significant issues.

4 Point Inspection: Usage Steps

Completing the 4 Point Inspection form requires careful attention to detail. This process involves gathering specific information about the property's electrical, HVAC, plumbing, and roof systems. Accurate documentation is essential for the underwriting process, as it helps determine insurability. Following the steps outlined below will assist in filling out the form correctly.

- Begin by entering the Insured/Applicant Name and Application/Policy Number at the top of the form.

- Fill in the Address Inspected and the Actual Year Built of the property.

- Record the Date Inspected.

- Ensure you meet the Minimum Photo Requirements for each system:

- Dwelling: Each side

- Roof: Each slope

- Plumbing: Water heater, under cabinet plumbing/drains, exposed valves

- Main electrical service panel with interior door label

- Electrical box with panel off

- All hazards or deficiencies noted in the report

- Complete the Electrical System section by indicating the type of panel, total amps, and whether the amperage is sufficient for current usage. Note any hazards present and provide a general condition assessment.

- In the HVAC System section, indicate whether there is central AC and heat. Provide details on the condition and age of the HVAC system.

- Fill out the Plumbing System section, noting the presence of a temperature pressure relief valve and any signs of leaks. Assess the general condition of plumbing fixtures and connections.

- For the Roof section, provide details on the predominant roof covering material, age, and overall condition. Include any visible signs of damage or leaks.

- Use the Additional Comments/Observations section to document any further details or observations that may be relevant.

- Finally, ensure that a verifiable Florida-licensed inspector completes, signs, and dates the form.

Following these steps will help ensure that the 4 Point Inspection form is filled out accurately and comprehensively. This attention to detail is crucial for the evaluation of the property application.