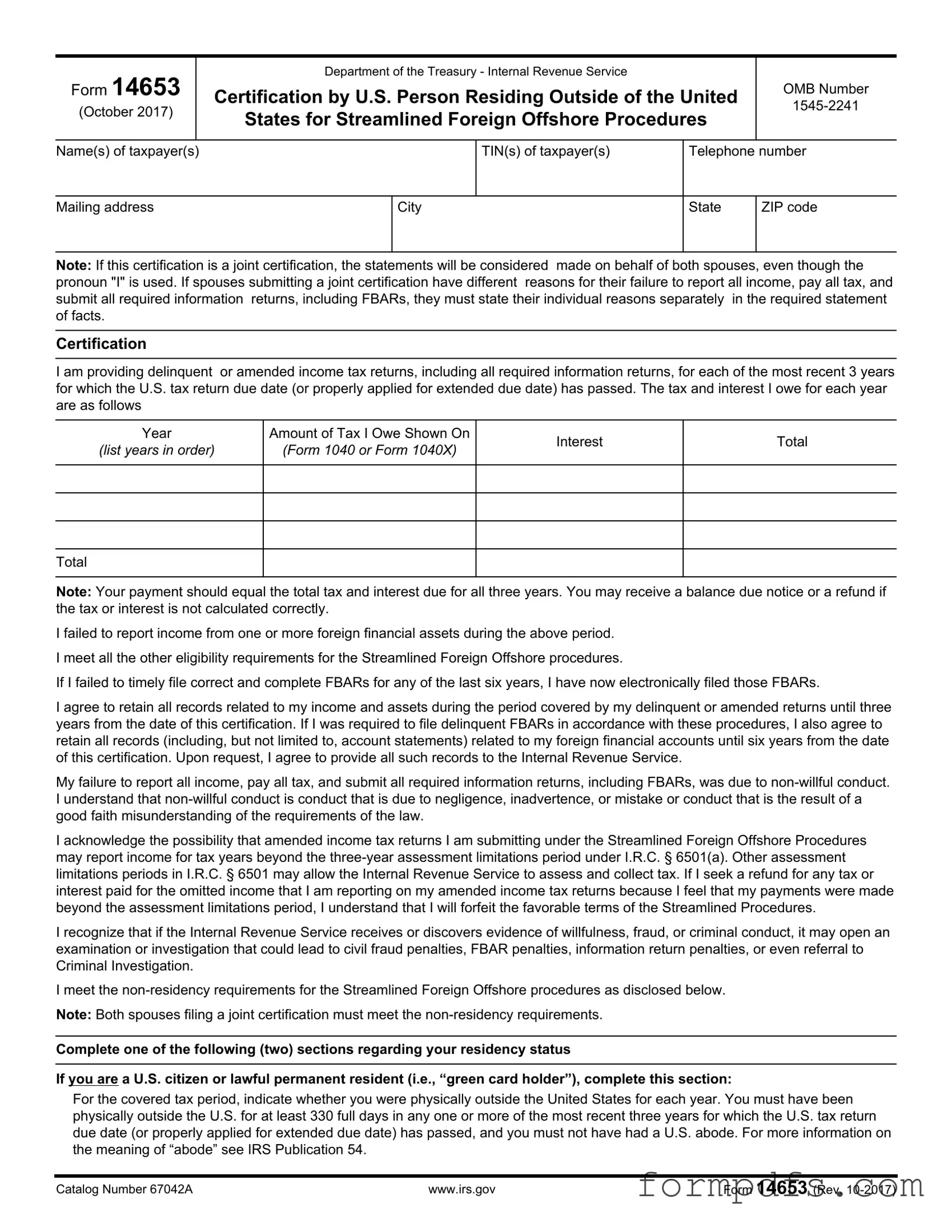

Blank 14653 PDF Form

The 14653 form, officially titled "Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures," serves as a critical tool for U.S. taxpayers living abroad who have not fully complied with their tax obligations. This form, issued by the Internal Revenue Service (IRS), allows eligible individuals to certify their non-willful failure to report income, pay taxes, and submit required information returns, including Foreign Bank Account Reports (FBARs). Taxpayers must provide detailed information about their residency status, including whether they were physically outside the U.S. for at least 330 full days during the relevant tax years. The form requires individuals to submit delinquent or amended tax returns for the past three years, along with a comprehensive statement of facts explaining their non-compliance. This narrative must include personal and financial background information, as well as details about foreign financial accounts. By completing this form, taxpayers can potentially benefit from reduced penalties under the Streamlined Foreign Offshore Procedures, provided they meet all eligibility requirements. However, it is essential to understand the implications of this certification, including the possibility of IRS examination if evidence of willfulness or fraud is discovered.

More PDF Templates

Hurt Feelings Report - Serve as a channel for understanding personal experiences.

Roof Inspection Template - Identifying the correct roofing company ensures professional handling of the installation.

Understanding the intricacies of the leasing process is crucial for anyone involved in renting property, and the California Residential Lease Agreement form is a key instrument in this regard. By detailing the responsibilities and rights of both landlords and tenants, this document helps to mitigate potential disputes related to rental properties. For further guidance on various leasing documents and to access necessary forms, you can visit All California Forms, which provides comprehensive resources for both parties.

Acord 130 - The scope includes various business types, including corporations, LLCs, and sole proprietors.

Documents used along the form

When submitting Form 14653, there are several other forms and documents that may be required or beneficial to include. These documents help provide clarity and ensure compliance with the IRS regulations regarding the Streamlined Foreign Offshore Procedures. Below is a list of commonly associated forms and documents.

- Form 1040: This is the standard individual income tax return form used by U.S. citizens and residents to report their annual income and calculate their tax liability.

- Form 1040X: Known as the Amended U.S. Individual Income Tax Return, this form is used to make corrections to a previously filed Form 1040.

- New York Bill of Sale: This document is essential for recording the sale of personal property within New York, ensuring both parties have a record of the transaction. For more information, visit https://smarttemplates.net/fillable-new-york-bill-of-sale.

- FBAR (FinCEN Form 114): This form is required to report foreign bank and financial accounts. It must be filed electronically and is separate from the income tax return.

- Form 8938: This form is used to report specified foreign financial assets and is part of the requirements under the Foreign Account Tax Compliance Act (FATCA).

- Form W-7: If applicable, this form is used to apply for an Individual Taxpayer Identification Number (ITIN) for individuals who are not eligible for a Social Security number.

- Form 4868: This is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, allowing taxpayers to extend their filing deadline.

- Form 8854: This form is used by expatriates to report their status and to certify compliance with U.S. tax obligations for the five years preceding their expatriation.

- Power of Attorney (Form 2848): If someone else is handling your tax matters, this form grants them the authority to represent you before the IRS.

- Statement of Facts: A detailed narrative explaining the reasons for any failures to report income or file returns, which is crucial for qualifying for the streamlined procedures.

- Supporting Documentation: This may include bank statements, proof of residency, and any other documents that support the claims made in the tax filings.

Including these forms and documents can facilitate a smoother process when dealing with the IRS and ensure that all necessary information is provided. It is important to carefully review the requirements for each document and provide accurate and complete information to avoid potential issues.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | Form 14653 is used by U.S. persons residing outside the United States to certify eligibility for the Streamlined Foreign Offshore Procedures, allowing them to rectify past tax reporting issues. |

| Eligibility Requirements | To qualify for the streamlined procedures, individuals must meet specific criteria, including being physically outside the U.S. for at least 330 days in one of the last three years and having non-willful conduct regarding their tax obligations. |

| Record Retention | Taxpayers must retain all records related to their income and assets for three years from the date of certification. If FBARs were required, records related to foreign financial accounts must be kept for six years. |

| Governing Law | The use of Form 14653 is governed by the Internal Revenue Code, specifically I.R.C. § 6501 regarding assessment limitations and I.R.C. § 7701(b)(3) for the substantial presence test. |

More About 14653

What is Form 14653?

Form 14653 is a certification used by U.S. persons residing outside the United States who want to participate in the Streamlined Foreign Offshore Procedures. This form allows individuals to report previously unreported income and file delinquent tax returns without facing penalties, provided they meet specific eligibility requirements.

Who should use Form 14653?

This form is intended for U.S. citizens and lawful permanent residents who have failed to report all income, pay all taxes, and submit required information returns, including Foreign Bank Account Reports (FBARs). It is particularly relevant for those who have lived outside the U.S. for at least 330 days in one or more of the last three tax years.

What are the eligibility requirements for using Form 14653?

To qualify for the Streamlined Foreign Offshore Procedures, you must meet several criteria. You need to have been physically outside the U.S. for at least 330 full days in one of the last three tax years and not have a U.S. abode. Additionally, your failure to report income must be due to non-willful conduct, meaning it was not intentional or due to negligence.

What information do I need to provide on Form 14653?

On Form 14653, you must provide personal information, including your name, taxpayer identification number (TIN), and contact details. You will also need to list the years for which you are filing delinquent returns, the amounts owed, and the reasons for your failure to report income. A detailed narrative explaining your situation is crucial for your submission to be considered complete.

What happens if I don't meet the requirements for Form 14653?

If you do not meet the eligibility requirements, your submission may be considered incomplete, and you could face penalties for failing to report income or file returns. The IRS may also investigate your case further if they suspect willful conduct, which could lead to civil or criminal penalties.

How long do I need to keep records related to my submission?

You are required to retain all records related to your income and assets for three years from the date of your certification. If you have filed delinquent FBARs, you must keep those records for six years. This includes account statements and any documentation related to your foreign financial accounts.

Can I file Form 14653 jointly with my spouse?

Yes, spouses can file a joint certification using Form 14653. However, both spouses must meet the non-residency requirements. If each spouse has different reasons for their failure to report income, they must provide separate statements of facts detailing their individual circumstances.

What are the potential consequences of submitting false information on Form 14653?

Submitting false information can lead to severe penalties, including civil fraud penalties and possible criminal charges. It is crucial to provide accurate and complete information to avoid complications with the IRS.

14653: Usage Steps

Completing Form 14653 is a crucial step in ensuring compliance with U.S. tax regulations for individuals residing outside the United States. After filling out this form, you will submit it along with any necessary documentation to the IRS, which will review your information as part of the Streamlined Foreign Offshore Procedures. This process can help resolve any outstanding tax issues you may have.

- Begin by entering the Name(s) of taxpayer(s) in the designated field.

- Provide the TIN(s) of taxpayer(s), ensuring accuracy.

- Fill in your Telephone number for contact purposes.

- Complete the Mailing address section, including city, state, and ZIP code.

- If applicable, indicate whether this is a joint certification. Remember, the statements will be considered made on behalf of both spouses.

- In the Certification section, confirm that you are providing delinquent or amended income tax returns for the past three years.

- List the Year, Amount of Tax I Owe, Shown On (Form 1040 or Form 1040X), and Interest for each year in the table provided.

- Indicate if you failed to report income from foreign financial assets during the specified period.

- Confirm that you meet all eligibility requirements for the Streamlined Foreign Offshore procedures.

- If applicable, check the box stating you have electronically filed any required FBARs.

- Acknowledge your agreement to retain records related to your income and assets for the required periods.

- State that your failure to report income, pay taxes, and submit required information returns was due to non-willful conduct.

- Complete the residency status section based on whether you are a U.S. citizen or lawful permanent resident, or not.

- Provide specific facts regarding your failure to report income and any relevant background information.

- In the designated area, write a detailed narrative explaining your situation, including the source of funds in foreign accounts.

- If you relied on a professional advisor, include their contact information and a summary of the advice received.

- Sign and date the form in the appropriate areas, ensuring all required signatures are included.

- If applicable, provide information for a paid preparer, including their signature and details.

- Finally, check if you wish to allow another person to discuss this form with the IRS, and provide their contact information if applicable.